He plans a 35% tariff on goods manufactured by American firms abroad: The U.S. is going to substantialy reduce taxes and regulations on businesses, but any business that leaves our country for another country, — Donald J. Trump (@realDonaldTrump) December 4, 2016 fires its employees, builds a new factory or plant in the other country, and then thinks it will sell its product back into the U.S. …… — Donald J. Trump (@realDonaldTrump) December 4, 2016 without retribution or consequence,...

Read More »Trade, Trump, and the economy: What does Greg Mankiw’s textbook say?

from Dean Baker Harvard professor, textbook author, and occasionally New York Times columnist Greg Mankiw told readers today that Donald Trump’s economic team is wrong to worry about the trade deficit. “The most important lesson about trade deficits is that they have a flip side. When the United States buys goods and services from other nations, the money Americans send abroad generally comes back in one way or another. One possibility is that foreigners use it to buy things we produce,...

Read More »Labour links

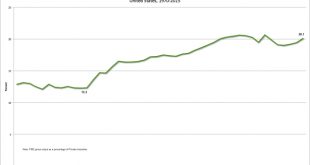

Brexit, TrumpKKK, the EU – broadly defined labour markets are key. About this: A. Noah Smith is changing his opinion A job is more than a paycheck. It is a social institution, too Debunking labour economics 101 (very clever but also logical and empirical) B. Frances Coppola is not changing her opinion: ‘Reinventing work for the future'(about basic income) C. The Daily Mail wants to change your opinion, about this (graph) Source: ONS. The non-far right should not leave it to the Daily Mail...

Read More »Class before Trumponomics, part 3 (8 graphics)

from David Ruccio In the second installment of this series on “class before Trumponomics,” I argued that, in recent decades, while American workers have created enormous wealth, most of the increase in that wealth has been captured by their employers and a tiny group at the top—as workers have been forced to compete with one another for new kinds of jobs, with fewer protections, at lower wages, and with less security than they once expected. And the period of recovery from the Second...

Read More »Payrolls, Vehicle sales, Carrier

Year over year growth continues to decelerate, and wage growth remains critically low. And participation rates further evidence a massive shortage of aggregate demand, and it’s all only getting worse: Highlights Payroll growth is solid and the unemployment rate is down sharply, but not all the indications from the November report employment are favorable. Nonfarm payrolls rose 178,000 in November to just beat out expectations with revisions no factor, as a sharp downward...

Read More »Stephen Hawking: “we are at the most dangerous moment in the development of humanity”

from The Guardian “the world’s leaders need to acknowledge that they have failed and are failing the many” . . . the recent apparent rejection of the elites in both America and Britain is surely aimed at me, as much as anyone. Whatever we might think about the decision by the British electorate to reject membership of the European Union and by the American public to embrace Donald Trump as their next president, there is no doubt in the minds of commentators that this was a cry of anger...

Read More »Billionaire ‘King of Bankruptcies’ to Head Commerce Under Trump

NEP’s Bill Black appears on The Real News Network. “Despite promises to ‘drain the swamp,’ Trump chose a man for Deputy Secretary of Commerce who enriched himself at expense of labor and consumers and shipped jobs overseas.” [embedded content]You can view the transcript here. Share this:

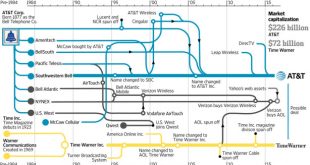

Read More »The slow, painful death of the TPP

from Dean Baker In spite of the hopes of many elite types for a last-minute resurrection, it appears that the Trans-Pacific Partnership (TPP) is finally dead. This is good news, but it took a long time to kill the deal, and the country is likely to pay a huge price for the execution. The basic point that everyone should know by now is that the TPP had little to do with trade. The United States already had trade deals with six of the 11 other countries in the pact. The trade barriers with...

Read More »Chain store sales, PMI and ISM surveys, Construction spending, Auto sales, Delinquencies

Highlights Chain stores are reporting mixed to lower year-on-year rates of November sales compared to October. Today’s results do not hint at another month of strength for the government’s ex-auto ex-gas retail sales reading which posted very strong monthly gains of 0.6 percent and 0.5 percent in October and September. Manufacturing muddling through at current levels: Markit Manufacturing PMI: Highlights Durable orders picked up in October and the momentum appears to...

Read More »Pay to model

from David Ruccio Back in 2010, Charles Ferguson, the director of Inside Job, exposed the failure of prominent mainstream economists who wrote about and spoke on matters of economic policy to disclose their conflicts of interest in the lead-up to the crash of 2007-08. Reuters followed up by publishing a special report on the lack of a clear standard of disclosure for economists and other academics who testified before the Senate Banking Committee and the House Financial Services Committee...

Read More » Heterodox

Heterodox