from Asad Zaman I am planning a sequence of posts on re-reading Keynes, where I will try to go through the General Theory. This first post explains my motivations for re-reading Keynes. As always, my primary motive is self-education; this will force me to go through the book again — I first read it in my first year graduate course on Macroeconomics at Stanford in 1975, when our teacher Duncan Foley was having doubts about modern macro theories, and decided to go back to the original...

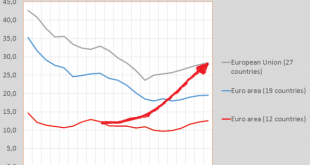

Read More »Macro and migration – EU edition.

So, ‘What’s it going to be then, eh’? Will we let migration wreck the EU or will we opt for sound macro policies? The non-far right should double down on the present freedom of movement of people inside the EU. But only when credible macro-economic demand and welfare policies are installed. Otherwise, the internal inconsistencies of the present macro-economic set up will fracture the EU. Which means that the freedom of capital flows, one of the other EU freedoms, might have to be...

Read More »Yellen statements

Not good: Said Yellen: “The long-run deficit probably needs to be kept in mind.”http://www.usatoday.com/story/money/2016/11/17/yellen-fed-track-dec-rate-hike/93991628/ http://www.bloomberg.com/news/articles/2016-11-17/yellen-signals-fed-won-t-be-cowed-after-trump-s-election-victory “In addition, with the debt-to-GDP ratio at around 77 percent there is not a lot of fiscal space should a shock to the economy occur, an adverse shock that did require fiscal stimulus,” she said....

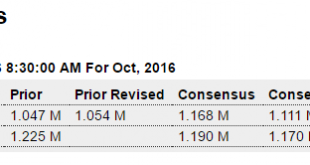

Read More »Housing starts, Consumer price index, Philly Fed survey

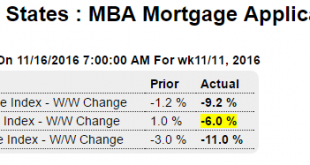

Nice move up after a large move down. Note that the average of the last two months is about where this series has been. And, again, it’s the permits that count, and they are about the same as last month. And not to forget mortgage applications to buy homes fell a full 6% last week after rates went up in response to the election. Highlights In data that will lift estimates for fourth-quarter GDP, housing starts surged 25.5 percent in October to a 1.323 million annualized...

Read More »Bannon, DB on repatriation, The $

The big stupid continues uninterrupted from regime to regime: Documentary Of The Week: Stephen Bannon Explains America’s Problems By John Lounsburry Nov 15 (Econintersect) — Econintersect: This lecture was presented to the inaugural session of the Liberty Restoration Foundation in Orlando, FL October, 2011. Stephen Bannon, the CEO of Donald Trump’s successful presidential campaign and to-be Chief Strategist in the Trump White House, describes his view of what is wrong with...

Read More »Mainstream economists, globalization, and Trump

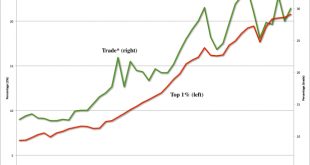

from David Ruccio Are mainstream economists responsible for electing Donald Trump? I think they deserve at least part of the blame. So, as it turns out, does Dani Rodrick. My argument is that, when mainstream economists in the United States embraced and celebrated neoliberalism—both the conservative and “left” versions—they created the conditions for Trump’s victory in the U.S. presidential election. As I see it, mainstream economists adopted neoliberalism as a set of ideas (about...

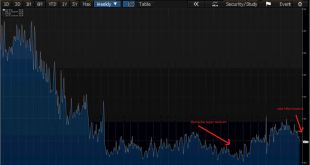

Read More »Taper tantrum redux, Repatriating rhetoric, Architectural billings index

With the Bernanke taper tantrum a housing market showing at least some signs of recovery immediately reversed course and headed south. The shale boom got things going again, and the shale bust saw some softening. But with the latest anticipatory spike in mtg rates and still not much underlying effective demand, we’re seeing the beginnings of another setback. This is the chart for the index for mortgage applications for home purchases: I haven’t yet seen any reason for a...

Read More »Blame globalization?

David Ruccio Chris Dillow is right about one thing: citing globalization as the reason for the success of Donald Trump’s campaign, especially among working-class voters, “suits some people very well for foreigners to get the blame rather than for inequality and the health of capitalism to come under scrutiny.” But that doesn’t mean that, alongside many other factors (from the decline in labor unions to increasing automation), globalization—to be precise, capitalist globalization—doesn’t...

Read More »Mtg rates, Industrial production

If rates were being raised due to excess demand for mortgages the higher rates wouldn’t likely slow things down. But in this case demand has been relatively low, so the jump in rates not due to demand will likely slow demand: Highlights Purchase applications for home mortgages fell a seasonally adjusted 6 percent in the November 11 week as a sharp increase in mortgage rates took its toll on application activity. The rise in rates had an even greater impact on refinancing,...

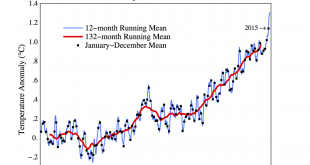

Read More »Above the rising trend. Update on global temperature

From: Geoff Davies (reblogged from: Our better nature) (a comparable graph not including 2016 has been published a few days ago, developments in 2016 are however so extreme and out of sample that this data has to be included, too, M.K.) A couple of graphs show the extraordinary nature of the present situation. 1998 used to be one of the biggest outliers from the general trend. 2016 is going way beyond that. The second graph shows the deviation from the recent trend more clearly: It...

Read More » Heterodox

Heterodox