from Maria Alejandra Madi The Call for papers for the current conference Food and Justice is now open. We invite you to submit a paper to [email protected] by 15th September, 2016. A paperback, Food and Justice, of conference papers will be published by WEA Books in the new year. Visit the Conference website http://foodandjustice2016.weaconferences.net/ Food production has always been present in the economic debate because of the concern about population growth and demographic...

Read More »Bank loans, Japan savings, Comments on the economy

Accelerated with the shale boom, still decelerating with the shale bust: Problem is incentives to not spend income, as below, reduce sales, output, and employment. That is, they’ve got it backwards if the goal is increased GDP etc. Japan mulls longer-term tax break for savers Aug 18 (Nikkei) — The Japanese government plans to offer a new option for tax-free investment accounts featuring a much longer exemption. More than 10 million of the so-called NISA accounts were opened...

Read More »Not so fast!

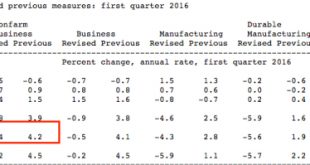

from David Ruccio Everyone has read or heard the story: the labor market has rebounded and workers, finally, are “getting a little bigger piece of the pie” (according to President Obama, back in June). And that’s the way it looked—until the Bureau of Labor Statistics revised its data. What was originally reported as a 4.2 percent increase in the first quarter of 2016 now seems to be a 0.4 decline (a difference of 4.6 percentage points, in the wrong direction). What’s more, real hourly...

Read More »Jobless claims, Philadelphia Fed business survey, Japan trade

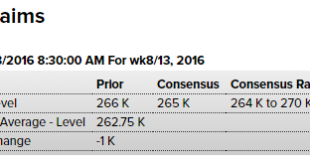

Still looks to me like this is perhaps the most misunderstood statistic, as analysts believe it is signaling strength in the labor markets. Instead I’m suggesting claims are extraordinarily low because the unemployment benefits have become much harder to get: Even with a much higher population and labor force, and with a higher unemployment rate,new claims are at 40 year lows: Not at all good: HighlightsOnce again the Philly Fed’s headline tells an entirely different story...

Read More »Trade, Truth and Trump

from Dean Baker Donald Trump seems to have driven a substantial portion of the media into a frenzy with his anti-trade rhetoric. While much of what Trump says is wrong, and his solutions are at best ill-defined, the response in the press has largely been dishonest. For example, a New York Times editorial tried to imply that there was an ambiguous relationship between the size of the trade deficit and employment in manufacturing. It pointed out that Japan and Germany, both countries with...

Read More »Mortgage purchase applications, Stock buybacks

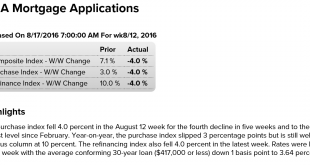

The chart shows both how depressed the mortgage market is historically as well as how it’s been deteriorating over the last several months: And lots of headlines like this popping up: Wednesday, August 17, 2016Sacramento Housing in July: Sales down 7%, Active Inventory down 10% YoYLas Vegas Real Estate in July: Sales down 10% YoY, Inventory down 1% Read more at http://www.calculatedriskblog.com U.S. companies’ stock buyback plans hit four-year low: TrimTabs Aug 16...

Read More »Education, inequality, and power

from David Ruccio Is education the solution to the problem of growing inequality? As I wrote in early 2015, Americans like to think that education is the solution to all economic and social problems. Including, of course, growing inequality. Why? Because focusing on education—encouraging people to get more higher education—involves no particular tradeoffs. More education for some doesn’t mean less education for others (at least in principle). And providing more education doesn’t involve...

Read More »Financialization of corporate behaviour

from Maria Alejandra Madi The global scenario has restated the menace of deep depressions among the economic challenges. Indeed, in the current setting, the principles of corporate behaviour have reinforced the lack of commitment to long-run social and economic sustainability. Looking backward, in the context of the 1930 Great Depression, John Maynard Keynes pointed out that the evolution of capital markets increases the risk of speculation and instability since these markets are mostly...

Read More »CPI, Housing starts, Redbook retail sales, Industrial production, Euro area trade balance

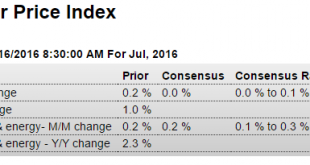

Lots of nuances but still tending to keep the Fed on hold: HighlightsThe headlines for the consumer price report look very soft but there are important offsetting pressures. The CPI came in unchanged in July, pulled back by a 1.6 percent monthly decline in energy prices and other weakness including flat prices for food and contraction in transportation. And it doesn’t look much better when excluding food & energy where the gain for the core is only 0.1 percent. But two...

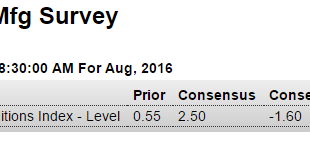

Read More »Empire manufacturing index, Housing market index, Hotel occupancy

Just another bit of bad news: HighlightsThe New York region’s manufacturing sector remains flat based on the Empire State index which came in slightly below zero at minus 4.21 in August vs plus 0.55 in July. New orders are especially flat, at plus 1.04 vs July’s minus 1.82, with unfilled orders extending a long run of negative readings at minus 9.28. There is, however, strength in shipments, at 9.01, but it won’t last long given the weakness in orders. Employment is also...

Read More » Heterodox

Heterodox