[unable to retrieve full-text content] Ann Pettifor discussed how Phillip Hammond’s stint at the treasury will differ to Osbornes on Share Radio yesterday, with their regular economics commentator John Weeks. Listen to the full show here.

Read More »Mtg purchase apps, Gallup index, Euro area current account

Down again, and you can see from the chart that it’s most recently gone flat after ramping up a bit: Just another index that headed south after the collapse in oil capex: The euro area current account surplus continues to trend higher: Euro Area Current Account The current account surplus in the Eurozone came in at €15.4 billion in May of 2016 compared to an €8.4 billion surplus a year earlier. The goods surplus widened 16 percent to €31.1 billion while the services one...

Read More »Making firm governance part of the economists’ dialogue

from Robert Locke In a recent article,”The Milton Friedman Doctrine is Wrong. Here’s How to Rethink the Corporation,” Susan Holmberg and Mark Schmitt intoned: “We won’t fix the problem until we address the nature of the corporation.” at http://economics.com/milton-friedman-doctrine-wrong-heres-rethink-corporation/. Egmont Kakarot-Handtke asserts that sciences of society make no contribution to economics because they are scientifically invalid — to which I replied that his assertion is...

Read More »Flat or falling (5 charts)

from David Ruccio A new report from McKinsey & Company, “Poorer than Their Parents? Flat or Falling Incomes in Advanced Countries” (pdf), confirms many people’s worst fears. As it turns out, the trend in stagnating or declining incomes for most workers (including the middle-class) is not confined to the United States, but is a global phenomenon. Brexit and Trump are just the tip of the iceberg. Because of flat or falling incomes, many workers across the rich countries are...

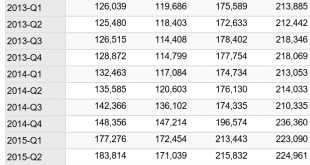

Read More »Housing starts, Redbook retail sales, Comments on low rates

Last month’s downward revision and the drop in permits make this report particularly negative. Again, looks like housing will be a drag on growth this year vs last year: Still trending from bad to worse: With the govt a net payer of interest, rate cuts reduce total interest income for the economy by that amount. But some of the effects are lagged, as indicated below, and are therefore still ongoing, as lower pension returns often result in higher contributions and lower...

Read More »Why ZLB Economics and Negative Interest Rate Policy (NIRP) are Wrong: A Theoretical Critique

NIRP is quickly becoming a consensus policy within the economics establishment. This paper argues that consensus is dangerously wrong, resting on flawed theory and flawed policy assessment. Regarding theory, NIRP draws on fallacious pre-Keynesian economic logic that asserts interest rate adjustment can ensure full employment. That pre-Keynesian logic has been augmented by ZLB economics which [...]

Read More »Shaky Assumptions

All models by necessity distort reality in one way or another. A sculptor, when modelling in stone or clay, does not try to clone Nature; he highlights some things, ignores others, idealizes or abstracts some more, to achieve an effect. Likewise a scientist must necessarily pick and choose among various aspects of reality to incorporate into a model. An economist makes assumptions about how markets work, how businesses operate, how people make financial decisions. Any one of these...

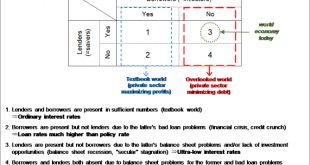

Read More »Four possible states of borrowers and lenders – Richard Koo

. . . an economy is always in one of four possible states depending on the presence or absence of lenders (savers) and borrowers (investors). They are as follows: (1) both lenders and borrowers are present in sufficient numbers, (2) there are borrowers but not enough lenders even at high interest rates, (3) there are lenders but not enough borrowers even at low interest rates, and (4) both lenders and borrowers are absent. These four states are illustrated in Exhibit 2. Of the four, only...

Read More »Partying like it’s 1848

from Peter Radford This is not a time to dwell on the inconsistencies and even contradictions of the recent uprising of populism in the western world. Treat it as a fact. It just is. For there can be no mistaking the trend: people, large numbers of people, in a large swathe of Europe and America really are unhappy with their lot in life. Really unhappy. Fully 52% of Republican supporters of Donald Trump tell pollsters that they are angry with the way the country is going. Not just unhappy...

Read More »SNB, Homebuilder optimism, Corporate profits, Morgan Stanley cartoon

It looks like the SNB (Swiss National Bank- the central bank) has been building $ reserves faster than euro reserves, which has worked to support the $ vs the euro. That is, when they were buying euro to keep their currency down they were selling quite a few of those euro for $ to keep their portfolio ‘balanced’. And for the last two quarters reported below, $ holdings went up about 12.5 billion while euro holding fell by about 4 billion, which means the shifting is...

Read More » Heterodox

Heterodox