A few weeks ago I posted the announcement of Saudi price cuts, suggesting this could be meant to bring down prices, which now seems to be happening: Again, with no loan demand, they are calling for higher rates, presumably to slow down lending: Six Fed banks called for discount rate hike: minutes By Lindsay Dunsmuir July 12 (Reuters) — The number of regional Federal Reserve banks pushing the central bank to raise the rate it charges commercial banks for emergency loans rose...

Read More »Ann Pettifor on Nationalism, Polanyi and the Double Movement

July 13th, 2016 On the 1st July Ann Pettifor spoke at the FT’s Festival of Finance. Ann gave a presentation on ‘The New Nationalism: the money story’ and discussed nationalism, and Polanyi’s Double Movement. She was joined by a panel made up of Frances Coppola, Tyler Cowen, and Srinivas Thiruvadanthai. The discussion was moderated by John Authers. The full podcast is available on FT Alphaville.

Read More »Mtg purchase apps, EU deficit limits, Wholesale sales, New home sales per capita

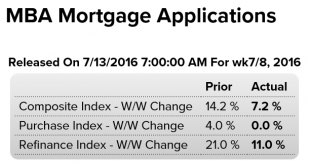

Unchanged from last week as modest growth from very low levels continues: The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index decreased 20 percent compared with the previous week and was 5 percent lower than the same week one year ago. Last year, the Fourth of July fell on the prior week.Read more at http://www.calculatedriskblog.com/#sQ3JkrmqGOvif9t3.99 So now that they know larger deficits are better for an economy, why...

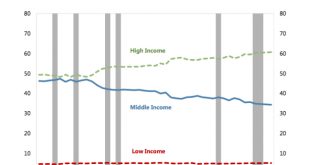

Read More »Inequality and polarization in the United States

from David Ruccio The problem of the growing gap between the small group of haves and all other Americans is (as I noted a week ago) so bad even the International Monetary Fund is sounding the alarm. Despite the ongoing expansion, the U.S. faces a confluence of forces that will weigh on the prospects for continued gains in economic well being. A rising share of the U.S. labor force is shifting into retirement, basic infrastructure is crumbling, productivity gains are scanty, and labor...

Read More »Small business index, Redbook retail sales, Wholesale trade, Jolts

Up a bit, but still weak and in a downtrend, and employment declining: HighlightsThe small business optimism index rose 0.7 points in June to 94.5, the third monthly increase since falling to a 2-year low in March. The improvement in small business optimism slightly exceeded expectations, though the index remains in the downtrend in place since the 100.4 recovery peak set in December 2013 and below the 42-year average of 98. Four of the 10 components of the index posted...

Read More »Fed’s labor market conditions index, Tax revenues

Not good: Not a good sign when tax revenue growth decelerates like this:

Read More »On the central importance of a meta-theory for economics

from Asad Zaman This post was meant to provide a framework for further elaboration of the idea of ET1% — the Economic Theory of the top 1% — as one ingredient of a Meta-Theory of Economics. However, covering necessary preliminary background already took up more than a thousand words, so this project has been deferred for a later post. The goal of this post is to explain why we need to focus on Meta-Theoretical aspects of social science, rather than whether or not economic theories are...

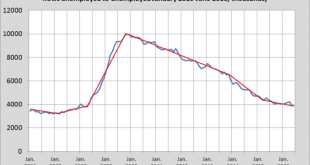

Read More »Labor statistics history: it rhymes. About the consistency of economic statistics

Does, contrary to the assumptions of many economic models, ‘involuntary unemployment’ exist? Of course. We measure it (for the definition see below). And in the USA it is going down. About two months ago I posted this graph, which showed that what I call involuntary unemployment in the USA tended upwards. Two months of additional data show that this was, fortunately, just a hiccup – though the decline is not as fast as it used to be. Some musings about models and measurement, starting...

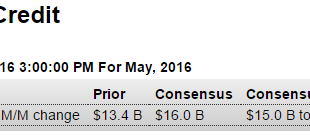

Read More »Consumer credit, Corporate profits, Bank lending

Still decelerating on a year over year basis: United States Consumer Credit ChangeConsumer credit in the United States increased by $18.56 billion in May 2016 following a downwardly revised $13.4 billion rise in April and above market expectations of a $16 billion gain. This was decelerating and below stall speed when the boom in oil capex reversed that trend early in 2014. Then in late 2014 oil capex collapsed and bank lending growth reversed and resumed its deceleration:...

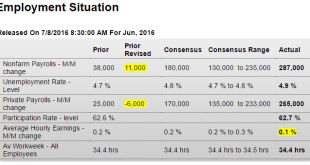

Read More »Employment, Bank losses, German Banks

Nice rebound as Verizon workers return to work, but the year over year deceleration continues and, of course, this number will be revised next month. And the lower average hourly earnings gains could put off fears of the US turning into Zimbabwe and Weimar for several hours: The payroll gain in June is what is striking in this report. Yet smoothing the big ups and downs, second-quarter payroll growth averaged a monthly 147,300 vs a more substantial 195,700 in the first...

Read More » Heterodox

Heterodox