Two “fundamental” indicators for the American middle/working class and the economy – by New Deal democrat This week is a little light on data, except for housing permits and starts (Tuesday) and existing home sales (Thursday), so let me catch up on a few other indicators. In particular, two of my favorite indicators are based on “fundamentals.” Basically, how much the average American is earning, and how much they are spending. Needless to...

Read More »Testimony of Kip Sullivan, on behalf of Health Care for All Minnesota

I used to think Minnesota was a pretty cool state. Spent some time in the boundary waters between Minnesota and Canada. Great experience for a 15 year old. After reading this, I find Minnesota to be just as backwards as Wisconsin is outside of Madison and Milwaukee. Great place to roam and bad politics. I know it is tough to get many to read beyond a couple of paragraphs. This post documents Kip Sullivan’s testimony to the Minnesota Health and...

Read More »Financialism

Back before, municipal and state governments, pension funds, etc. mostly invested in financials of the manufacturing sort. Then, America was in the manufacturing business. An issuing manufacturer was contractually bound to hand over the return owed. The investors were entitled. If they didn’t get their entitle, it was, ‘”see you in court.” In 2023, in Biden v. Nebraska, six states are arguing that Biden’s proposed cancellation of certain student loan...

Read More »New Deal democrats Weekly Indicators April 10 -14

Weekly Indicators for April 10 -14 at Seeking Alpha – by New Deal democrat My ‘Weekly Indicators’ post is up at Seeking Alpha. The slow drip-drip-drip of deceleration generally continues. Perhaps most significantly, YoY consumer spending as measured by Redbook sank to a new post-pandemic lockdown low of only +1.5%. But other coincident indicators in particular, like tax withholding, appear resilient. As usual, clicking over and reading...

Read More »Real manufacturing and trade sales probably rose to a new record high in February; may have declined in March

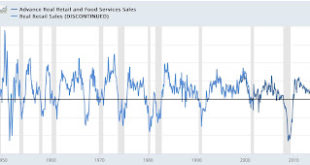

Real manufacturing and trade sales probably rose to a new record high in February; may have declined in March – by New Deal democrat Real manufacturing and trade sales is one of the 4 monthly coincident indicators most monitored by the NBER to determine whether the economy is in expansion or recession. Because the reporting of this series lags badly (by 2 months), I have developed several placeholders to estimate it on a more timely basis....

Read More »Positive revisions make for a good March industrial production report

Positive revisions make for a good March industrial production report – by New Deal democrat If retail sales for March were bad, industrial production (blue in the graph below) was at very least mixed to the upside. Total production increased +0.4%, and on top of that February was revised higher by +0.2%, and January was revised higher by +0.5%. The not so good news is that while manufacturing (red) was also revised higher by +0.5% for...

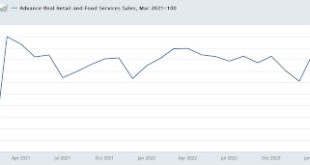

Read More »March real retail sales lays an egg

March real retail sales lay an egg, suggests downturn in nonfarm payrolls by the end of summer – by New Deal democrat After a quiet early part of the week, today we get a deluge of data: retail sales and industrial production for March, and total business sales for February. Because real total business sales are one of the 4 big coincident indicators tracked by the NBER, and because retail sales are about 1/3rd of the total, and industrial...

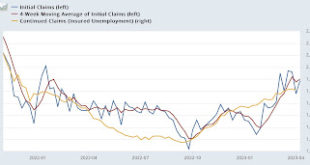

Read More »Initial claims continue to warrant yellow caution flag

Initial claims continue to warrant yellow caution flag – by New Deal democrat Initial jobless claims last week rose 11,000 to 239,000. The more important 4 week average rose 2,250 to 240,000. Continuing claims, with a one week delay, decreased 13,000 to 1,823,000: At this juncture the YoY change is more important, because increases of more than 10%, especially in the 4 week average, or monthly, are a yellow caution flag for recession, and...

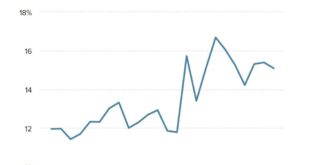

Read More »Even with today’s slowdown, profit growth remains a big driver of inflation

This is a brief and targeted commentary by EPI’s Josh Bivens to which I have added input. The Fed has been flailing away at the economy in the belief Labor is the issue. Josh contends, product or profit markups have been a major issue. He does provide a foundation for his posit. I look to the supply chain issue(s) as the basis for the higher profits. I experienced similar in getting componentry in 2008-2010. With less supply and a lengthen (and...

Read More »Consumer inflation is about 3.0% YoY. The economy has experienced Deflation since last June

Properly measured, consumer inflation is only about 3.0% YoY, and the economy has experience Deflation since last June – by New Deal democrat One month ago, I “officially” took the position that inflation had been conquered, and that, properly measured, the economy had actually been experiencing deflation since last June. This morning’s report only confirmed that position. The primary reason, as I have been pounding on for almost 18 months,...

Read More » Heterodox

Heterodox