“States Should Use New Guidance to Stop Charging Parents for Foster Care, Prioritize Family Reunification,” Center on Budget and Policy Priorities, cbpp.org, Diana Azevedo-McCaffrey. This article was referenced at “Mike’s Blog Round Up,” Crooks and Liars, by Batocchio, on October 22, 2022. The Health and Human Services (HHS) Administration for Children & Families is allowing states to end the practice of charging parents for costs associated...

Read More »New factory orders remain an economic bright spot

New factory orders remain an economic bright spot – by New Deal democrat New factory orders for October were reported this morning. I normally don’t write about them, because they are very noisy, but since at the moment they are one of the few bright spots among the short leading indicators, let’s take a look. Total new factory orders rose 1.0%. “Core” orders excluding defense and aircraft rose 0.6%: “Core” orders have been flat for 2...

Read More »US Needs More Housing to Meet Demand and Costs

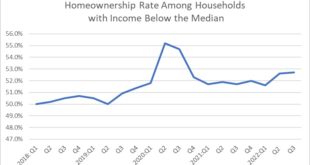

Anne Lowrey at The Atlantic recognizes a shortage of housing overall and mostly in the cities. “The U.S. Needs More Housing Than Almost Anyone Can Imagine.” Just how many houses, what is the number? How many homes must the expensive coastal cities in the US build to become affordable for middle-class and the working-poor families? Over the past few weeks, Anne asks a number of housing experts that question. Anne expected a straightforward...

Read More »New Deal democrat’s Weekly Indicators for November 28 – December 2

Weekly Indicators for November 28 – December 2 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. First the long leading indicators turned. Then the short leading indicators turned. Now the coincident indicators are weakening to new expansion lows almost every week. The silver lining is: the first long leading indicator may already have hit its worst levels. As usual, clicking over and reading...

Read More »A Tale of Two Recoveries

A Tale of Two Recoveries podcast from the Roosevelt Institute compares the recoveries between now and the Great Recession. What’s Changed since the Great Recession? The shifts in economic policy thinking over the last decade helped produce today’s record-breaking recovery. Heidi Shierholz: “The economy is not like the freaking weather, right? Like it really is a policy choice. The difference in the speed of the recovery really, really...

Read More »Census and WaPo at Odds Over Effect of Inflation on Low-Income Families

As I read Dean Baker’s perspective on Low Income families, I find it hard to believe. The market in the Southwest has dried up due to high prices and interest rates. One or the other has to be lower to attract buyers. Builders have not lower prices and bank rates have remained high. One builder was complaining of a lack of interest in a rate at 6%. Coupling to a higher price this is very true. It is also taking anywhere from 6 to 12 months to...

Read More »Economic Policy After the Midterm Elections

Economic Policy After The Midterm Elections Will economic policy change much aa a result of the midterm elections? After all, the GOP has taken the House of Representatives, if only narrowly, with inflation and the economy supposedly the top issue, especially for those supporting the GOP. Will this reappearance of “divided government” have an impact on economic policy? My bottom line is probably not too much, although there is the serious...

Read More »Strong personal income and spending – near record low in saving

Strong personal income and spending contrast with near record low in saving – by New Deal democrat Like retail sales earlier in November, personal income and spending both rose smartly, as shown in the below graph of real retail sales compared with real personal spending: Real personal income was up 0.4%, and real personal spending increased 0.5%: Nominally each increased 0.3% more; i.e., the PCE deflator was 0.3%. Each metric only had...

Read More »Jobless claims get closer to signaling recession

Initial jobless claims get closer to signaling recession – by New Deal democrat Today is one of those data-palooza days, so I’ll put up separate posts on personal income and spending, and the ISM manufacturing report and construction spending reports later. But let’s start with weekly jobless claims, and the news here is OK for the week, but the trend is troublesome. Initial claims declined -16,000 from last week’s 3 month high to...

Read More »The Inflations

Inflation is defined as a significant increase in the price of most goods and services in an economy over a short period of time. No controversy. Or, is there? And, … since inflation is likely but an effect, a symptom; the real question might should be, “What are the causes of inflation?” It is always better to address the cause rather than the symptom, is it not? Sometimes, in hard times when there isn’t enough money to go around, in an effort to...

Read More » Heterodox

Heterodox