From the Economic Policy Institute comes this piece on who gets benefits: The pandemic highlighted vast inequalities in the United States, especially in the U.S. labor market. Striking disparities were magnified in who could work from home and who had to go into work in person, who was able to keep their job and who suffered from lost work hours or employment altogether, who had health insurance to seek care when they needed it and who didn’t,...

Read More »August personal income and spending: major downward revisions overwhelm modestly positive monthly gains

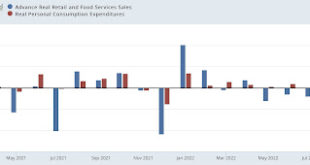

– by New Deal democrat This morning’s personal income and spending report for August was positive month over month both in nominal and real terms, but the major story was in the revisions. Personal spending is the essentially the opposite side of the transaction of retail sales. Both have been tracking relatively closely since the end of the stimulus-fueled spring spending spurge of 2021, as shown in the m/m% changes below: Real...

Read More »Distibution and Total Growth of Family Wealth

This popped up on “Letters from an American” just last night. I was too tired to read Prof. Heather Cox-Richardson’s article. So, I missed out on a good message about the income of America’s population. This is a recent commentary by the not-so nonpartisan Congressional Budget Office in September 2022. The thrust of the article? “Trends in the Distribution of Family Wealth, 1989 to 2019.” Prof. Heather Cox-Richardson’s Introduction; Since...

Read More »The positive trend in jobless claims continues

The positive trend in jobless claims continues For still another week, initial jobless claims continued their recent downtrend. Initial claims declined -16,000 to 193,000, a 5 month low. The 4 week average also declined -8,750 to a new 4 month low of 207,000. Continuing claims, which lag somewhat, declined -29,000 to a 2.5 month low of 1,347,000: The downtrend of the past 2 months is almost certainly a positive side-effect of lower gas...

Read More »Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

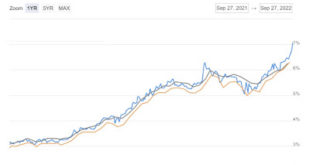

Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace There’s a lot going on with interest rates in the past few days. Mortgage rates have increased above 7%: This is the highest rate since 2008. Needless to say, if it lasts for any period of time it will further damage the housing market. The yield curve has almost completely inverted from 3 years out (lower bar on left; upper bar shows a similar curve in April...

Read More »What News was in My In-Box

Kind of a mixed bag of what news was showing up in My In-Box. It was evenly spread amongst various topics. Ford building a battery plant just like everyone else is planning. Wall Street buying up residential homes. That purchasing of houses will come to no-good for the average citizen. ACA Preventive is under threat by a looney federal judge in Texas and SCOTUS has to decide. Non-Opioid pain treatment sounds like a good idea. If you do not like the...

Read More »House price indexes: more evidence of a summer peak

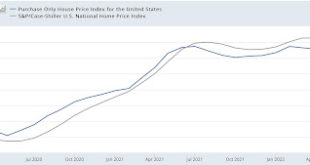

House price indexes: more evidence of a summer peak – by New Deal democrat The Case Shiller and FHFA house price indexes were updated through July (technically, the average of May through July) this morning. Ordinarily I do not pay them too much mind, but this year they are very important in confirming a peak in house prices. Although the FHFA index is seasonally adjusted, the Case Shiller index is not, so the best way to show them in...

Read More »What’s the math on inflation?

I’m not a macro person, I can’t even play one on TV. That said, from 20,000 feet, with my admittedly blurry glasses on, I really don’t understand why the Fed and other central banks are pushing so hard on the brakes. What follows are questions, skeptical about rate hikes, but genuinely questions. What exactly would have happened if the Fed had raised rates more moderately, or even not at all? Would inflation have spiraled out of control? It’s...

Read More »September 26, 2022, Letters from an American

This is a good one from Prof. Heather Cox-Richardson. It is along the lines of what I would consult in at various companies till I fixed it and was no longer needed. It is an update on what has happened in the United States. Something which has not occurred since pre-Reagan. The nations labor is being “valued” again. Peter Drucker: “Balance Sheets are meaningless. Our accounting systems are still based on the assumption that 80% of costs are...

Read More »Gas and oil price update: good news and bad news

Gas and oil price update: good news and bad news We’ll get some important house price information tomorrow, but there is no economic news of significance today, so let’s update gas and oil prices. As indicated in the title, there’s good news and bad news. I’ll start with the bad news first. According to GasBuddy, gas prices have not declined in over a week: They have bounced off $3.64/gallon and stabilized at $3.66-7/gallon. Which still...

Read More » Heterodox

Heterodox