As we hear how poorly the economy has been doing, I thought I might review Biden’s first year in office using six graphs from CEPR. I only wish the economy was this poor in 2008 when I forced to seek jobs out of state and work out of state for four years. I was good on making the swoop home to my wife the same as I did coming home from overseas duty. “Assessing the First Year of Biden, in Graphs” is what CEPR is calling its collection of articles...

Read More »Signs and portents of an employment slowdown and a near-term recession

Signs and portents of an employment slowdown and a near-term recession – by New Deal democrat I continue to believe that a recession – possibly a deep if relatively brief one – is likely to start early next year. As I’ve mentioned before, this isn’t just an academic exercise; recessions by definition feature jobs and income losses, which is my primary interest. With that introduction, let’s look at one overall metric, and several which will...

Read More »September jobs report: positive report within a framework of continued deceleration

September jobs report: a very positive report within a framework of continued deceleration As I have written many, many times, consumption leads employment; and the near stagnation in real sales and spending signaled that we should expect weaker monthly employment reports, with both fewer new jobs and a higher unemployment rate. In September, the former happened; the latter did not. The three month average in employment gains since February...

Read More »I am an extreme Inflation dove and complain that heads they win tails I lose

The point of this post is that I see an odd consensus about the conclusion based on opposite assumptions. The conclusion is the standard conclusion that US inflation is currently definitely too high and that it is necessary to reduce it even at the risk of a recession. First the US public considers current US inflation to be a very bad problem. It is easy to see why. Normal people use “inflation” to mean price inflation and assume given...

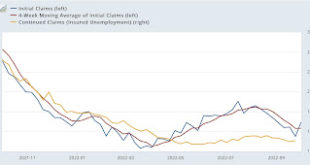

Read More »Jobless claims rise, gas price low is probably ending

Jobless claims rise; the gas price low is probably ending – by New Deal democrat Initial jobless claims may have ended their recent downtrend. Initial claims rose 19,000 to 219,000 from last week’s 5 month low. The 4 week average rose 250 from its 4 month low to 206,500. Continuing claims, which lag somewhat, increased 15,000 to 1,361,000: The downtrend of the past 2 months was almost certainly a positive side-effect of lower gas prices....

Read More »Putin Supporters In US Becoming Desperate

Putin Supporters In US Becoming Desperate Latest reports have after Putin annexed four oblasts in Ukraine the Ukrainian military making numerous gains in several of those and simply on a major roll that seems very unlikely to be stopped or even slowed down all that much, short of Putin using nuclear weapons. First Lyman was taken, now the last town the Russians held in Kharkiv oblast was taken. Ukrainian troops appear to be closing fast on both...

Read More »Unfinished Ford Truck Inventory Piling Up as seen from Space

Once again, automotive is building inventory dues to parts shortages. Semiconductors appear to be an issue again or the issue never went away. Much of this is due to automotive OEMs trying to drive parts cost down to the tiers. Many of them are running tight budgets due to the OEMs. They will not hold inventory unless the OEMs commit to it. The other side of this being Ford splitting it business into two parts, traditional fuel vehicles and Electric...

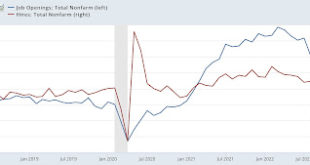

Read More »August JOLTS report: the game of reverse musical chairs in the jobs market is ending

August JOLTS report: the game of reverse musical chairs in the jobs market is ending – by New Deal democrat Since early this year I’ve been making the point that, because of the pandemic, there have been several million fewer persons looking for work, leaving a huge number of unfilled job vacancies, particularly in the face of a roughly 10% higher jump in demand. This has given employees the upper hand, as there are almost always higher...

Read More »September manufacturing new orders and August construction spending both turn down

September manufacturing new orders and August construction spending both turn down – by New Deal democrat As usual, we begin another month and another quarter with important manufacturing and construction data. The ISM manufacturing index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three cases did not actually cross the line...

Read More »What is in My In-Box

As you can see bullet spewing weapons takes the lead this week. There are a lot of articles as taken from JAMA Network. which also has more and unlisted here. You are probably also wondering why the term “bullet spewing weapons” verbiage. There was always a discussion on semi-automatic, automatic, revolvers, etc. So, I cut to the chase. We are talking about weapons which spew bullets. Hence the name. Everything else is a mixture of various topics...

Read More » Heterodox

Heterodox