Something interesting is happening in Texas. Agricultural Commissioner Sid Miller’s office has made a hard push on a marketing campaign for a renewed push for the Farm Fresh Network. Including a new website design. To catch you all up, the Farm Fresh Network was an initiative created by the Ag Commissioners office in 2015 that created an online network of local farms; a database of where, who, and what is being grown there, for the farmers as...

Read More »Jobless claims: put the recession on hold!

Jobless claims: put the recession on hold! (For now) For the last several months, there had been nearly a relentless slow increase in new jobless claims. That trend has broken, at least for now. Initial jobless claims declined by 2,000 to 243,000. The 4 week average, however, increased by 1,500 to 247,000. Continuing claims declined -19,000 from their 4 month high water mark one week ago to 1,415,000: Claims had been trending almost...

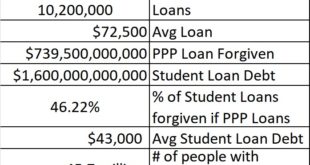

Read More »PPP Loans forgiven and Students holding Loans can pound sand

All the delays in getting to this point. I certainly was not fooled. Biden has an extensive history of believing students will renege on their loans, when there was no evidence to support his contention early-on. By early, let go back to 1978 (link is provided). I have added other Angry Bear links to build a foundation for my words. Amateur Socialist brought up a point at Naked Capitalism, which makes sense: Reading through the comments I’m...

Read More »Sources of Interest

Agricultural news is slim, few and far between and usually relegated to only a few places. Mainstream media doesn’t have an audience for hard ag journalism, and ag journalism mostly preaches to the choir. Two great publications that I typically get information from are Successful Farming and AgWeb –. Both have varying degrees of in-depth coverage and decent reporting. I also subscribe to Successful Farming magazine. Usually, I can find topics...

Read More »July new home sales signal a recession is near

July new home sales signal a recession is near Let’s start with reminders about new home sales data: 1. It is very noisy 2. It is heavily revised. But 3. It usually leads at peaks and troughs. With that in mind, unless today’s new home sales data for July is revised away, it is very significant. First of all, June’s sales data was indeed revised slightly lower from 590,000 to 585,000. More significantly, the median price of a...

Read More »What News was in My In-Box

Kind of a mixed bag on articles this week. Quite a few articles on what I would call general interest, kind of interesting stories. An abused elephant tears his owner into two pieces. An article about a pod of penguins(?) save a swimmer from a shark? It is worth a read just to find out the author meant dolphins (which is in the text). Sad Good Byes Judith Durham obituary | Pop and rock | The Guardian, Garth Cartwright, As you age, you begin to...

Read More »The state of inflation … gas, housing, and vehicles

The state of inflation There’s no big economic news today (Aug. 22), and as usual very limited COVID reporting over the weekend, so let’s catch up on the state of inflation in the economy. Three of the biggest components of inflation have been gas, housing, and vehicles. Let’s look at each in that order. According to GasBuddy, average US prices as of today are $3.86/gallon: As the above graph shows, that means that almost 80% of the...

Read More »Weekly Indicators for August 15 – 19 at Seeking Alpha

Weekly Indicators for August 15 – 19 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The continued decline in gas prices has been doing some nice things to other indicators as well. Meanwhile, manufacturing as measured by the regional Feds is getting worse. As usual, clicking over and reading will bring you fully up to date, and reward me just a little bit for my efforts. ...

Read More »Prices of existing homes have probably peaked

Prices of existing homes have probably peaked By now you may already know that existing home sales declined further in July, to an 8 year low (excluding the pandemic lockdown months: This is roughly a 30% decline from their peak, and is certainly a recessionary level. But perhaps more importantly at the moment, it appears that the prices of existing homes have now peaked. Here is the one year graph from FRED: Since there is no...

Read More »Ridding the Post Office of Louis DeJoy

David Dayen: The president may soon have an opportunity to remove Louis DeJoy. Later in December of this year, two postal governor spots will be open. The terms of Republican William Zollars and Democrat Donald Lee Moak will expire then. Both Zollars and Moak are allies of Postmaster General DeJoy. At that time, Biden could nominate two of his choices for those spots as replacements. The only issue I see with this plan is Democrats must have...

Read More » Heterodox

Heterodox