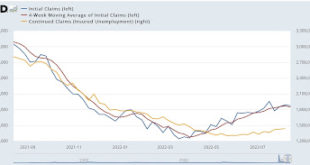

New jobless claims decline for a (recent) change For the last several months, there has has been nearly a relentless slow increase in new jobless claims. That trend broke, at least for this week. Initial jobless claims declined by 2,000 to 250,000. More importantly, the 4 week average also declined by 2,750 to 246,750. Continuing claims rose 7,000 to 1,437,000, the highest since April: Claims have been on track to turn higher YoY in...

Read More »July real retail sales show more stagnation, but slightly positive YoY

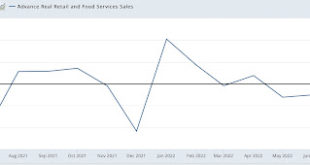

July real retail sales show more stagnation, but slightly positive YoY Consumption leads employment. Increasing demand for goods and services leads employers to hire more people to fulfill that demand. That, in a nutshell, is the biggest reason why real retail sales is one of my favorite economic indicators. In July, nominal retail sales increased by less than 0.1%, rounding to 0. Consumer prices declined by less than -0.1%, also rounding...

Read More »Industrial production heats up in July

Industrial production heats up in July If the news in the housing sector this morning was bad, the news from the King of Coincident Indicators, industrial production, was quite good. Total production rose 0.6% to a new all-time high. Manufacturing production rose 0.7%, and is below its April peak by only -0.1%: Barring downward revisions, this, together with the latest blockbuster employment report, makes it *very* unlikely that the US was...

Read More »What Was in My In-Box

climate and the environment edition This week, a number of articles in My In-Box were about climate and the environment. Seeking Alpha was featuring Michael Smith’s “The Future of Farming,” on their site. Recognizing AB authors is not unusual. Climate and Environment “The U.S. could see a new ‘extreme heat belt’ by 2053” (nbcnews.com), Denise Chow and Nigel Chiwaya, An “extreme heat belt” reaching as far north as Chicago is taking shape, a...

Read More »Housing permits, starts, and construction telegraphing a deeper economic decline ahead

Housing permits, starts, and units under construction telegraph a deeper economic decline ahead Housing had another negative month in July. Permits (gold in the graph below) declined -1.3% to 1.674 units annualized, an 8 month low. Single family permits (red, right scale) declined -4.3% to 928,000 units annualized, the lowest since January 2020 except for the pandemic lockdown months. And the three month average of starts (blue) declined to...

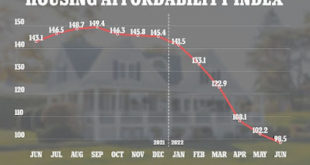

Read More »Housing affordability: at or near the worst this Millennium

Housing affordability: at or near the worst this Millennium The NAR calculates a monthly “housing affordability index,” which estimates the median mortgage payment for the median priced existing home based on an estimate of median household income. For June that came in at 98.5: Not only has affordability deteriorated sharply this year, but the June reading was the lowest in over 20 years, i.e., even worse than at the peak of the housing...

Read More »Extreme heat belt

Angry Bear Michael Smith’s post The Future of Farming reminded me that food and water supply issues need regular updates and highlighting. This report caught my eye since we here in Boston are experiencing very dry conditions with hot day temps. The U.S. could see a new ‘extreme heat belt’ by 2053: The report, released Monday by the nonprofit research group First Street Foundation, found that within a column of America’s heartland stretching...

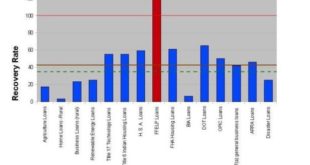

Read More »GAO: Government Losses on Federal Student Loan Programs?

As you “should” know by now, Alan Collinge is an activist and has organized the Student Loan Justice Org a number of years ago. The Organization attempts to represent those student loan borrowers who have no recourse for forgiveness or bankruptcy as every other person in the nation has when taking out a loan? Alan and his thousands of followers having gathered well over 1 million signatures on a petition seeking relief from these loans. The...

Read More »The Semiconductor Bill and Moderna Billionaires

A lot has been said about building semiconductor manufacturing plants in the US. One plant grows the silicon wafers and the other plant fabricates (fabs) the semiconductors. The manufacture of semiconductors is not labor intensive. Growing wafers is boring business as one engineer told me a decade back. The US did manufacture much of its need domestically at one time (see graph at the left). However, U.S. policymakers held tight to the belief...

Read More »The long leading outlook through mid-year 2023 at Seeking Alpha

The long leading outlook through mid year 2023 at Seeking Alpha I posted the long leading outlook this last week at Seeking Alpha, and seeing as there is no big economic news today, this might be a good day to bring you up to speed. My long leading outlook for 12 months from now can be found by clicking here. These indicators have been sufficiently negative that I am actually looking to see when they begin to forecast a positive outlook...

Read More » Heterodox

Heterodox