In chemistry, and in physics, a positive feedback loop usually yields an explosion. In biology, it is a population explosion. In electronics, it might be an unpleasant screech. In economics, both housing bubbles and inflation are products of a positive feedback loop. In re Global Warming: The melting of permafrost due to Global Warming releases methane a greenhouse gas which increases Global Warming, …, …. The melting of Arctic Ice reduces...

Read More »Continued good news for consumers on gas prices

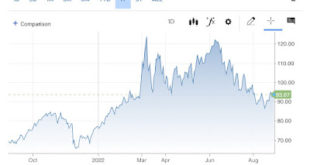

Continued good news for consumers on gas prices There’ll be lots of economic news starting tomorrow, but for today let’s pause and take a look at the energy situation. Here’s a look at oil prices in the past year up through yesterday from CNBC: And here’s a look over the same time period from Gas Buddy: Here’s a close-up of gas prices for the past month: Gas prices follow oil prices with typically a delay of several weeks. Oil prices...

Read More »irs.gov

The republicans are indignant as hell that the Inflation Reduction Act, née Climate and Healthcare Bill, would increase funding for the Internal Revenue Service (IRS). Since Reagan, republicans had been defunding it for them that brought them; them being the very rich who don’t like paying taxes. After the 2010 cuts, it had gotten to the point that the rich hardly pay any taxes at all. Why bother; the IRS didn’t have the money nor the personnel to...

Read More »What is the difference between 2011 and 2022?

I wanted to find a post/article which could details the differences between 2011 and 2022. I could not find exactly what I wanted. Infidel’s post comes close. I am looking at the years after 2008 when the nation was struggling to get back on an even keel. What is difference between 2011 and 2022? For one thing, actions not taken in 2011, were taken in 2022 due to the pandemic. The extension of funds to help families with children, increased ACA...

Read More »Student Loans

America is the land of equal opportunity. Well, yeah, truth be, your odds are little bit better if your parents can afford to send you to a good university. Other that, it’s even stephen. What if those who weren’t born to means could borrow the money? That would almost be as good, no.? Before 1965, if they went to their friendly banker, he asked them if they or their family had an account at the bank. If the answer was that their parents did have...

Read More »Weekly Indicators for August 22 – 26 at Seeking Alpha

Weekly Indicators for August 22 – 26 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. In the past couple of weeks, the decline in gas prices has slowed considerably. Once they stabilize, the underlying economic fundamentals should reassert themselves. In the meantime, there are cross currents of interest rates and manufacturing orders, among other things. As usual, clicking over and reading should be educational for you...

Read More »Who Should Have Children? If You have to ask . . .

[embedded content] April 10, 2008, at Economist’s View former Angry Bear writer Noni Mausa had this to say . . . Take the time. Watch this, I just did. It explains exactly why the middle class is in trouble and where the money has gone. Over on Angry Bear we were discussing who can afford children, in this post: “Who Should Have Children? Or, If You Have To Ask, You Can’t Afford Them“ Me again: Our Middle Class is still in trouble. The...

Read More »Will the Inflation Reduction Act (IRA) Reduce Inflation?

Will the Inflation Reduction Act (IRA) Reduce Inflation?, Econospeak Probably not, but it also will probably not increase it either. This is the judgment of the Congressional Budget Office and also the Penn Wharton Budget Model, as well as libertarian economist Tyler Cowen of George Mason, who is critical of much of its content. It has inflationary and disinflationary elements, and it looks that they about balance out, although in the longer run...

Read More »DOT: Vehicle Miles Driven Decreased year-over-year in June

Bill McBride at Calculated Risk (8/23/2022 02:21:00 PM) had this report on mileage driven for June 2022. I am sure as Bill suggests gasoline prices may have played a role in the decrease. I wonder too if Covid kept people from travelling too? One of the links to the DOT page also shows travel by segments of the country. The West showing a far greater (5X) decrease than the Northeast. Calculated Risk: DOT: “Vehicle Miles Driven Decreased...

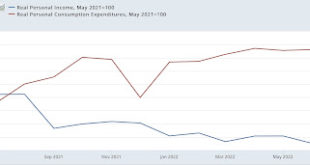

Read More »More modestly good fallout from lower gas prices

July personal income and spending: more modestly good fallout from lower gas prices There was more good fallout from the recent decline in gas prices in today’s July report on personal income and spending. Personal income rose 0.2% for the month nominally, and nominal spending rose 0.1%. But because the relevant measure of inflation, the PCE deflator, declined -0.1%, real income rose 0.3% and real personal spending rose 0.2%. Meanwhile June’s...

Read More » Heterodox

Heterodox