RJS: MarketWatch 666 Summary: 1st quarter GDP revision; April’s personal income and outlays, durable goods, and new home sales 1st Quarter GDP Revised to Show Our Economy Shrunk at a 1.5% Rate The Second Estimate of our 1st Quarter GDP from the Bureau of Economic Analysis indicated that our real output of goods and services shrunk at a 1.5% annual rate in the 1st quarter, revised from the 1.4% contraction rate reported in the advance...

Read More »Natural gas prices hit 13½ year high, Oil Exports at 26 Month High . . .

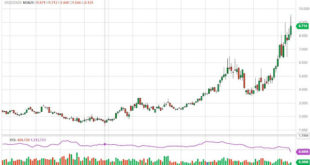

RJS: Focus on Fracking Summary: natural gas prices hit 13½ year high after a six-fold increase in less than 2 years; US oil exports at a 26 month high even with SPR at a 34½ year low & US oil supplies at a 17 year low; total oil + products inventories at a new 13½ year low even with highest refinery utilization rate since 2019 & greatest refinery throughput in 11 months; rigs down first time in 31 weeks Natural gas prices hit 13½ year...

Read More »Weekly Indicators for May 23 – 27 at Seeking Alpha

by New Deal democrat Weekly Indicators for May 23 – 27 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Few changes to the headlines, but lots of churning underneath. People seem to have jumped the gun on recession, thinking one is either here or imminent. It’s not here, and it isn’t imminent. I wonder if people will get complacent later in the year, thinking we have dodged a bullet. That probably won’t be true either....

Read More »Households are getting much more overextended

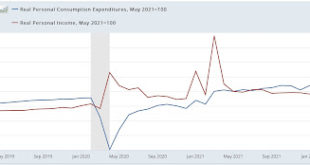

Real income and – especially – spending increase in April, but households are getting much more overextended by NewDealdemocrat In April nominal personal income rose 0.4%, and spending rose 0.9%. March’s spending was revised up from 1.1% to 1.4%. In more good news, the personal consumption deflator, i.e., the relevant measure of inflation, rose only 0.2%, so real income rose 0.2%, and real personal spending rose 0.7%. So far, so good. While...

Read More »Outlawing Abortion, It is a costly Endeavor

Boston Public Radio May 19th episode held a discussion of the consequences for the nation when abortion is outlawed. The guest was Jonathan Gruber, the Ford Professor of Economics at MIT. He was involved with the ACA and the Mass health insurance system. Getting right to it: Based on studies: Women who wanted an abortion but could not get one are more likely to die in child birth, have worse mental health outcomes and a huge increase in...

Read More »March and April’s retail sales Revised Higher

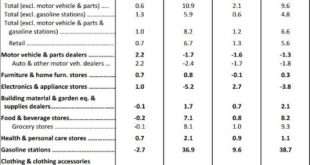

RJS, MarketWatch 666 Summary: Retail Sales Rose 0.9% in April after March Sales Revised 0.9% Higher Seasonally adjusted retail sales rose 0.9% in April, after retail sales March were revised 0.9% higher, while sales for February were revised a bit lower . . . the Advance Retail Sales Report for April (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled a record high $677.7 billion...

Read More »Baby Boomers Unretiring

“Will baby boomers unretire?” (beckershospitalreview.com), Molly Gamble, Becker’s Hospital Review Me: I am seeing this phenomenon happening quite a bit myself with multiple inquiries on job status. Millions of older Americans have returned to work in recent months, with nearly 64 percent of adults between ages 55 and 64 working in April. Essentially this is matching the share working in February 2020 and marking a more complete recovery than...

Read More »Housing still an economic positive over the next 12 months

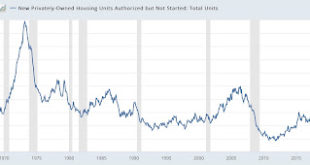

Housing permits and starts decline slightly, but housing still an economic positive over the next 12 months Housing permits and starts declined, but not by much, in April. Importantly, while typically permits, especially single family permits, lead these series, in the past year there has been a unique divergence between permits and starts due to construction supply shortages. This has been reflected in the number of housing units...

Read More »Corporate profits have contributed disproportionately to inflation.

Economic Policy Institute offers an explanation that our current inflation is different from previous recessions in the US in addition to what NDd and Barkley Rosser offer : Since the trough of the COVID-19 recession in the second quarter of 2020, overall prices in the NFC sector have risen at an annualized rate of 6.1%—a pronounced acceleration over the 1.8% price growth that characterized the pre-pandemic business cycle of 2007–2019....

Read More »Industrial production continues to show excellent growth

Industrial production continues to show excellent growth I call industrial production the King of Coincident Indicators, because it speaks volumes about where the economy is at any particular moment, and empirically is the indicator whose peaks and troughs coincide most definitively with NBER recession dates. In April the story told by industrial production continued to be very positive, as total production rose by 1.1%, and manufacturing...

Read More » Heterodox

Heterodox