Whenever Elon Musk says a thing, I reflexively mistrust it. So when I saw a video clip of Musk making this assertion, I wanted to think I learned something about the auto industry, but then I considered the source:“Large incumbent carmakers sell their cars at low to zero true margin. Most of their profit is selling replacement parts to their fleet, of which 70% to 80% are past warranty. Like razors & blades.”What say you, Bears? Is he correct?...

Read More »Repeat home sales price declined slightly in January; expect deceleration in the CPI measures of shelter to continue

– by New Deal democrat As I noted again yesterday, house prices lag home sales, which in turn lag mortgage rates. Yesterday we got the final February reading on sales. This morning we got the final January read on prices, for repeat sales of existing homes. Last week’s report on existing home sales showed a sharp increase in February, a repeat of the seasonally adjusted sharp increase last February, which was almost completely taken back over...

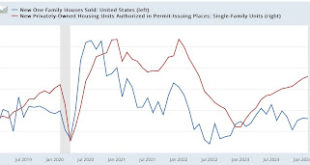

Read More »As mortgage rates remain rangebound, so do new home sales

– by New Deal democrat Let’s begin this post by putting why I am watching new home sales in context. The economy was kept out of recession last year, despite aggressive Fed rate hikes, in large part by commodity price deflation, much or most of which was triggered by the un-kinking of supply chains after the pandemic. That gale force economic tailwind is gone, but the Fed rate hikes remain. So, the big question for this year is whether the...

Read More »The economy is actually doing great — unless you want to make a change in your life.

Liking your present situation right now? Your job, your house, your car, you can keep it and you may have to do so. Buying a new car, house, or getting a different job may be more costly and not pay off. Even if you are not so satisfied, chances maybe you having to manage your pennies and stay put. Making a major economic change today involving costly upgrades, may not be advantageous, right now. Getting far out on a limb in a new job or with...

Read More »More for Them, Less for Us, Talking Taxes and Deficits

Ran across am Americans for Tax Fairness article last night. Corporation tax dodging and executive pay has both is far out of control. A significant number of major U.S. corporations are paying their top executives more than they’re paying federal income taxes. Matters have worsened with trump taking office in 2016 and the TCJA Making the Tax System, and the Tax Season More Burdensome. There is roughly a $2.1 trillion deficit resulting from this...

Read More »Open Thread March 24 2024 Shorter Work Week – Is It All It Promises to Be?

A New Norm: Senators Bernie Sanders and Laphonza Butler presented an intriguing idea: making a shorter work week a national norm. The bill they introduced proposes changing the standard workweek with no loss in pay for certain groups of employees, including many hourly workers, from 40 to 32 hours, at which point overtime pay would kick in. Whether that change sounds quixotic depends on whom you ask. But as Sanders said in a statement: “Moving to...

Read More »Leading Indicators Continue To Improve

New Deal democrats Weekly Indicators for March 18 – 22 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. I look at the high frequency weekly indicators because while they can be very noisy, they provide a good nowcast of the economy, and will telegraph the maintenance or change in the economy well before monthly or quarterly data is available. They are also an excellent way to “mark your beliefs to...

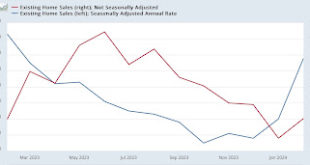

Read More »Signs of a thaw in the frozen existing homes market, but a very long way to go

– by New Deal democrat There’s no big economic news today, but yesterday existing home sales were released. While they have historically constituted up to 90% of the entire market, they have much less economic impact than new home sales, which involve all sorts of construction activity, followed by landscaping, furnishings, and other sales. Since the Fed started raising rates two years ago, the two markets have gone in entirely different...

Read More »The Lie Banks Use To Protect Late-Fee Profits

Hal Singer at Lever News wrote a commentary explaining how banks (mostly) are upset with the Consumer Financial Protection Bureau capping credit card late fees at $8. One would think this covers every bank. It does not and only covers banks with more than 1 million card holders. Any bank or organization with less customers can avoid the new rule. And of course there are other exceptions. The new rule takes effect sixty days after being posted in...

Read More »The positive streak of news from initial and continuing jobless claims continues

– by New Deal democrat Initial and continuing claims once again continued their recent good streak. Bonddad Blog Initial claims declined -2,000 to 210,000, while the four-week moving average rose 2,500 to 211,250. Continuing claims, with the typical one-week delay, increased 4,000 to 1.807 million: While these aren’t the 50+ year lows we saw 18 months ago, they’re not far off. For forecasting purposes, the YoY% change for initial...

Read More » Heterodox

Heterodox