According to legend, King Canute tried to order the tide not to come in. Needless to say, he failed, divine rights of kings nonwithstanding.Back when we lived in North Carolina, we visited the Outer Banks a few times. There were many expensive homes on the shoreline. These were often casualties of hurricanes that would push ocean water up over the islands. Then, as the hurricanes moved up the coast, water that had been pushed into Pamlico Sound would...

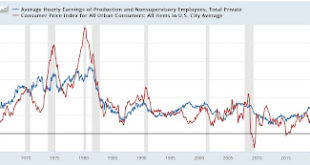

Read More »The most potent labor market indicator of all is still strongly positive

The Bonddad Blog – by New Deal democrat On Monday I examined some series from last Friday’s Household survey in the jobs report, highlighting that they more frequently than not indicated a recession was near or underway. But I concluded by noting that this survey has historically been noisy, and I thought it would be resolved away this time. Specifically, there was strong contrary data from the Establishment survey, backed up by yesterday’s...

Read More »Probing the Impact of Private Equity in Healthcare

Not rewriting anything on this commentary or adding to it. Shahon Firth covers a lot of territory in his brief commentary. Probe Into Private Equity in Healthcare Launched, MedPage Today, Shannon Firth Government officials announced a joint investigation into the role of private equity and “corporate profiteering” in healthcare during an online workshop hosted by the Federal Trade Commission (FTC) on Tuesday. The goal of the public...

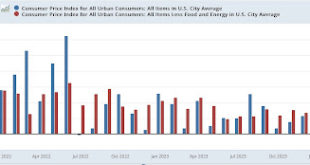

Read More »February consumer inflation: the tug of war between gasoline and shelter continues

February consumer inflation: the tug of war between gasoline and shelter continues The Bonddad Blog – by New Deal democrat Last month I described the trend in consumer inflation as an ongoing “tug of war” between energy and housing. Energy (mainly gasoline) peaked in June 2022 and made its low in June 2023, while housing, which peaked in early 2023, has been gradually disinflating since. That tug of war continued in February. Energy...

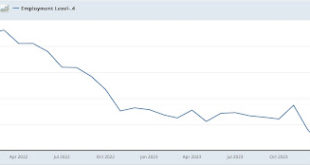

Read More »Scenes from the February jobs report: yes, the Household Survey really was recessionary

Scenes from the February jobs report: yes, the Household Survey really was recessionary – by New Deal democrat Later this week we get a lot of interesting reports, including CPI tomorrow, retail sales on Thursday, and industrial production on Friday. In the meantime, let’s take a further look at some of the more noteworthy data from Friday’s employment report. In particular, as I wrote then, the Household Survey portion of that report was...

Read More »The economics of lighting

I grew up with the admonition that you always turn off the lights if you’re the last to leave the room. Or “close the lights,” as my grandma used to say. But home lighting technology has evolved considerably over the past couple of decades.1. Does it save money to turn out the lights when you leave the room?2. Does it shorten the life of the bulb by turning it off and on more frequently?If you have LED lighting, the answers are (1) not enough to...

Read More »New Deal democrats Weekly Indicators March 4 – 8 2024

Weekly Indicators for March 4 – 8 at Seeking Alpha – by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. Generally speaking, there is a demarcation between consumer-oriented data, which is in the main positive, and manufacturing-oriented data, which is mainly weak or negative. As usual, clicking over and reading will bring you up to the virtual moment on the economy, and reward me with a little lunch money. New...

Read More »Biden Says Billionaires Pay an 8.2% Tax Rate. What Do Other Households Pay?

Let’s compare apples to apples here. Originally Published at Wealth Economics Uncle Joe has thrown out this 8.2% figure a couple of times, including in last night’s SOTU. Multiple folks have unpacked it; it’s not the standard “tax rate” measure. The usual “tax rate” is taxes divided by personal income, which doesn’t include accrued holding gains. The alternative that Joe’s using is based on Total “Haig-Simons” income, which does include...

Read More »February jobs report: Household Survey is downright recessionary and the Establishment Survey is decidedly mixed

February jobs report: the Household Survey is downright recessionary, while the Establishment Survey is decidedly mixed – by New Deal democrat In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing; and more specifically: Whether there is further deceleration in jobs gains compared with the last 6 month average,...

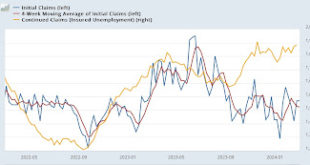

Read More »Initial jobless claims continue positive, suggesting good news for the tomorrow’s February unemployment rate as well

Initial jobless claims continue positive, suggesting good news for the tomorrow’s February unemployment rate as well – by New Deal democrat The most important reason I cover initial jobless claims is because they are an “official” short leading indicator. They are also very good at forecasting the short-term trend in the unemployment rate in the monthly jobs report, which will be updated for February tomorrow. And the news continues to be...

Read More » Heterodox

Heterodox