Interest Rate increases to fight perceived inflation or not fight perceived inflation? Big believer in the cause of much of the inflation being deliberate supply chain planning to increase prices. Have not seen a deliberate price increase yet which will fix a supply chain. Poor or deliberate planning creating issues, a lack of knowledge on supply chains, and invalid sourcing. Pick one. Similar occurred in 2008-10 and it raised its ugly...

Read More »“Are you better off than you were four years ago?”

Bonddad Blog – by New Deal democrat No economic news today, so let me take a look at the supposed killer recent GOP meme that they claim is completely unanswerable: “Are you better off today than you were four years ago?” This is based primarily on consumer sentiment reading as well as polling that has consistently shown that most people think that the economy is poor, even though they rate their own situation as doing well. Dan...

Read More »Flash finding: How drug money from sick people really works

AB: I was searching for a clear, brief, and understandable explanation of how the pharma industry works in delivering pharmaceuticals to patients. This article is one of the better ones out there and has a good and reasonable explanation on how the system works with prices, rebates, etc. A quick email to Antonio and I was given permission to use their commentaries. First in a series. It is not terribly long and the words give meaning to the charts....

Read More »Housing construction rebounds in February, as permits and starts are stable and rebounding

– by New Deal democrat The Bonddad Blog Yesterday I wrote of how Fed rate hikes had not translated into a decline in the amount of housing under construction, and without that I did not see how a recession could occur. And in reaction to January’s housing construction report I concluded, “To signify a likely recession, units under construction would have to decline at least -10%, and needless to say, we’re not there. With permits having...

Read More »Manufacturing and construction vs. the still-inverted yield curve

– by New Deal democrat at the Bonddad Blog Prof. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest previous time between onset of such an inversion and a recession. So he believes the threat of recession is still on the table. And he’s correct about the yield curve, although it is getting very long in the tooth. In the past half century, the shortest time between a 10...

Read More »Open Thread March 17 2024, January and February were rough months for inflation

Employ America’s current corecast is for a 2.86% YoY core PCE print for February. The six-month growth rate of core PCE, which was under 2% in December, should now be over 3% in February. Core services ex-housing inflation will be up on a year-on-year basis versus the previous meeting. Many FOMC members, especially among the moderates in the committee (Daly, Mester, Powell, Waller) have expressed a willingness to look through a hot January...

Read More »Inflation and Auto Insurance

Center for Economic Development and Policy Research, CEPR Dean Baker When we hear about inflation most of us probably think of items like food, gas, and rent, but when it comes to the Consumer Price Index (CPI), the most frequently cited measure of inflation, auto insurance has played a very large role in recent years. The index for motor vehicle insurance rose 0.9 percent in July. It was responsible for 0.024 percentage points of the 0.4...

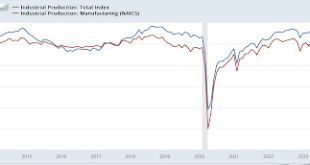

Read More »Industrial and manufacturing production improve for the month, but 16+ month fading trend continues

Originally Published at The Bonddad Blog by New Deal democrat Industrial production is an indicator that has faded somewhat in importance in the modern era since China’s accession to normal trading status in 2000. Before that, a downturn in production was an excellent coincident indicator for a general downturn in the economy. Since then there have been several downturns, most importantly during 2015-16, when the broader economy, most notably...

Read More »Good news and bad news Thursday: the good news is jobless claims . . .

Bonddad Blog – by New Deal democrat This morning brought us both good and bad economic news. The good news was that initial jobless claims continue very low, at 209,000, down -1,000 from last week, while the four week average declined -500 to 208,000. Even better, after major downward revisions, continuing claims rose 17,000 to 1.811 million: Recall that continuing claims had been reported over 1.900 million, so as I said above, this...

Read More »High school financial literacy?

I thought this might make a fun follow-up on my post on 8th grade algebra. Over at jabberwocking.com, Kevin Drum discusses a proposal to make a semester of financial literacy a high school graduation requirement. He feels that this would fill a much-needed gap:“There are no long-term tests of financial literacy that I can locate, and overall financial indicators aren’t flashing any red lights. Over the past few decades, both mortgage delinquency and...

Read More » Heterodox

Heterodox