This is not just Physican practices being bought up. A while back I was writing about hospitals merging with other hospitals and healthcare practices being bought up. The advantage of such is in negotiating rates with insurance companies. ~~~~~~~~ A measurement of the competitiveness of a hospital within a certain area of the country is done utilizing the Herfindahl-Hirschman Index (HHI). It has been used to measure competition in and around...

Read More »January personal income and spending: Goldilocks is knocking at the door

January personal income and spending: Goldilocks is knocking at the door – by New Deal democrat Personal income and spending has become one of the two most important monthly reports I follow, because it nets out the impacts of higher interest rates and abating inflation due to the unlinking of the supply chain. Because real personal spending on services for the past 50 years has generally risen even during recessions, the more leading...

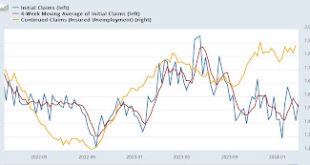

Read More »Initial jobless claims still very positive, especially YoY

Initial claims still very positive, especially YoY – by New Deal democrat Before I get to this morning’s personal income and spending report, let’s get the latest weekly update to jobless claims out of the way. New jobless claims rose 13,000 to 215,000, while the four-week moving average declined -3,000 to 212,500. Continuing claims, contrarily, rose 45,000 to 1.905 million, their second highest reading in over 2 years (but remains...

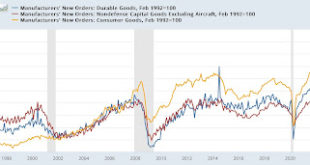

Read More »The state of freight

The state of freight – by New Deal democrat There’s no significant economic news today. Yesterday we did get durable goods orders, which are an official leading indicator. I don’t pay too much attention to them, because they are so volatile. Thus yesterday’s big -6.1% decline (blue in the graph below) is more likely than not just noise, particularly because “core” capital goods orders (red) increased 0.1%, and have been generally tending...

Read More »Michigan awards GM $1bn in incentives for new electric cars

Michigan has always been in the hunt for new model manufacturing in Michigan. This one pitched by Michigan to GM is nothing new. Just another state buying a company by funding its stay. I can find my records on this, Michigan owes $billions to corporate Michigan. This all started with Governor Engler. Companies are used to it, so now they expect to get it. Read on . . . Automakers’ history of taking fat subsidies and overpromising job growth make...

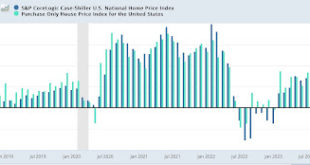

Read More »Repeat sales house price indexes continue to increases on par with past expansions

Repeat sales house price indexes continue to increases on par with past expansions – by New Deal democrat House prices lag home sales, which in turn lag mortgage rates. Yesterday we got the final January reading on sales. This morning, we got the final monthly (for December) read on prices, for repeat sales of existing homes. The FHFA purchase only price index rose 0.1% on a seasonally adjusted basis, and is up 6.6% YoY. Meanwhile the Case...

Read More »Kroger and Albertsons selling hundreds of stores in a bid to get FTC approval

This merger would only make groceries higher in cost. The economies of scale would not be passed along to consumers. Kroger and Albertsons sell hundreds of stores in a bid to clear merger of the 2 largest US groceries, QUARTZ The Federal Trade Commission has sued to block the $24.6 billion acquisition of Albertsons by rival grocer Kroger, alleging the deal would harm American consumers already facing high grocery bills. The FTC says the deal...

Read More »City mouse, country mouse

Over at jabberwocking.com, Kevin Drum takes on Paul Krugman over his assertion that small-town America is aggrieved because the working-age men are more likely to be unemployed than their metropolitan counterparts. As usual, Kevin brings the charts and numbers to show that while Krugman isn’t wrong, the differences are small and don’t explain “white rural rage.” Kevin notes that while pay is less in rural areas, the difference is mostly compensated...

Read More »Renewables 2023, Analysis and forecast to 2028

Renewables 2023, Analysis and forecast to 2028. IEA, Paris Executive Summary I did this before with the IEA. Sent the IEA a few emails establishing what Angry Bear could and could not use. Attributing the analysis I have posted here was one of the requirements. With their permission, I can bring to Angry Bear much of what is going on in the globally in the area of energy. They asked that I do not report on oil as companies pay for the reports....

Read More »New home sales and YoY prices change little; expect sideways trend to follow similar recent trend in mortgage rates

New home sales and YoY prices change little; expect sideways trend to follow similar recent trend in mortgage rates – by New Deal democrat This week we conclude January’s housing market data with repeat sales prices tomorrow, and new single family home sales, which were reported this morning. Per my usual caveat, while new home sales is that they are the most leading of the housing metrics, they are noisy and heavily revised. Which was the...

Read More » Heterodox

Heterodox