Two year low in new home prices and turndown in sales show renewed pressure caused by increased mortgage rates – by New Deal democrat Once again, this morning’s report on new single family home sales shows that the compete bifurcation of the new vs. existing home markets continues. Unlike existing homeowners, many of whom are shackled in place by 3% mortgages, new home builders can offer price incentives and downsize floor plans to increase...

Read More »Comparing energy efficiency of boiling water: household appliances

Comparing energy efficiency of boiling water: household appliances Michael D. Eissenberg, BSME, PE, Leed AP*, and Joel C. Eissenberg, Ph.D.* *co-corresponding authors Abstract Kitchen appliances use various mechanisms to heat, with differences in energy sources and geometry. The goal of this study was to compare energy efficiency across common household appliances. To facilitate comparison, 1 L of water was used as the heating substrate...

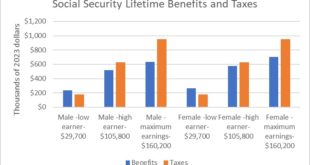

Read More »Social Security and Medicare: Fun with Numbers Time

I have added little to this commentary. Economist Dean Baker has taken a position on various aspects of the economy. A positive position which you will see many other commentaries trashing. We avoided one hell of a recession to date which would have been the equal to the 2008 collapse due to Wall Street’s addiction to gambling. You will not hear the news media promoting this. I will be posting more on this issue. Meanwhile, there exists a lot...

Read More »Divine Right

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.–That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, –That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or...

Read More »New Deal democrats Leading Indicators November 24 2023

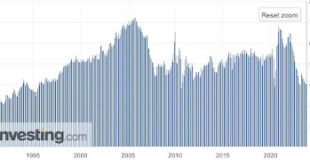

Why the Index of Leading Indicators failed – by New Deal democrat I have a post by the above title up at Seeking Alpha. The Index of Leading Indicators has persistently declined for 22 months, and is off by a level that in the past has been consistent with already ongoing, deep recessions. And yet the economy has continued to improve. Clearly there has been a misfire. The above article explains in more detail why I believe this has...

Read More »Rental Housing Economics in 2023

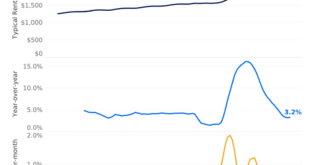

Doing my usual internet walkabout and looking for things which may be interesting to present at AB. Rental Housing costs and Mortgage costs are important in trying to find reasonable housing. A reader does not have to travel far to pick up on this topic. Angry Bear’s features New Deal democrat, who also covers similar topics every day. You can also read Bill McBride (Calculated Risk) comments on similar topics. At one time, Bill wrote at Angry Bear...

Read More »The Economy and “A Trump Thanksgiving”

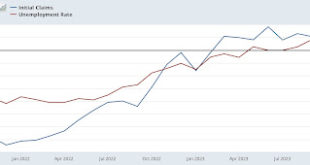

As suggested by New Deal democrat, the nation is experiencing an expansion of the economy which seems less likely to end in a recession. “There has been some commentary that continuing claims mean a recession is imminent or may even be underway. I am discounting that because initial claims have always signaled first, and also because continuing claims have been in the range of 25%-30% higher YoY for the last 6 months without worsening. Turning...

Read More »Initial jobless claims confirm benign employment conditions

Initial jobless claims confirm benign employment conditions – by New Deal democrat Initial claims declined -14,000 to 209,000 last week, and the four week moving average declined -750 to 220,000. With the usual one week lag, continuing claims declined -22,000 to 1.840 million: On a YoY basis, both weekly claims and their four week average were up only 4.6%. Continuing claims, which have been much more elevated YoY, were up 24.0%:...

Read More »Existing homeowners with 3% mortgages remain frozen in place, as sales fall to a new 28 year low

Existing homeowners with 3% mortgages remain frozen in place, as sales fall to a new 28 year low – by New Deal democrat October marked yet another month in the fully bifurcated housing market, in which most existing homeowners are frozen in place by their 3% mortgages, and buyers have turned to new homes (and in particular condos and apartments) instead. Existing home sales fell yet again, by 16,000 annualized, to 3.79 million, 45% down...

Read More »On Thanksgiving, enjoying the bounty of foods native to the New World

On Thanksgiving, enjoying the bounty of foods native to the New World – by New Deal democrat Happy Thanksgiving to all readers of this old-fashioned blog. One little fact I did not know until this year is that, with just a couple of exceptions, all of the foods that we traditionally put on the table for Thanksgiving dinner all are native to the New World:, including: Turkey Cranberries Squash Cornbread Potatoes Green...

Read More » Heterodox

Heterodox