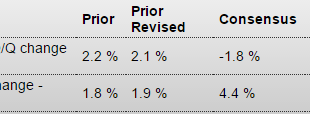

As previously discussed, the numbers are showing that business is hiring more than output is increasing, which doesn’t seem to make sense to me. That is, it wouldn’t surprise me to see this reconciled by a drop in hiring, or a downward revision to employment in general. Productivity and CostsHighlightsFlat output and a rise in hours worked combined to sink fourth-quarter productivity to an annualized rate of minus 3.0 percent. The Econoday consensus was minus 1.8 percent with the low...

Read More »Mtg purchase apps, Car sales comments, ADP, ISM services, Exxon capex, BOJ comment

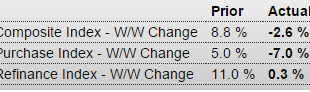

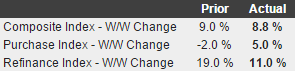

Up last week now back down as this sector remains in prolonged depression: MBA Mortgage ApplicationsHighlightsThe purchase index has been posting outsized gains this year but not in the January 29 week, falling 7.0 percent. The refinance index, however, did post a gain in the week, up 0.3 percent. Low interest rates have triggered strong demand for mortgage applications. The average 30-year fixed loan for conforming mortgages ($417,000 or less) fell 5 basis points and is back under 4.00...

Read More »Car sales, Redbook retail sales, Bank loans

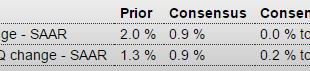

This is being spun as a positive, when all I see is a chart showing the seasonally adjusted annual rate of sales peaked several months ago and is going down: U.S. Light Vehicle Sales at 17.46 million annual rate in January Based on an estimate from WardsAuto, light vehicle sales were at a 17.46 million SAAR in January.That is up about 5% from January 2015, and up about 1.4% from the 17.2 million annual sales rate last month.This graph shows the historical light vehicle sales from the BEA...

Read More »Personal income and spending, ISM manufacturing, construction spending

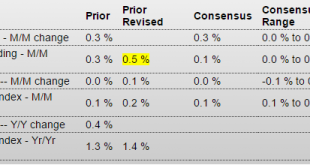

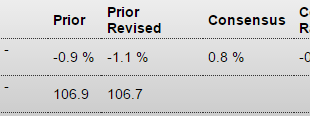

Spending still not good, and GDP *is* spending. Personal income growth remains low, but is higher than spending. I suspect this gets reconciled with downward revisions to income over time, perhaps due to downward revisions to employment. With GDP growth near flat employment growth implies more employees are being hired to produce the same levels of output, which sends up a red flag for downward revisions to employment. Personal Income and OutlaysHighlightsConsumers had a healthy December...

Read More »Japan, China, Fed comment, Capex cutbacks, South Korea

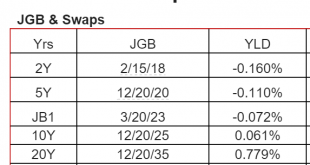

This is the yen yield curve after over 20 years of a 0 rate policy, massive QE, and now negative overnight rates. Maybe now the economy will finally respond.:( (And how good can the BOJ think the economy is?) The western educated kids/monetarists who’ve taken control don’t seem to be doing all that well, as China begins to look like the other countries they’ve taken over, like the EU, US, etc. etc. etc. What they learned is that it’s about balancing the federal budget and using monetary...

Read More »GDP, Saudi oil production, KC Fed, Chicago PMI, Shale Italy and Japan comments

As expected, the deceleration continues, and over the next couple of years it wouldn’t surprise me if the entire year gets revised down substantially: GDPHighlightsConsumer spending is the central driver of the economy but is slowing, at least it was during the fourth quarter when GDP rose only at a 0.7 percent annualized rate. Final demand rose 1.2 percent, which is the weakest since first quarter last year but is still 5 tenths above GDP.Spending on services, adding 0.9 percentage points,...

Read More »Economic Index, Storefronts, Fed statement, Pending home sales, Durable goods orders

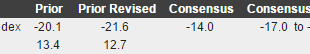

Also tracing the weakness back to the oil capex collapse: Econintersect’s Economic Index declined and is barely positive – and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014. The Fed got this highlighted first part right: Information received since the Federal Open Market Committee met in...

Read More »Mtg purchase apps, Vehicle sales, Oil capex, Business equipment borrowing, Equipment sales, New home sales

Inching up a bit but still seriously depressed: MBA Mortgage ApplicationsHighlightsWeekly mortgage applications have been very volatile so far this year but mostly to the upside. Purchase applications jumped 5.0 percent in the January 22 week with refinancing applications up 11.0 percent. Low mortgage rates are driving the activity, down 4 basis points in the week to an average 4.02 percent for 30-year conforming loans ($417,000 or less). Looks like Wards is forecasting no improvement in...

Read More »Recession warnings, Dallas Fed

Reads like we are already in recession… Recession Warnings May Not Come to Pass Jan 24 (WSJ) — Every U.S. recession since World War II has been foretold by sharp declines in industrial production, corporate profits and the stock market. Industrial production has declined in 10 of the past 12 months, and is now off nearly 2% from its peak in December 2014. Corporate profits peaked around the summer of 2014 and were off by nearly 5% as of the third quarter of last year. The Dow Jones...

Read More »Bank loans

When the growth rate was even modestly increasing it made the news. Now that it’s decelerating not a word…

Read More » Mosler Economics

Mosler Economics