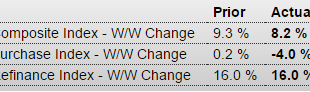

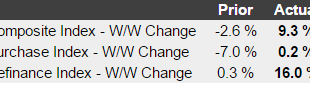

Purchase apps down again: MBA Mortgage ApplicationsHighlightsFalling mortgage rates continue to drive refinancing applications sharply higher, up 16 percent for a second straight week. Purchase applications, up 30 percent year-on-year, are also being driven higher though they declined 4 percent in the latest week. The average rate for 30-year conforming loans ($417,000 or less) fell 8 basis points in the week to 3.83 percent. Again, so much for what’s been forecast to be the ‘driver’ of...

Read More »NY Mfg survey, Home builder’s index, oil losses, Japan, China trade, euro trade

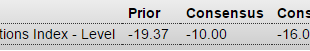

A lot worse than expected and still deep in contraction: Empire State Mfg SurveyHighlightsFor the seventh straight month, the Empire State report is signaling significant contraction for the manufacturing sector. The general business conditions index for February came in below low-end expectations, at minus 16.64 vs even deeper contraction of minus 19.37 in January. New orders, at minus 11.63, are in contraction for a ninth month in a row while employment, though improving to minus 0.99...

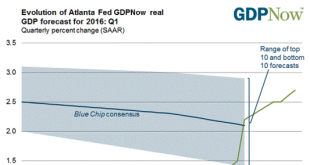

Read More »Atlanta Fed, Japan GDP, Consumer comment. LA port traffic

This is supported by increases in inventories that were already too high and likely to either be revised down or followed buy large declines for the rest of Q1. The retail sales number is also suspect and likely to revert to lower numbers: The Myth Of The Resilient Consumer By Lakshman AchuthanThe premise of incomes powering a consumer-driven pickup in U.S. economic growth is demonstrably false. And for people renting their homes the squeeze is even greater.One clue is the extent of the...

Read More »Retail Sales, Import and Export prices, Business inventories, Consumer sentiment, Japan

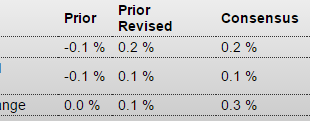

Retail SalesHighlightsVehicles are back on top, helping to lift retail sales to a 0.2 percent gain in January. Excluding vehicles and pulled down by falling gas prices, sales inched only 0.1 percent higher. But retail sales excluding gasoline stations — which is a central reading given the price fall — are up 0.4 percent for a very respectable year-on-year gain of 4.5 percent. The reading excluding both autos and gasoline is also up 0.4 percent in the month for a year-on-year rate of plus...

Read More »Mtg purchase apps, Distillates, Goldman, Investment, C & I non performing loans, Baltic dry index

No bounce this week for purchase apps: Goldman Sachs Abandons Five of Six ‘Top Trade’ Calls for 2016 By Rachel Evans and Andrea WongFeb 9 (Bloomberg) — Goldman Sachs to clients: whoops. Just six weeks into 2016, the New York-based bank has abandoned five of six recommended top trades for the year.The dollar versus a basket of euro and yen; yields on Italian bonds versus their German counterparts; U.S. inflationexpectations: Goldman Sachs Group Inc. was wrong on all that and more.

Read More »Euro banks, Fed’s labor market index, NFIB chart

Getting more obvious it’s ‘spreading’ much like during the sub prime days, as previously discussed? European banks face major cash crunch European banks may have to pare down assets to bolster capital reserves as cheap oil is taking a toll on portfolios of energy-exposed loans. It’s slowing, whatever it is…;) Labor Market Conditions IndexHighlightsPayroll growth slowed in Friday’s employment report as did the Fed’s labor market conditions index, to plus 0.4 in January from a downward...

Read More »Wholesale inventories, Small business index, Redbook retail sales

And another bad one as sales are falling just as fast as inventories: Wholesale TradeHighlightsWholesale inventories fell an as-expected 0.1 percent in December with November revised 1 tenth lower to minus 0.4 percent. Wholesalers have been liquidating inventories as sales have been falling, down 0.3 percent in the latest month following a 1.3 percent sales decline in November. And they’ve been successful, keeping down the stock-to-sales ratio at 1.32 the last two reports which is still...

Read More »Saudi March pricing, Consumer credit

Looks to me like some a bit higher but some a bit lower as well, which tells me the ongoing policy of ‘excess’ discounts remains in place:Nothing here to indicate spending this year will be any better than last year:This is largely student loans:

Read More »Inventories, Payrolls, Trade

This is getting out of control. Sales are slowing faster than inventories are being sold.A weak print and year over year growth continues to decelerate as per the chart: Employment SituationHighlightsHeadline weakness masks an otherwise solid employment report for January. Nonfarm payrolls rose 151,000 vs expectations for 188,000. December was revised 30,000 lower to 262,000 but November was revised 28,000 higher to 280,000. Now the signs of strength as the unemployment rate fell 1 tenth to...

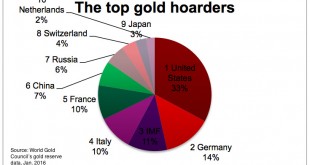

Read More »China and Russia buying gold

Seems it’s always a central bank story. Goes up when they buy, down when they sell. Furthermore gold buying is supported by how it’s accounted for. That is, it doesn’t count as deficit spending or part of the pubic debt, even though the ‘taxpayer’ has to pay interest on the funds spent, just like any other deficit spending. Gold purchases are accounted for not as an ‘expense’ as ‘normal’ govt spending, but as purchases of an asset that remains on the balance sheet at ‘cost’. And yes, the...

Read More » Mosler Economics

Mosler Economics