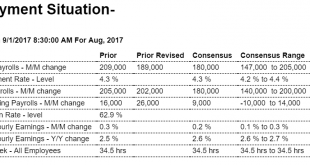

Weaker than expected, downward revisions, depressed earnings growth and participation rate. And note how the year over year growth has been going down now in, for all practical purposes a straight line, for over 2 1/2 years, when the shale boom ended and oil capex collapsed: Highlights August payroll growth, though solid, missed expectations while wage data clearly disappointed. Nonfarm payrolls rose 156,000 in the month vs Econoday’s consensus for 180,000. Revisions are...

Read More »Personal income and spending, Pending home sales

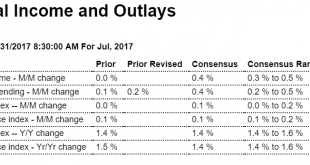

Personal income growth remains weal as per the charts, which also showed a sharp drop in the personal savings rate, which generally forecasts reductions in spending: Highlights Vital signs for the consumer are strong but inflation is completely lifeless, based on a mixed personal income & outlays report for July. Income is the highlight, up 0.4 percent in the month including a second straight 0.5 percent gain for wages & salaries in what is an important and emerging...

Read More »Mtg applications, GDP, Personal savings, Corporate profits, ADP employment, Federal tax reciepts

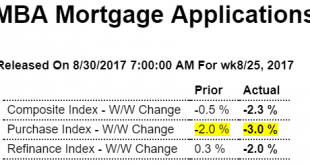

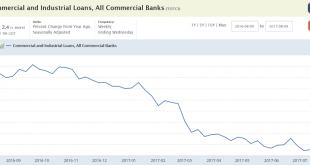

Purchase applications were down again, as housing weakness reflects the drop in the growth of mortgage credit: Highlights Low mortgage rates are failing to entice home buyers, whose activity declined for the third straight week according to the Mortgage Bankers’ Association. Purchase applications for home mortgages fell a seasonally adjusted 3.0 percent in the August 25 week following 2 percent declines in the two prior weeks. Unadjusted, the purchase index decreased 5...

Read More »Trade, SUV’s, Redbook retail sales, Trump and Harvey

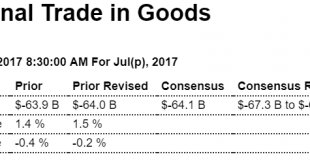

No ‘improvement’ here: Highlights Third-quarter GDP is off to a slow start, at least for international trade in goods where the July trade gap widened more than $1 billion to $65.1 billion. Exports fell 1.3 percent and were pulled down by a sharp fall in vehicles and also consumer goods which are two weak categories for the US. Helping to ease the effect of exports was a 0.3 percent decline in imports where foreign vehicles, which are usually in strong demand, fell 2.8...

Read More »Durable goods orders, Vehicle sales, Credit check

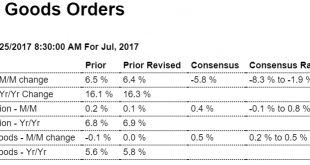

Nothing impressing me here, as per the chart: Highlights Durable goods orders came in as billed with a steep aircraft-related decline for the headline, at minus 6.8 percent, contrasting with solid gains for ex-transportation at 0.5 percent and core capital goods (nondefense ex-aircraft) at 0.4 percent. A special plus in the report, and one that will lift GDP, is a sharp pickup in shipments of core capital goods, up 1.0 percent in July with June revised 2 tenths higher to 0.6...

Read More »Tax proposals, New home sales, PMI surveys, Architecture Billings Index

Seems to me the highlighted proposals will reduce spending more than the cut in tax rates will increase spending: Trump’s team and lawmakers making strides on tax reform plan Aug 22 (Politico) — President Trump’s top aides and congressional leaders have made significant strides in shaping a tax overhaul. There is broad consensus on some of the best ways to pay for cutting both the individual and corporate tax rates. The options include capping the mortgage interest deduction...

Read More »House prices, Redbook retail sales, NY Fed survey

Home prices may be softening, but too soon to tell: Highlights The FHFA house price index came in at a very soft 0.1 percent increase in June, well short of Econoday’s consensus for 0.5 percent and low estimate of 0.3 percent. This is both good news and bad news, as slowing price appreciation should help affordability for home sales but will also limit growth in household wealth. Despite June’s weakness, year-on-year prices remain very strong, at plus 6.5 percent which is...

Read More »Credit check, Rig count, Consumer sentiment, Romney comment, Pollak comment

More of same: More evidence this has stabilized and maybe reversed: Expectations up, current conditions down: Highlights Consumer sentiment unexpectedly burst higher in the August flash but the results, warns the report, do not fully reflect the impact of the weekend’s violence in Virginia. The index rose to 97.6 which is well over Econoday’s high estimate and the strongest reading since the post-election surge in January. But the report said “too few” interviews were...

Read More »Industrial production, Trump comments

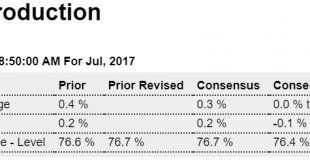

Worse than expected, but modest growth from depressed levels. Highlights The Federal Reserve inadvertently released what is a weak July industrial production report about a 1/2 hour early this morning. Headline production rose 0.2 percent vs expectations for 0.3 percent with manufacturing output showing outright contraction, at minus 0.1 percent vs Econoday’s consensus for a 0.2 percent gain. Capacity utilization hit expectations at 76.7 percent. A 3rd straight decline in...

Read More »Housing starts, Alt right study

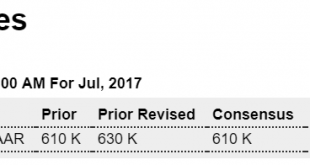

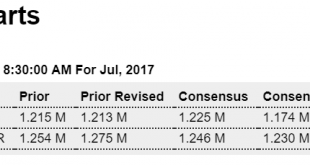

Lower than expected, and, as always starts are ultimately determined by permits, which have been slowing as per the chart, which also reflects the deceleration in mortgage lending over the last 6 months: Highlights Housing starts couldn’t hold the 1.200 million annualized line in July, falling to a lower-than-expected 1.155 million. The rate is now back to the weakness of March and April in what may be emerging as a declining trend this year. Permits also fell but are...

Read More » Mosler Economics

Mosler Economics