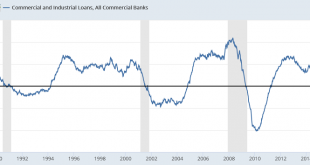

The chart still looks weak to me. Shale boom in 2014 pumped it up, and then reversing with the shale bust, and still looking suspect after January when consumer credit further decelerated: Highlights The consumer was back in the stores last month in a July retail sales report, headlined by a 0.6 percent monthly gain, that not only exceeds top expectations but also includes sizable upward revisions. Nonstore retailers, vehicle dealers, building materials stores lead the...

Read More »Credit check

This kind of deceleration has always been associated with recession: Bending the curve: Actual lending continues to decelerate: So for the last 6 months the Fed is seeing a steep decline in credit growth and a softening in price pressures, wage growth, employment growth, auto sales, home sales and permits, retail sales, and personal income. Apart from that things are looking up!;)

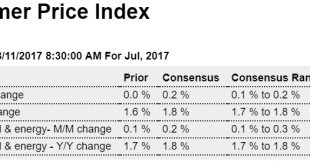

Read More »CPI, Oil and gas production, Hotels

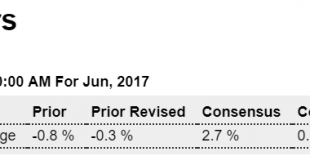

So the Fed is failing to meet its inflation target, wage growth remains weak, and all measures of credit expansion have been decelerating for more than 6 months: Highlights Consumer prices remain very soft, failing to match what were modest Econoday expectations for July. Total prices edged 1 tenth higher in July as did the core (less food & energy) which are both no better than the low estimates. Year-on-year rates are also at the low estimates, at 1.7 percent each....

Read More »PMC 2017

Thanks to all for your support for this year’s PMC! Looking like $48 million will be donated to Dana Farber for cancer research this year! Not too late if you haven’t contributed… ;) http://www2.pmc.org/profile/WM0015 I make my personal donation as a sponsor to insure every $ you donate goes to cancer research and not to expenses: ‘Mosler Economics/MMT’ was featured on the back pocket of the jersey. Hard to see in this picture so I circled it in red: The start in Wellesley:...

Read More »Dodge index, Euro area lending, China investment, Wholesale trade

This is reflected in the deceleration of commercial real estate lending: From Dodge Data Analytics: Dodge Momentum Index Stumbles in July The Dodge Momentum Index fell in July, dropping 3.3% to 135.0 (2000=100) from its revised June reading of 139.6. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move...

Read More »Small business survey, JOLTS

No sign of Trumped up expectations fading here: Hires fell, which most are saying indicates a lack of supply of workers. But the low wage growth and low participation rates tell me it’s more likely about low aggregate demand: Highlights Job openings rose sharply in June, to 6.163 million from 5.702 million in May. Hires, however, fell sharply, to 5.356 million from 5.459 million. This data set can be volatile but the underlying theme is a separation between openings and...

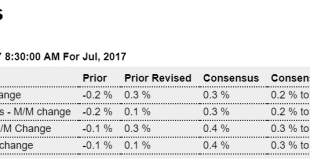

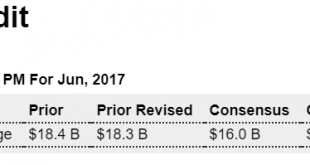

Read More »Consumer credit

Less than expected as the deceleration continues. I read this as reflecting a drop in consumer spending. The savings rate has been down, and the personal income curve has been bent lower as well, and retail sales have also slowed. So it can all be read this way:The consumer has less real disposable income, has cut back on spending, and has been ‘forced’ to put some of that reduced spending on his credit card, though less than the prior month, which doesn’t bode well for...

Read More »Credit check

Possibly bottoming at much lower rates of growth: Still heading lower: Is the deceleration in borrowing reflecting a deceleration in spending?

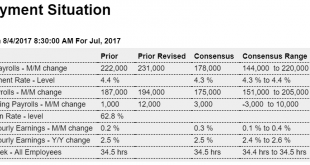

Read More »Employment, Trade, M2, Public employment, Rig count

More than the entire gain in civilian employment seems to have been via part time work: Highlights The second half of the year opens on a strong note as nonfarm payrolls rose 209,000 in July, far above Econoday’s consensus for 178,000. The unemployment rate moved 1 tenth lower to 4.3 percent while the participation rate rose 1 tenth to 62.9 percent, both solid positives. And a very strong positive is a 0.3 percent rise in average hourly earnings though the year-on-year rate,...

Read More »Factory orders, ISM services, China investments, ISM NY

Up nicely but not so good excluding aircraft orders, which are highly volatile: Highlights Factory orders surged 3.0 percent in June but were skewed higher by a more than doubling in monthly aircraft orders. Excluding transportation equipment, a reading that excludes aircraft, orders actually fell 0.2 percent in the month following a 0.1 decline in May and no change in April. June orders for capital goods (nondefense ex-aircraft) were also weak, unchanged in the month....

Read More » Mosler Economics

Mosler Economics