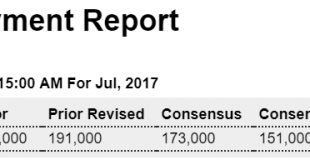

Highlights ADP sees the private payroll reading in Friday’s employment report coming in at 178,000. But ADP has been wild lately, evident in its sharp 33,000 upward revision to June which is now at 191,000. Econoday expectations are calling for 175,000 in private payroll growth in Friday’s report and 178,000 in total nonfarm payroll growth. ADP private falling off since year end: The now strong euro seems to be keeping a lid on prices via a drop in import prices. Looks to...

Read More »Construction spending, Personal income and spending, Vehicle sales

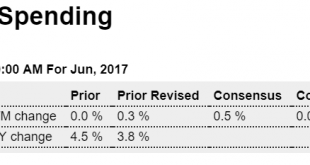

The chart is consistent with the deceleration in real estate lending as previously discussed: Highlights June’s construction spending report has much in common with June’s personal income and outlays released earlier this morning: lack of any apparent life. Spending fell an unexpected 1.3 percent in June with a 3 tenths upward revision to May only a minor offset. Residential spending in June fell 0.2 percent as a setback for multi-family units offset a respectable 0.3...

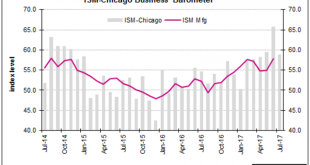

Read More »Chicago PMI, Dallas Fed, Pending home sales, Swiss reserve tax

The PMC annual bike ride is this weekend, so much appreciate that those of you who haven’t yet done soget your donations in, thanks, and if any of you will be there, let me know and I’ll be looking for you! http://www2.pmc.org/profile/WM0015 Settling down a bit: Better than expected: Better than expected, lots of volatility, and anticipates existing home sales by a couple of months, which have flattened this year: Highlights After three straight declines, the pending home...

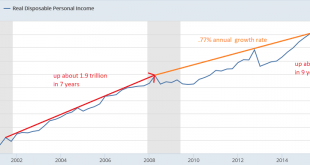

Read More »GDP personal income, Employment growth, Agricultural states performance, Rent growth, Chief of staff

In line with low aggregate demand: http://econintersect.com/a/blogs/blog1.php/gdp-growth-seems-to-be-normalizing As mentioned above, real per-capita annual disposable income dropped materially (by $74 per annum). At the same time the household savings rate was reported to have dropped by -0.1% from a sharp downward revision (-1.2%) to the prior quarter. It is important to keep this line item in perspective: real per-capita annual disposable income is up only +7.11% in...

Read More »GDP, Consumer sentiment, Rail traffic, Vehicle sales, Credit check

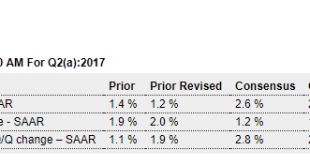

Up as expected though way down from initial forecasts as data deteriorated, and q1 was revised lower. More q2 data will be released over the next month when the first revision will be released. Consumer spending up vs prior quarter (but down year over year) even as consumer credit numbers decelerate, with ‘goods’ contributing over 1% to growth. Residential investment fell, in line with the deceleration in real estate lending, as did auto related spending, in line with...

Read More »Durable goods orders, Inventories, Trade, Consumer charge offs, Euro lending

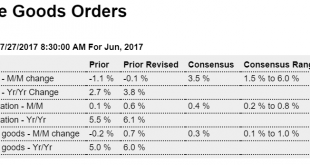

The theme of today’s data seems to be higher q2 gdp than otherwise, but for the wrong reason- over production- as spending weakened and unwanted inventories rose. Nice headline number for durable goods orders but most of the gain was in civilian aircraft which happens every year about this time. However, as previously discussed, the manufacturing sector is chugging along at modest levels after the large dip from the drop in oil related capital expenditures about 2.5 years...

Read More »New home sales, CAB, house prices

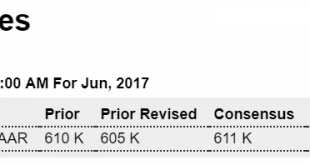

New homes aren’t built without permits, which have flattened as well, and are therefore not adding as much to growth: Highlights New home sales are steady near the best levels of the expansion, at a 610,000 annualized rate in June. The 3-month average is 597,000 which is, however, noticeably below the first-quarter cycle peak of 617,000. This is a negative for second-quarter residential investment in Friday’s GDP report. But the upshot of today’s report is mostly positive....

Read More »Consumer confidence, Euro zone comments

Consumer confidence (soft data) up for the month but retail sales (hard data) continue to decelerate:No one talking about how this reduced what would have been private sector income and net financial assets by exactly that much, as the savings on interest was not spent by the governments but instead went towards deficit reduction: Euro zone budget savings could complicate ECB rate hikes: Bundesbank By Balazs Koranyi Jul 24 (Reuters) — Euro zone countries have saved nearly a...

Read More »Existing home sales, Services pmi

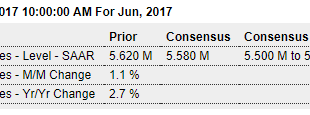

Mirrors the deceleration in mortgage lending: Highlights The slip in pending home sales was no false signal as existing home sales fell 1.8 percent in June to a lower-than-expected annualized rate of 5.520 million. Year-on-year, sales are still in the plus column but not by much, at 0.7 percent which is the lowest reading since February. Compared to sales, prices are rich with the median of $263,800 up 6.5 percent from a year ago. Another negative for sales is supply which...

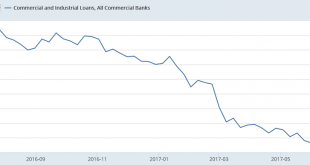

Read More »Credit check, Venezuela, US petro reserve sale, Spicer resigns

No relief here. Just a question of what this is reflecting: Someone robbing the cookie jar? No comment. Just hoping it doesn’t happen: Wheels coming off:

Read More » Mosler Economics

Mosler Economics