The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 1 percent lower than the same week one year ago. Trumped up expectations falling off:

Read More »Industrial production, Housing starts, Forecasts, Loan growth

Very modest growth continues from the lows following the crash in oil capex, and note that the numbers are not inflation adjusted: The painfully slow recovery following the crash continues, and note the numbers are not population adjusted: Trumped up expectations fading: Forecasters Lower Growth Outlook as Hopes for Quick Stimulus Fade By Josh Zumbrun Apr 13 (WSJ) — Following the election, respondents to The Wall Street Journal’s monthly survey of forecasters...

Read More »Retail sales, Bank loans, Philly state index

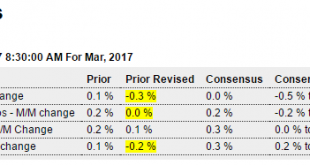

Worse than expected and downward revisions as well. Seems related to what looks like a continuing credit collapse: Highlights First-quarter consumer spending is in trouble. Retail sales fell 0.2 percent in March which is under the Econoday consensus for no change. Importantly, February sales are revised sharply lower, to minus 0.3 percent vs an initial gain of 0.1 percent. Vehicle sales round out the quarter with a 3rd straight sharp decline at minus 1.2 percent. Sales at...

Read More »Healthcare, Regulation comments, Policy statement

Looks like no repeal and replace pending: I think Paul Ryan is trying to pull a fast one on repealing Obamacare On the surface, it looked like a GOP news conference touting a possible compromise with conservatives to help get the health-care reform bill passed. But House Speaker Paul Ryan and his fellow Republicans really just tipped their hand and admitted their top concern isn’t really repealing and replacing Obamacare, it’s keeping what’s left of the Obamacare exchanges...

Read More »Credit check, Consumer credit, Wholesale sales, Rail traffic

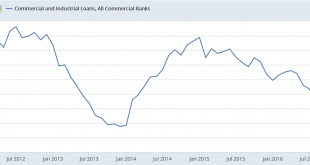

From bad to much worse: Highlights Consumer credit rose a nearly as-expected $15.2 billion in February with January revised $2.1 billion higher to $10.9 billion. Revolving credit perked up with a $2.9 billion gain following January’s $2.6 billion decline. Nonrevolving credit, which includes vehicle financing and also student loans, rose $12.3 billion which is on the slow side for this reading. Credit growth isn’t robust but is steady and constructive for the economy....

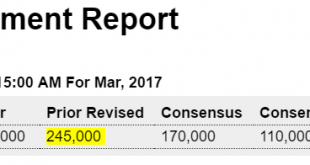

Read More »Employment report, Atlanta Fed GDP forecast

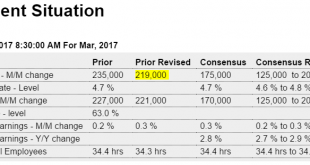

Looking at the chart today’s number looks entirely consistent with the near linear rate of deceleration since oil capex collapsed about 2 1/2 years ago or so. And so far there’s no reason to expect the trend to reverse: Highlights Throw ADP out, it was the weather in March! Or at least the Category 3 storm that swept the Northeast may explain a much weaker-than-expected 98,000 increase in March nonfarm payrolls. This compares with Econoday’s consensus for 175,000 and a low...

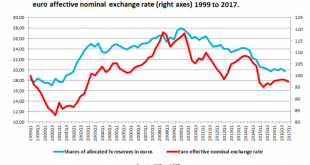

Read More »Saudi pricing, Euro fx rate, Tooth fairy index, NY Times Trump interview

Looks like Saudis are moving to lower prices? Saudi Aramco Said to Cut Pricing For May Arab Light Oil to Asia By Serene Cheong and Sharon Cho Apr 5 (Bloomberg) — Saudi Aramco sets Arab Light crude differential at 45c/bbl discount to Oman-Dubai benchmark for May sales to Asia, say people with knowledge of matter who asked not to be identified because the information is confidential. That’s a 30c/bbl decrease from April OSP NOTE: Co. was expected to decrease Arab Light...

Read More »ADP employment, PMI services, ISM services

Higher than expected but last month was revised down by 53,000 (and same could happen of course for this month). And this is just a forecast for the Friday jobs report, not a hard number. Also note that as per the chart the annual growth rate has been declining and it’s too soon to say that the decline has reversed: Highlights The March employment report may not prove as impressive as February or January but it still looks to be very strong, based on ADP’s 263,000 estimate...

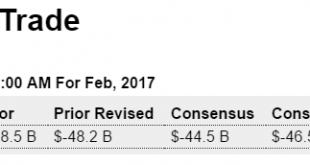

Read More »Trade, Manufacturing new orders, Redbook retail sales, GDP forecasts

The trade deficit was a bit less than expected, all due to lower imports. The question is whether this means there were more domestic purchases, whether this is an indicator of lower aggregate demand: HighlightsIn favorable news for first-quarter GDP, the nation’s trade gap hit Econoday’s low estimate in February at $43.6 billion and reflects a 1.8 percent drop in imports but only a 0.2 percent gain for exports. The goods deficit came in at $65.0 billion vs $64.8 billion in...

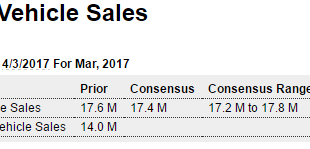

Read More »Vehicle sales, Construction spending, PMI, ISM

Big drop, and in line with collapsing bank loan reports: Highlights First-quarter GDP will take another hit, this time from March vehicle sales which like February and January proved weak. But the March data is unusually weak, down 5.7 in the month to a 16.6 million annualized rate that is a 2-year low. Sales of North American-made and imports both suffered, at 13.3 and 3.4 million rates, with light trucks and autos both down. Vehicle sales seem to have been pulled forward...

Read More » Mosler Economics

Mosler Economics