Yikes! Check out that 2nd derivative!;) Sure looks like something bad happened early in q416 to an economy already decelerating since oil capex collapsed just over a couple of years ago. Seems to me the only thing preventing a stock market collapse is a stock market collapse…;)

Read More »Personal income and spending, Consumer sentiment, Atlanta Fed

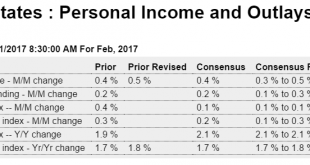

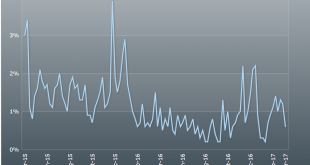

Trumped up expectations are fading a bit while ‘hard data’ continues to fade. And note the real disposable personal income chart which continues its deceleration that began when oil capex collapsed: Highlights A second month of weak spending on services pulled down on consumer spending which could only manage a 0.1 percent rise in February, one that follows a nearly as weak 0.2 percent gain in January. February’s result is below consensus and at the low end of the Econoday...

Read More »Border tax comments, Redbook retail sales, International trade, Consumer confidence

So they used to tell the story about a guy who claimed he could make cars out of wood, and he started a company in Oregon that brought trees into one door of his giant building with new cars coming out of another door, and he wouldn’t let anyone inside to see how it was done. He was given a award for innovation and widely acclaimed, until one day someone got inside and saw he was shipping the trees out the back to Japan and bringing in new Korean cars. He was then arrested...

Read More »Credit check, Vehicle sales forecast

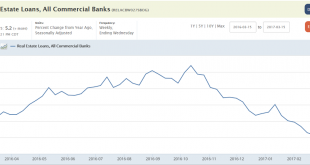

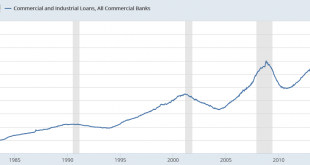

Hard to say the credit collapse is over. And as the causation is “bank loans create bank deposits” that component of the ‘money supply’ is decelerating as well: The seasonally adjusted rate of sales continues to work it’s way lower: From WardsAuto: Forecast: U.S. March Sales to Reach 17-Year High A WardsAuto forecast calls for U.S. automakers to deliver 1.61 million light vehicles in March, a 17-year high for the month. The forecasted daily sales rate of 59,776 over 27...

Read More »Services and manufacturing PMI, Durable goods orders, Atlanta Fed

Trumped up expectations fading, as weakness in the service sector continues, And if Trump loses today’s health care vote, I expect those expectations to fade that much faster: Highlights All in the mid-to-low 50s and at 6-month lows, a significant moderation in growth is the signal from Markit Economics’ U.S. diffusion indexes. The composite flash for March is 53.2 which is more than 1 point below the consensus. The manufacturing flash, at 53.4, is also about 1 point below...

Read More »New home sales

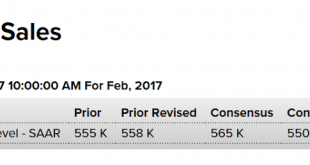

More than expected but as per the chart it looks like they’ve peaked and are working their way lower. And as no house is built without a permit, and permits are also soft, I don’t see anything good happening. Also, bank lending for real estate has been decelerating and mortgage applications are going sideways: The longer term chart shows that recent weakness might just be part of the ‘pattern’ of the longer term uptrend, albeit from very depressed levels and at a slower...

Read More »FHA house price index, Existing home sales, Industrial production

This was a surprise: Highlights In an unusually weak showing, the FHFA house price index came in unchanged in January with year-on-year appreciation falling a steep 5 tenths to 5.7 percent. This is the weakest month-to-month showing in more than 4 years and the weakest year-on-year rate in 2-1/2 years. Also weak: Highlights Existing home sales are on the soft side of expectations, down 3.7 percent in February to a 5.480 million annualized rate and below the Econoday...

Read More »Credit check

Note how it’s all been decelerating since the collapse in oil capex, and most recently the deceleration hasintensified: This is the absolute level of loans outstanding, which seems to only go negative like this in recessionsThis is the annual growth rate which appears to be in a state of collapse: Note the pattern of accelerating into recession, then decelerating:

Read More »Housing starts, Atlanta Fed Q1 GDP forecast

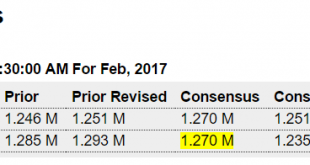

No houses built without a permit: Highlights Strength in single-family permits leads a mostly favorable housing starts report for February where however the headlines are mixed, at a 1.288 million annualized rate for starts and a 1.213 million rate for total permits. The results compare with Econoday expectations of 1.270 million for both. Permits for single-family homes, where building costs and sale prices are the highest, rose 3.1 percent in February to an 832,000 rate...

Read More »Mtg purchase apps, Retail sales, Business inventories, Housing index

The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 6 percent higher than the same week one year ago.Read more at http://www.calculatedriskblog.com/#rYAGsCBZRKvRLYa4.99 Depressed and moving sideways for over a year:Prior month revised up, but current month worse than expected, and I suspect the seasonal adjustments a nominally small increase in sales to...

Read More » Mosler Economics

Mosler Economics