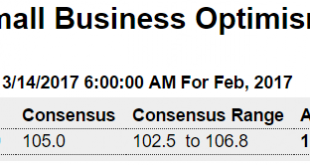

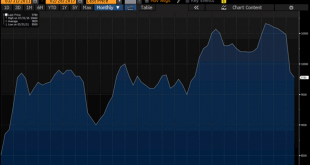

Trumped up expectations falling off some,and the details don’t look so good: HighlightsThe small business optimism index fell 0.6 points in February to 105.3, retreating slightly from the lofty levels reached in the previous months after the post-election surge in November and the largest increase in the history of the survey in December that shot the index to the highest reading since December 2004. The small decrease was in line with expectations and the fact of the index...

Read More »Credit check

Keeps getting worse and looks to me like it’s well below stall speed:

Read More »Payrolls, Gasoline demand

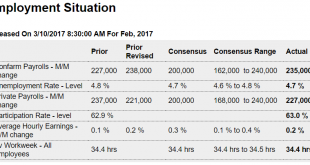

Better than expected, but not nearly enough to even begin to conclude that the multi year deceleration has reversed: This chart does not tell me this multi year downtrend has been broken: And growth of the household survey is down to 1% year over year: Participation seems to be settling in at depressed levels not seen since before women started entering the labor force: Compare the recent gains with those of prior cycles: Above 0 has coincided with recession: Obama the Tea...

Read More »Mtg apps, ADP payrolls, Wholesale trade, Atlanta Fed GDP forecast, Tax refund delays

The growth rate has slowed and the level of apps remains depressed: Nice move up. This is just a forecast of Friday’s number: Highlights The February employment report looks to be a blockbuster based on ADP’s estimate for giant growth of 298,000 in private payrolls. This would be the biggest gain since October 2015 and one of the very largest of the cycle. ADP isn’t always followed closely but its call last month for outsized growth in January payrolls did prove correct....

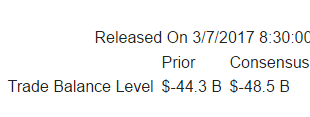

Read More »Trade, Consumer credit

As previously discussed, trade looks to be more negative in q1 than it was in q4: Highlights January’s trade deficit came in very deep but at least right on expectations, at $48.5 billion and reflecting a surge in foreign consumer and vehicle imports and higher prices for imported oil. January imports rose 2.3 percent from December to $197.6 billion with imports of consumer goods jumping 2.4 percent to $52.1 billion and with vehicle imports up 1.3 percent to $13.6 billion....

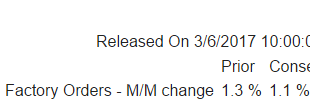

Read More »Factory orders, Rail Carloads, Trump comments

Back to slow growth from the lower levels: Durable goods orders: Capital goods: It’s gone from bad to worse. Hard to see how this can continue much longer: Trump’s Wiretap Claims: What We Know and What We Don’t White House sources acknowledge that Trump had no idea whether the claims he was making were true when he made them. He was basing his claims on media reports—some of them months old—about the possibility that the Foreign Intelligence Surveillance Court may have...

Read More »Credit check

Starting to look seriously ominous: When delinquencies start going up, banks tend to start tightening up lending standards a bit to keep them in check, which tends to slow down lending, which causes the economy to soften, resulting in a downward spiral that doesn’t end until public sector deficit spending increases sufficiently: Released Feb 23 For what it’s worth:

Read More »Service sector, Household income, Expectations

These service sector surveys are ‘soft data’: Markit : ISM: Another income measure that’s going nowhere: Trumped up expectations: Gauging Firm Optimism in a Time of Transition

Read More »Fed Atlanta, Saudi output, Unemployment claims

Yes, recent ‘hard data’ has driving down GDP estimates, trumped up expectations not withstanding: At current pricing the Saudis are seeing less demand, due to others pumping more most likely: This chart tells me that it’s gotten a lot harder to be eligible for unemployment benefits this cycle, and an automatic fiscal stabilizer the cushioned weakness in prior cycles may have been deactivated as well: New law makes it harder to get unemployment New rules make it harder to get...

Read More »Personal income and spending, Construction spending, Light vehicle sales, Trade, GPD

The theme of trumped up expectations and actual data heading south continues: Note the real disposable personal income chart- not good!! Highlights Inflation is nearly at the Fed’s 2.0 percent target, up a sharp 3 tenths to 1.9 percent for the PCE price index which is the strongest rate since April 2012. The monthly gain, reflecting rising energy costs, rose an outsized and higher-than-expected 0.4 percent for the highest reading since February 2013. But the core, which...

Read More » Mosler Economics

Mosler Economics