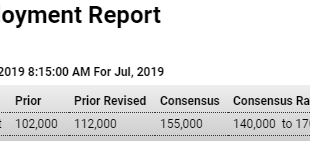

Rolling over: Highlights ADP estimates that private payroll growth in Friday’s employment report for July will rise 156,000. Econoday’s consensus for this estimate was 155,000 and forecasters see actual private payrolls coming in at 160,000 in Friday’s report vs 191,000 in June. Highlights In the lowest reading in 4-1/2 years, the Chicago PMI fell 5.3 points in July to 44.4. New orders sank deeper into contraction with employment falling into contraction for the first...

Read More »Personal income and consumption, Home prices, Pending home sales, Oil capex, Euro area

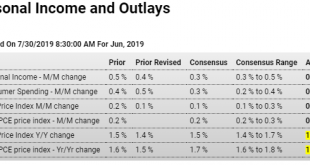

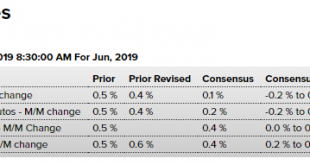

Income and consumption is growing at lower but moderate pace, but has been decelerating since the tariffs started to bite and global trade began its collapse: Highlights The month-to-month breakdown of consumer spending shows slowing in what will offer support for those on the FOMC who want to cut interest rates this week. Despite the strength of June retail sales, total consumer spending in the month rose only 0.3 percent following gains of 0.5 percent in May and 0.6...

Read More »GDI, Productivity, China pmi, Dallas Fed

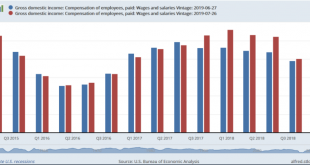

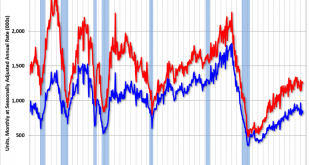

Gross domestic income was just revised higher. The blue bars are the previously reported levels and the red bars are the revised levels. This further meant that the savings rate unspent income) was higher as previously discussed. And an increasing savings rate generally reflects a deceleration in borrowing: Lack of aggregate demand- desires to not spend income not being sufficiently ‘offset’ by’ private or public sector net (deficit) spending: I see deceleration in both,...

Read More »Durable goods, KC Fed, Mtg purchase apps, New home sales, US and euro area PMI’s, Trump quote

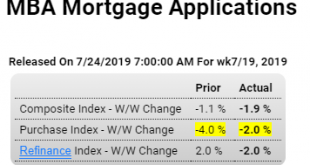

Year over year in contraction. And the chart is not adjusted for inflation: Negative: Lower rates don’t seem to be helping: Highlights The purchase index continues to pull back in what is an unfavorable indication for underlying home sales. After falling 4.0 percent in the prior week, the index fell 2.0 percent in the July 19 week to pull down year-on-year growth to 6.0 percent. Refinancing activity has also been coming down, 2.0 percent lower in the week. Rates fell back...

Read More »Mtg purchase apps, New home sales, US and euro area PMI’s, Trump quote

Lower rates don’t seem to be helping: Highlights The purchase index continues to pull back in what is an unfavorable indication for underlying home sales. After falling 4.0 percent in the prior week, the index fell 2.0 percent in the July 19 week to pull down year-on-year growth to 6.0 percent. Refinancing activity has also been coming down, 2.0 percent lower in the week. Rates fell back in the week, down 4 basis points to 4.08 percent for conventional 30-year loans. Still...

Read More »Existing home sales, Richmond Fed, UK factory orders, Chemical Activity Barometer

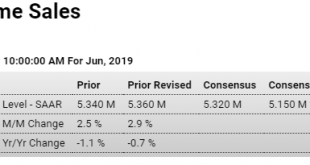

Worse than expected and in contraction year over year: Highlights The housing market firmed in the early Spring but has since flattened out. Existing home sales came in softer-than-expected at a 5.270 million annual rate in June which, however, is right in line with the 3-month average of 5.280 million. This average started the year at roughly 5.1 million. Single-family resales fell 1.5 percent in the month to a 4.690 million pace while condo sales, the second and much...

Read More »Housing starts, Architecture index, Foreign home buyers

Rolled over and on the decline and from highs that were at historically depressed levels: Now in contraction: From the AIA: Design services demand stalled in June, Project inquiry gains hit a 10-year low Demand for design services at architecture firms decreased in June in comparison to the previous month, according to a new report today from The American Institute of Architects (AIA). AIA’s Architecture Billings Index (ABI) score for June was 49.1, which is down from 50.2...

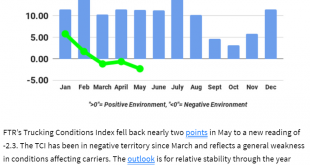

Read More »Trucking index, Tariffs, Singapore exports, Turkey retail sales

FTR Trucking Conditions Index weakens in May The President is in no hurry because he narrowly views the some $5 billion/mo in tariff revenues as a profit for the US at China’s expense, totally insensitive to the global economic downturn this ‘tax hike’ has created: Trade war to drag on as Trump says long way to go and China strikes hard-line tone

Read More »Retail sales, Industrial production, Housing index, Business inventories

Better than expected: HighlightsTaking out a policy-insurance rate cut when the main driver of the economy is booming sounds a little counter-intuitive, in retail sales results that came in much stronger than expected in June. Total sales rose 0.4 percent in the month with ex-auto sales also up 0.4 percent — both of these hit the top end of Econoday’s consensus range. Easily surpassing the top end of the consensus range are two of the report’s key core readings with less...

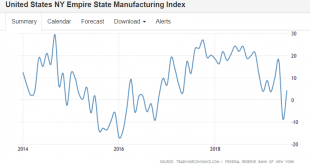

Read More »NY manufacturing, China retail sales, US car sales

Up this month but trending lower: China has been trying to recover with fiscal adjustments: Doesn’t include pickups and other light trucks:

Read More » Heterodox

Heterodox