Still in contraction: China Imports Tumble in June Imports to China plunged 7.3 percent from a year earlier to USD 161.86 billion in June 2019, much worse than forecasts of a 4.5 percent drop, a further sign of weak domestic demand that could lead Beijing to add more stimulus. Purchases fell for: unwrought copper (-27.2 percent); iron ore (-9.7 percent); and soybeans (-25.1 percent) amid higher tariff on US cargoes and following outbreaks of African swine fever. By...

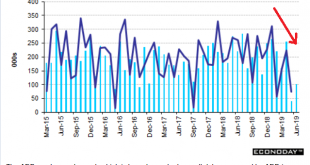

Read More »JOLTS, Manufacturing, rails, Recreational spending

All seems to be rolling over: This source of growth may be decelerating as well?

Read More »Employment, China, Trump speech

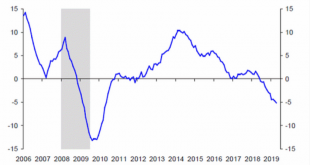

The annual rate of change continues to take a dive: Highlights There’s still time to cancel your rate-cut party. Nonfarm payrolls shot 224,000 higher in June and well beyond Econoday’s consensus range where the high forecast was 205,000. There are no flukes in this report underscored by a 17,000 jump for what has been an uneven manufacturing sector that Federal Reserve policy makers are watching with concern. Payrolls at professional & business services jumped 51,000 as...

Read More »Small business indicators, China business survey, Car sales, FDI, Euro retail sales

Light vehicle sales peaked a while back: Been helping to support the $US: Eurozone Retail Sales Fall Unexpectedly Retail trade in the Euro Area fell 0.3% in May, following a 0.1% drop in April and missing expectations of a 0.3% growth, as sales declined for all main categories. Among the bloc’s largest economies, Germany’s retail trade decreased for the second month, while gains were recorded in France and Spain. Year-on-year, retail sales rose 1.3%, also missing...

Read More »Payrolls, Durable goods, ISM services, CEO confidence, Fed comment, Trump comment on currencies

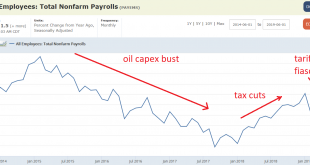

Another indicator turning south, and this is a big one, as it’s the source of most consumer income: Familiar pattern? As if rate cuts would help output, employment, or earnings, all of which are decelerating: Dow rises 100 points and heads for record close amid expectations for the Fed to lower rates He’s the dummy, of course, along with the all the others, including all of the Presidential contenders, who don’t understand that imports are real economic benefits, and...

Read More »Construction, Bank loans, Earnings

Been working its way lower and into contraction ever since the collapse in oil capital expenditures late in 2015, like a slow motion train wreck: There’s been a history of getting a spike up before the collapse: Companies are warning that earnings results are going to be brutal KEY POINTSWith earnings season looming, 77% of companies issuing pre-announcements say their profit picture will be worse than Wall Street is expecting.That’s the second-worst quarter on record...

Read More »China, UK, US, Euro zone

Global collapse continues, though you’d never know it watching the stock market: China Inflation Rate Slows to 6-Month Low The official Non-Manufacturing PMI in China unexpectedly inched lower to 54.2 in June, the lowest in six months, from 54.3 in the previous month and missing market consensus of China Factory Activity Shrinks More than Estimated The Official NBS Manufacturing PMI in China unexpectedly was unchanged at 49.4 in June 2019 and missing market expectations of...

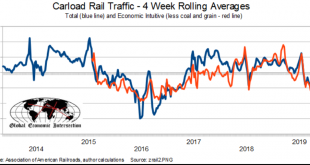

Read More »Rail traffic, Business confidence, UK imports, Trade news

Deep in contraction: Looks to be below 2008 levels: So looks like the current tariffs remain. As previously suggested, the US President is narrowly focused on the money he’s collecting, as the tariffs remove $US net financial assets from the global economy and discourages transactions with the US. That is, it all functions as a transactions tax on the global $US economy: Trump says he agreed with Xi to hold off on new tariffs and to let Huawei buy US products Trump and Xi...

Read More »Chicago PMI, Personal income and consumption, Trade comment

Bad: Highlights In the first sub-50 reading in 2-1/2 years, the Chicago PMI fell more than 4 points in June to miss Econoday’s low-end expectations. Deterioration in June was wide with only employment showing improvement. But further gains for employment in this sample are in question given contraction in new orders and a second straight month of contraction for backlog orders. In contrast to the general weakness, input prices are rising with some members of the sample...

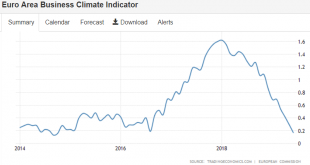

Read More »Euro area surveys, Goldman index, GDP, Corporate profits, Chem index

Most all euro area indicators still in collapse due to tariffs: Production held up even as consumer spending slowed: Highlights The outcome was expected but not the mix. The third estimate of first-quarter GDP rose 3.1 percent and is unchanged from the second estimate. But consumer spending did not live up to expectations, at only a 0.9 percent growth rate in the quarter vs 1.3 percent in the prior estimate and expectations for 1.3 percent. Making up the difference is an...

Read More » Heterodox

Heterodox