As previously discussed, unemployment benefits have become much harder to get than in prior cycles, which means they will go up that much less as employment slows, and also that they won’t function as an automatic fiscal stabilizer to the extent they did in prior cycles, which will work to delay a recovery: Tariff update- more to come: Trump says tariffs on China could be raised by another $300 billion if necessary Former Commerce secretary: Trump’s 5% tariffs on Mexico...

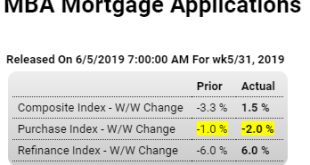

Read More »ADP, Mtg purchase apps, Vehicle sales

Employment can be a lagging indicator, so this forecast of Friday’s employment number could be verifying the rest of the weakness that’s been reported: US Private Sector Jobs Rise the Least in 9 Years Private businesses in the US hired 27 thousand workers in May, less than an expected 180 thousand and compared to April’s 271 thousand increase. It was the smallest payroll increase since March 2010, as the service-providing sector added 71 thousand jobs while the...

Read More »Factory orders, Fed comments, Lumber prices

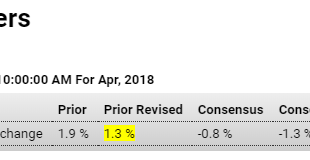

US Factory Orders Fall the Most in 6 Months New orders for US manufactured goods fell 0.8% in April, the most since October last year, due to lower demand for transportation equipment, computers and electronic orders, and primary metals. Meanwhile, shipments of manufactured goods declined 0.5% in April, the largest drop since April 2017. Highlights At an as-expected minus 0.8 percent, April’s factory orders report closes the book on what was a weak month for US...

Read More »Construction spending, ISM manufacturing, UK Manufacturing

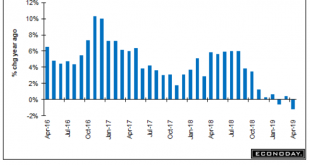

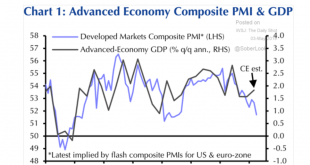

Global contraction in progress… :( US construction spending

Read More »Industrial Production, Forecast, US personal income, Oil, ATT Presidential boycott

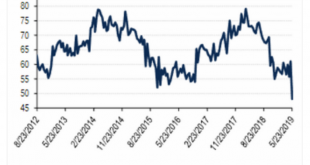

Slow motion trainwreck by Agent Orange, aka Tariff Man, continues… Below 50 indicates contraction: Demand for Saudi oil has fallen back: Saudi pricing of discounts generally trending higher but most recently there’s been a small move back: And how about this? https://www.cnbc.com/2019/06/03/trump-calls-for-a-boycott-of-att-to-force-big-changes-at-cnn.html

Read More »Bloomberg interview, Shipping, Lending, Profits, Trade, Pending home sales

Interest-Rate Policy Is Backward, Modern Monetary Theory Pioneer Mosler Says Under consumption identity: for ever agent that spent less than his income, another must have spent more, or the output would not have been sold. In other words, deficit spending, private or public, is the ‘offset’ to unspent income (savings). The chart shows one of the components of private sector deficit spending which appears to align with economic growth: Tariffs (levied on the grounds that...

Read More »Durable goods orders, earnings, container board, oil chart, German exports, infrastructure, GDP forecasts

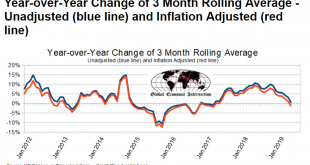

More of same as trade war takes its toll globally: Headline Durable Goods New Orders Declined in April 2019. Inflation Adjusted New Orders Are In Contraction Trump to Democrats: No infrastructure without trade deal On the eve of a highly anticipated meeting with Democrats at which President Donald Trump was expected to unveil a way to fund a $2 trillion infrastructure proposal, Trump instead put Congress on notice that it will have to take a backseat to a trade deal....

Read More »Investment, Mtg origination, Bank loans

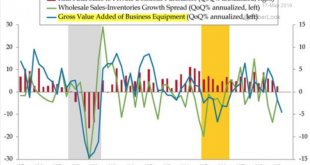

Real final sales slowing, and business equipment growth negative: From the NY Fed, reads like credit growth slowing: Total Household Debt Rises for 19th Straight Quarter, Now Nearly $1 Trillion Above Previous Peak The report includes a one-page summary of key takeaways and their supporting data points. Overarching trends from the Report’s summary include: Housing Debt Mortgage balances rose by $120 billion, to $9.2 trillion. Mortgage originations declined to $344 billion...

Read More »Retail sales, Industrial production, Interest payments, Japan profits, Euro area fiscal balance

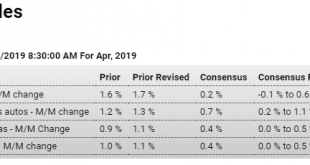

Weak and weaker than expected: Highlights The second quarter gets off to a stumbling start pulled down by a 0.2 percent headline decline in an April retail sales report where the core details show unexpected weakness. Excluding autos, in which sales were already expected to fall sharply, April sales managed only a 0.1 percent gain to fall underneath Econoday’s consensus range. Excluding autos and also gasoline sales, which were already expected to rise sharply, sales fell...

Read More » Heterodox

Heterodox