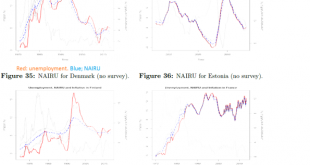

Below, three sets of graphs from three ‘structural’ seconomic tudies which show that the celebrated concept of NAIRU, as defined in these general equilibrium models is little more than a complicated running average of the level of estimated unemployment (though, quite unscientific, economics does not even seem to have an agreed upon algorithm to calculate this average). This a consequence of the assumption of these models that unemployment is a voluntary state of existence. Yesterday,...

Read More »Simon Wren-Lewis — flimflam defender of economic orthodoxy

from Lars Syll Again and again, Oxford professor Simon Wren-Lewis rides out to defend orthodox macroeconomic theory against attacks from ‘heterodox’ critics like yours truly. A couple of years ago, it was the rational expectations hypothesis (REH) he wanted to save: It is not a debate about rational expectations in the abstract, but about a choice between different ways of modelling expectations, none of which will be ideal. This choice has to involve feasible alternatives, by which I...

Read More »Service sector, Household income, Expectations

These service sector surveys are ‘soft data’: Markit : ISM: Another income measure that’s going nowhere: Trumped up expectations: Gauging Firm Optimism in a Time of Transition

Read More »Open thread March 3, 2017

Populism and mainstream economics

from David Ruccio There doesn’t seem to be anything remarkable about mainstream economists’ rejection of the new populism. Lest we forget, mainstream economists in the United States and Europe (and, of course, around the world) mostly celebrated current economic arrangements. As far as they were concerned, everyone benefits from contemporary globalization (the more trade the better) and from the distribution of income created by market forces (since everyone gets what they deserve). To be...

Read More »Today’s Taboo, And Where to From Here?

Here is the abstract from a paper that appeared two years ago in Molecular Psychiatry: Intelligence is a core construct in differential psychology and behavioural genetics, and should be so in cognitive neuroscience. It is one of the best predictors of important life outcomes such as education, occupation, mental and physical health and illness, and mortality. Intelligence is one of the most heritable behavioural traits. Here, we highlight five genetic...

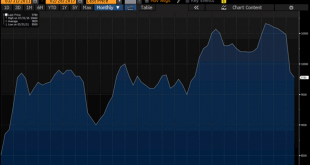

Read More »Fed Atlanta, Saudi output, Unemployment claims

Yes, recent ‘hard data’ has driving down GDP estimates, trumped up expectations not withstanding: At current pricing the Saudis are seeing less demand, due to others pumping more most likely: This chart tells me that it’s gotten a lot harder to be eligible for unemployment benefits this cycle, and an automatic fiscal stabilizer the cushioned weakness in prior cycles may have been deactivated as well: New law makes it harder to get unemployment New rules make it harder to get...

Read More »Robert Lucas — an example of macroeconomic quackery

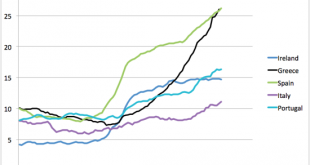

from Lars Syll In an interview a couple of years ago, Robert Lucas said he now believes that “the evidence on postwar recessions … overwhelmingly supports the dominant importance of real shocks.” So, according to Lucas, changes in tastes and technologies should be able to explain, e.g., the main fluctuations in unemployment that we have seen during the last seven decades. Let’s look at the facts and see if there is any strong evidence for this allegation. Just to take an example, let’s...

Read More »Looking for work in all the wrong places

from David Ruccio Donald Trump promised to bring back “good” manufacturing jobs to American workers. So did Hillary Clinton. Both, as I argued back in December, were wrong. What neither candidate was willing to acknowledge is that, while manufacturing output was already on the rebound after the Great Recession, the jobs weren’t going to come back. They were also wrong, as I argued in November, about there being anything necessarily good about factory jobs. But perhaps even more...

Read More »Personal income and spending, Construction spending, Light vehicle sales, Trade, GPD

The theme of trumped up expectations and actual data heading south continues: Note the real disposable personal income chart- not good!! Highlights Inflation is nearly at the Fed’s 2.0 percent target, up a sharp 3 tenths to 1.9 percent for the PCE price index which is the strongest rate since April 2012. The monthly gain, reflecting rising energy costs, rose an outsized and higher-than-expected 0.4 percent for the highest reading since February 2013. But the core, which...

Read More » Heterodox

Heterodox