from Peter Radford Well, the wait is over. We now know what the Republican health care plan looks like. It’s early days and the inevitable compromises will have to be made, but the Republican seven year crusade is reaching its climax. Or not. The problem is this: as we have discussed many times, any credible health care plan needs a number of key features. Three stand out: You need to ensure the biggest insurance pool you can. In an ideal world this pool would be the entire population of...

Read More »Trade, Consumer credit

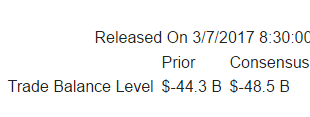

As previously discussed, trade looks to be more negative in q1 than it was in q4: Highlights January’s trade deficit came in very deep but at least right on expectations, at $48.5 billion and reflecting a surge in foreign consumer and vehicle imports and higher prices for imported oil. January imports rose 2.3 percent from December to $197.6 billion with imports of consumer goods jumping 2.4 percent to $52.1 billion and with vehicle imports up 1.3 percent to $13.6 billion....

Read More »Trumponomist

from David Ruccio According to recent news reports, Kevin Hassett, the State Farm James Q. Wilson Chair in American Politics and Culture at the American Enterprise Institute (no, I didn’t make that up), will soon be named the head of Donald Trump’s Council of Economic Advisers. Yes, that Kevin Hassett, the one who in 1999 predicted the Down Jones Industrial Average would rise to 36,000 within a few years. Except, of course, it didn’t. Not by a long shot. The average did reach a record...

Read More »Open thread March 7, 2017

Minsky matters!

from Lars Syll In his book Why Minsky Matters L. Randall Wray tries to explain in what way Hyman Minsky’s thoughts offer a radical challenge to mainstream economic theory. Although there were a handful of economists who had warned as early as 2000 about the possibility of a crisis, Minsky’s warnings actually began a half century earlier—with publications in 1957 that set out his vision of financial instability. Over the next forty years, he refined and continually updated the theory. It...

Read More »Indian ministers and CEOs flock to the US to report to the digital colonizers

from Norbert Häring To “prepare the next generation of world leaders”, the Massachusetts Institute of Technology (MIT) will hold its 2017 MIT India Conference, this time on “Digital India”. Members of the Indian government and CEOs are travelling to Cambridge to report on the “success” of the US inspired crackdown on the use of cash. As usual, the plight of the cash-using poor and the data-security and privacy nightmare resulting from mandatory biometric identification are unlikely to be...

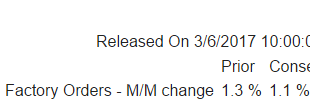

Read More »Factory orders, Rail Carloads, Trump comments

Back to slow growth from the lower levels: Durable goods orders: Capital goods: It’s gone from bad to worse. Hard to see how this can continue much longer: Trump’s Wiretap Claims: What We Know and What We Don’t White House sources acknowledge that Trump had no idea whether the claims he was making were true when he made them. He was basing his claims on media reports—some of them months old—about the possibility that the Foreign Intelligence Surveillance Court may have...

Read More »Education and Externalities

Some years ago I read this NBER working paper. (Note – a couple years later a slightly modified version appeared in the American Economic Journal but I will quote from the earlier, non-paywalled version since it is available to everyone.) Here’s the issue, in a nutshell: In this paper, we use administrative data from the Houston Independent School District and the Louisiana Department of Education to examine whether the influx of Katrina and Rita students...

Read More »Look, Ma, no competition

from David Ruccio It comes as no surprise, at least to most of us, that corporations are getting larger and increasing their share in many different industries. We see it everyday—when we buy plane tickets or try to take out a loan or just make a purchase at a retail store. We know it. And now, it seems, economists and the business press have finally taken notice. According to recent research by Gustavo Grullon, Yelena Larkin, and Roni Michaely, More than 75% of US industries have...

Read More »Credit check

Starting to look seriously ominous: When delinquencies start going up, banks tend to start tightening up lending standards a bit to keep them in check, which tends to slow down lending, which causes the economy to soften, resulting in a downward spiral that doesn’t end until public sector deficit spending increases sufficiently: Released Feb 23 For what it’s worth:

Read More » Heterodox

Heterodox