I agree with Charles Gaba. Medicare Advantage is not much better than Commercial Healthcare Insurance. To wit, it is Commercial Healthcare Insurance gussied up to look like FFS Medicare. The extra benefits given to enrollees in Medicare Advantage comes from FFS Medicare expenditures. Furthermore, the companies providing healthcare to those on Medicare bid low and are paid high: “benchmarks and payments remain above FFS spending levels. We estimate...

Read More »Nobody is getting laid off, all systems are go

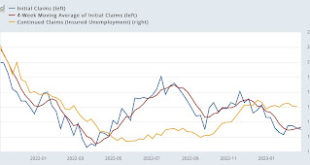

Jobless claims: the situation remains, ‘all system go’ – by New Deal democrat Initial jobless claims declined -2,000 last week to 190,000, while the 4 week moving average increased 1,750 to 193,000. Continuing claims, with a one week delay, increased 5,000 to 1,655,000. All of these remain excellent numbers: To repeat my meme over the past year, virtually nobody is getting laid off. It’s almost impossible to have an economic downturn with...

Read More »When Confronted By the Truth . . .

“Jawboning, the moral suasion in the context of economics and politics. In action such is the use of authority to persuade various entities to act in certain ways. It can sometimes be underpinned by the implicit threat of future government regulation.” President Joe Biden uses the bully pulpit during the State of the Union address to call for a universal price cap on insulin for all diabetes patients. The proposal is very unlikely to pass the...

Read More »Why Do Voters Trust Republicans on the Economy More Than Democrats?

This is another inciteful commentary by “annie asks you.” Just like Josh in the movie “Big,” I am raising my hand, stating “I don’t get it.” I don’t get it as to why people would prefer trump over Biden especially after two years of a recovering economy. Maybe many of them were not around for 2007/8 when the nation did not return to normalcy for years after the crash. A politician finally read the tea leaves, the nature of the economy (which is...

Read More »February Mfg. and January Const. Continue Negative, while Auto Sales Improve

February manufacturing and January construction continue negative, while auto sales improve – by New Deal democrat We started out yet another month of data with bad news in two leading sectors. The ISM manufacturing index has been showing contraction since November, and its more leading new orders subindex since September. And did so again in February, with the total index increasing slightly to 47.7, and the new orders index rebounding...

Read More »Water Usage Efficiency in Factory Farming and Housing

I am in Arizona these days and watching the state and local area scramble to get developments approved before the Federal Agency in charge of the Colorado River water decides who gets what. I suspect if you have an approved Build, a state will be allowed to build it. The Feds have applied the new restricts and the counties have to show they have a 100-year water supply. Interesting maneuvering in this story. Outside of Phoenix sits a farm. The...

Read More »Housing prices continue to come down – like a feather

Housing prices continue to come down – like a feather – by New Deal democrat As I’ve repeated many times in the past 10 years, in housing prices follow sales with a lag. Housing permits and starts both peaked early in 2022, and house prices followed during the summer. This morning the FHFA and Case Shiller house price indexes for December showed continued declines both on a monthly and YoY basis, continuing to presage a similar decline in...

Read More »Salve Lucrum: The Existential Threat of Greed in US Health Care

The biggest driver of healthcare cost is simply “pricing” increases reflected in hospitals, pharmaceuticals, and healthcare insurance. It was Dr. Donald Berwick while head of Medicare and Medicaid during the 1st half of the Obama administration has said, repeatedly, that at least 1/3 of Medicare dollars ware wasted on unnecessary tests, procedures and drugs that provide no benefit for the patient. Here is Dr. Berwick again discussing healthcare...

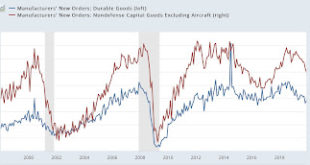

Read More »Durable goods orders: more deceleration, still no recession

Durable goods orders: more deceleration, still no recession – by New Deal democrat I normally don’t pay too much attention to durable goods orders. That’s because they are very noisy. They don’t always turn down in advance of a recession (see 2007-08), although they may at least stall, and there are a number of false positives as well (see 2016) as shown in the graph below showing up until the pandemic: But in 2022 they were one of the last...

Read More »Looking at the Trump 2017 Tax Breaks and Extension of them

Trump’s Tax Cuts and Jobs Act (TCJA) made significant changes to the federal tax code. The major changes were the lowering corporate and individual income tax rates, increasing the standard deduction, reforming child tax benefits, and reforming the corporate international tax system. In an effort to mask its true cost and fit it within cost limits, almost all of the individual and estate tax provisions were set to expire after 2025. Several...

Read More » Heterodox

Heterodox