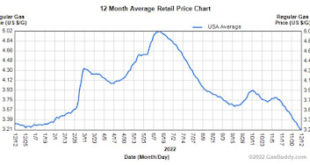

November CPI: Thank you, gas prices! No thank you, owners’ equivalent rent – by New Deal democrat Just like producer prices as reported last Friday, consumer prices for November confirm the inflection point of last June. Thank you, lower gas prices! Here’s what total and core (ex-food and energy) inflation look like, normed to 100 in June: Since June, overall consumer inflation has increased 1.0%, so is increasing at a 2.2% annual rate....

Read More »What News Was in My In-Box, Dec. 14, 2022

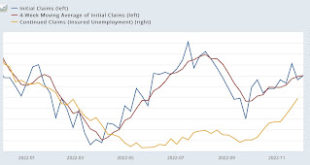

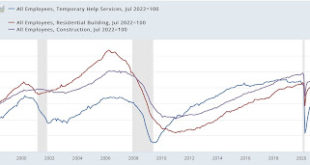

Rents decreasing, CPI slowly decreasing, and questions on whether any of this is due to the FED’s actions. Industrial production is still the same and gasoline prices have dropped. According to New Deal democrats’ analysis, real sales and real income have increased (still lower than they were one year ago), and payrolls have continued to increase but at a decelerating rate. Jobless claims have not yet reached the signal a recession point yet. If the...

Read More »Brief overview of the current state of the economy

A brief overview of the current state of the economy – by New Deal democrat This week we get the final most important data of 2022, with consumer prices tomorrow and industrial production and retail sales Thursday. The Fed will also be making its final rate hike decision of the year. Next week and the week after, the only data will be housing construction and prices, plus personal income and spending. So let’s take a look at few salient...

Read More »Pushing Train Crews and Other Railroad Workers to the Brink

What caught my attention to the potential train strike was it not being clear as to why. No one source was explaining why train crews and other crafts were angry at the railroad companies. Doing some reading I came away with a better understanding. Aaron Gordon at Vice does an excellent depiction of the issues. Biden stance on this issue is very similar to the screwing over of Students with their student loans. He made certain the law would stop...

Read More »Reciprocity

For some fifty years now, the question of how to get labor a fair share has been tantamount. Fact being, it was a problem from the beginning of the industrial age and even before. Union labor has never had leverage – the bosses don’t work for them. For the past 40-50 yrs, the bosses and the shareholders have operated with great reciprocity — management gets rewarded to the extent they reward the holders. Much of this rewards system has come at the...

Read More »New Deal democrat’s Weekly Indicators for December 5 – 9

Weekly Indicators for December 5 – 9 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The most noteworthy trend over the past several months has been the almost relentless deterioration in the YoY measures of consumer spending and employment. That trend continued last week. As usual, clicking over and reading will bring you up to the virtual moment as to the state of the economy, and reward me a...

Read More »November producer prices: YoY measures mask recent sharp deceleration

“November producer prices: YoY measures mask recent sharp deceleration to mainly tolerable levels“ – by New Deal democrat Consumer prices for November won’t be reported until next Tuesday, but this morning we got the upstream producer prices. The news was mainly good, although not good enough to likely dissuade the Fed from its current course of interest rate hikes. This is one of those cases where YoY measures give a false picture in...

Read More »Jobless claims: troublesome trend continues, but no yellow flag yet

– by New Deal democrat Jobless claims: troublesome trend continues, but no yellow flag yet Initial jobless claims is one of the few remaining positive short leading indicators. But as I’ve noted for the past several weeks, the trend is troublesome. This week initial claims rose 4,000 to 230,000, and the 4 week moving average rose 1,000, also to 230,000. Continuing claims one week previous rose 62,000 to 1.671 million: Initial claims...

Read More »What News Was in My In-Box, Dec. 7, 2022

Assorted topics this time. Consumerism was actually the first topic on the list of links in my In-Box. I am interested in seeing how the US negotiates with the Taiwanese on a new plant and what the US will do with Supply Chains. It is not as simple as what many people think. You should know how the product is made. The US is sorely lacking in Supply Chain planning. The expertise is concentrated in mathematics rather than on the floor actual...

Read More »November employment report

Scenes from the November employment report: the short leading jobs indicators – by New Deal Democrat Every month as part of my post on the jobs report, I run through the changes in those measures which are short leading indicators for the economy. There were some significant developments in the past several months, so let’s take a closer look here. Here’s a historical look at temporary help services, residential construction jobs, and...

Read More » Heterodox

Heterodox