The Treasury yield curve has now almost totally inverted – by New Deal democrat One of the few leading indicators not flashing red for recession has been the short end of the Treasury yield curve, which has been relentlessly positive – until now. While the 10 year minus 2 year Treasury spread has been negative for months, the 10 year minus 3 month had remained positive. But twice in the last two weeks the 3 month Treasury has yielded more...

Read More »The tide has now turned as to house prices

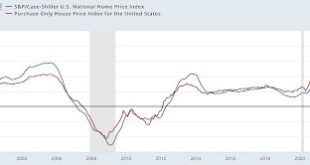

The tide has now turned as to house prices Last month I wrote that the FHFA showed evidence that house prices had peaked, and that “since the FHFA has a tendency to turn slightly ahead of the Case Shiller index, this strongly suggests that a sharp deceleration in the Case Shiller index YoY will start within a month or two.” That was borne out in this morning’s reports for August house prices. The FHFA purchase only index, which is...

Read More »When will housing construction turn down? A fuller consideration

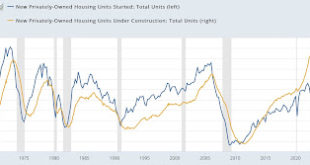

When will housing construction turn down? A fuller consideration – by New Deal democrat No important economic news today. Also I am traveling this week, so there might be some light posting, as in, I might skip a day or two. But I very much want to see what is happening with house prices, which will be updated tomorrow in the FHFA and Case Shiller indexes, and Wednesday as part of the new home sales release. In the meantime, after I posted...

Read More »New Deal democrat’s weekly indicators for October 17 – 21

Weekly Indicators for October 17 – 21 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. If you thought the long leading indicators couldn’t get any worse – well, they could. As usual, clicking over and reading will bring you up to the virtual moment as to how the economy is doing right now, and how it is likely to perform over the next 12 months+. “New Deal democrat’s Weekly Indicators for October 10 – 14,” Angry Bear...

Read More »If GOP Wins Either House Of Congress, Dems Must Kill the Debt Ceiling

If GOP Wins Either House Of Congress, Dems Must Kill Debt Ceiling If it comes to pass and especially if the GOP takes both houses, presumably Democrats will be able to kill the debt ceiling in the lame duck session. This assumes Manchin and Sinema stick with them on it, which one of them might not. As a budget matter, it can pass by reconciliation, which avoids a filibuster. It can also be passed with only 50 votes plus VP Harris in the Senate....

Read More »September existing home sales and prices decline

September existing home sales and prices decline – by New Deal democrat With the exception of their big impact on prices, I do not particularly pay attention to existing home sales. Their economic impact is small compared with the construction of new homes; at best they add confirmation to a trend in new home sales, permits, and starts. In September, existing home sales did continue to decline, by 2%, to 4.71 million units annualized (Note:...

Read More »Jobless claims flat for the moment

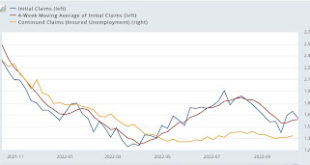

Jobless claims flat for the moment – by New Deal democrat There’s no big news in the jobless claims release this week. Initial claims fell -12,000 to 214,000, but the 4 week average increased 1,250 to 212,250. Continuing claims, which lag somewhat, increased 21,000 to 1,385,000: To the extent there is any discernible trend, I would call it sideways in the past few weeks. I had expected gas prices to continue to rise following OPEC’s...

Read More »Eileen AppeIbaum on Albertsons – Kroger Merger Big Win for Private Equity – Big Loss for Workers

With regard to the Albertson – Kroger merger. CEPR’s Eileen Appelman discusses a private equity profit scheme involving the Kroger/Albertsons grocery megamerger. Albertsons will pay out about a third of its market value to its former private equity owners and investors in November as part of the merger with Kroger. The large payment sets up Albertsons for bankruptcy which Kroger can use to defend the merger. Appelbaum” “‘Albertson’s...

Read More »Housing on track for an early 2023 recession, but with a major caveat

Housing on track for an early 2023 recession, but with a major caveat – by New Deal democrat I don’t think anybody was expecting a good housing construction report this month. Those non-expectations were certainly fulfilled. Housing permits rose slightly, 1.4%, from last month’s 2 year low. Single family permits, which contain even more signal, declined -3.1% to the lowest level in 3 years excluding two pandemic lockdown months. The more...

Read More »Strong September Industrial Production

September industrial production comes in very strong – by New Deal democrat September’s industrial production report puts the final nail in the coffin in the notion that the US is already in recession. I call industrial production the King of Coincident Indicators because, more than any other single metric, it coincides with the peaks and troughs of US economic activity as determined by the NBER. In September total production increased...

Read More » Heterodox

Heterodox