What Is The Worst Part Of The Current Inflation In the US we may have seen the peak of overall inflation, with the annualized CPI rate increasing at 8.3% in April, down from 8.5% in March, the highest rate of increase in 40 years. The issue has become the reported top concern of the US public, according to polling, with the hot job market apparently not offsetting the concerns that have arisen due to the emergence of this high rate of...

Read More »Will tomorrow’s real retail sales report forecast a recession, or just a continued slowdown?

No economic data today (May 16) of significance; but tomorrow one of my favorite economic indicators, retail sales, will be reported for April. Since real retail sales lead employment and generally are a short leading indicator for the economy as a whole, I wanted to update on what I see as their importance right now. Here are real retail sales per capita (red) vs. real aggregate payrolls per capita (blue), both normed to 100 as of last...

Read More »The Malthusianism of Benjamin Franklin and The Abortion Issue

The Malthusianism Of Benjamin Franklin And The Abortion Issue, Econospeak, Barkley Rosser Thomas Robert Malthus may well have been the least favorite economist of Karl Marx. Basically, Marx did not like him because he saw Malthus as blaming poverty on the poor themselves, their inevitable sinfulness that led them to constantly reproduce themselves excessively when things started to get better, thus leading to population pressing against the means...

Read More »New jobless claims rise slightly, but continuing claims make another 50+ year low

New jobless claims rise slightly, but continuing claims make another 50+ year low, May 12, 2022 – by New Deal democrat Initial jobless claims rose 1,000 to 203,000, continuing above the recent 50+ year low of 166,000 set in March. The 4 week average also rose by 4,250 to 192,750, compared with the all-time low of 170,500 set five weeks ago. On the other hand, continuing claims declined -44,000 to 1,343,000, yet another new 50 year low (but...

Read More »With the Fed already having begun to “stomp on the brakes,” inflation is still running very hot

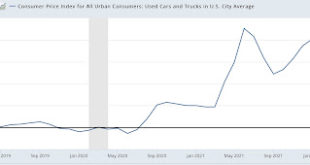

With the Fed already having begun to “stomp on the brakes,” inflation is still running very hot As promised, here is my second post on the April CPI number. The YoY advance in consumer prices, +8.3%, is down from last month’s 8.6%, which was the highest 12 month rate since 1981. As I suggested last month, “the spike in gas prices may be – to use a recently dreaded word – transitory,” since gas prices had declined 5% month over month at the time...

Read More »Real wages unchanged, real aggregate payrolls rose slightly in April

Real wages unchanged, real aggregate payrolls rose slightly in April Consumer inflation for April was +0.3%, the lowest monthly advance since last August. The number was helped by a big decline in energy prices, down -2.7% for the month, and also by used cars, down -0.4% for the month. In this post I’ll report on the impact on wages. I’ll put up a separate post with more general comments later. Since nominal nonsupervisory wages rose 0.4% in...

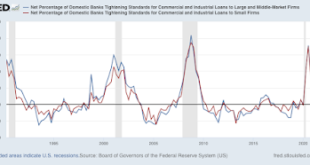

Read More »Strong demand for loans, but accommodation ends

Q1 Senior Loan Officer Survey: strong demand for loans, but accommodation ends The Senior Loan Officer Survey for Q1 was published yesterday (May 10), generally covering the supply of, and demand for, bank credit. It has two components that qualify as long leading indicators for the economy, as they have typically turned about one year before the onset of a recession over their 30+ year history. First, the below graph is of the percentage of...

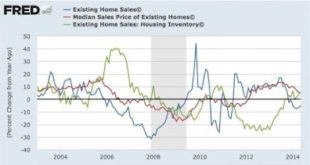

Read More »A “Big Picture” look at housing

A “Big Picture” look at housing at Seeking Alpha; plus an in-depth look at existing home sales and inventory I have one of my periodic “Big Picture” looks at housing up over at Seeking Alpha. One economic relationship – whether sales lead inventory for existing homes as well as new ones – has been extremely difficult to nail down, since for the past number of years the NAR has only allowed FRED to post the last one year of its data. Well,...

Read More »The Passing Of Axel Leijonhufvud

The Passing Of Axel Leijonhufvud On May 5, Swedish economist Axel Leijonhufvud died at age 88. I only met him once when he attended a seminar I gave in Trento, Italy a decade ago. I always admired his work and felt lots of sympathy with it, and I think he liked what I had to say at least in my seminar that day. He was someone who stood outside of orthodoxy while not being clearly tied to any particular school of economic thought. However, he...

Read More »April jobs report: strong Establishment survey, very weak Household survey

April jobs report: strong Establishment survey, very weak Household survey (UPDATED) I got a late start on this report today (May 6). I’ll add much more detail shortly, but for now, be advised in summary that while the establishment report was strong, with mainly positive internals, the household report was very weak, with some very weak, albeit mainly still positive, internals. To be continued . . . ——-UPDATE:Just as one month ago, I was...

Read More » Heterodox

Heterodox