Initial jobless claims rose 19,000 to 200,000, continuing above the recent 50+ year low of 166,000 set in March. The 4 week average also rose by 8,000 to 188,000, compared with the all-time low of 170,500 set four weeks ago. On the other hand, continuing claims declined -19,000 to 1,384,000, yet another new 50 year low (but still well above their 1968 all-time low of 988,000): The “job openings” component of the March JOLTS report...

Read More »The impact of supply constraints on the US economy in 3 easy graphs

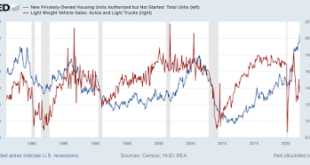

The impact of supply constraints on the US economy in 3 easy graphs The two most important purchases ever made by most consumers are (1) their houses, followed by (2) their motor vehicles. Indeed, according to Prof. Edward Leamer‘s forecasting model, ever since the end of World War 2 almost all American recessions have been preceded by, first of all, a decline in new home purchases about 6-7 quarters before, followed by a decline in the purchase...

Read More »Construction Revisions Add 28 Basis Points to 1st Qtr GDP

RJS, MarketWatch 666 Summary: Construction Spending Rose 0.1% in March after Prior Months Were Revised Higher The Census Bureau’s report on construction spending for March (pdf) estimated that the month’s seasonally adjusted construction spending would work out to $1,730.5 billion annually if extrapolated over an entire year, which was 0.1 percent (±0.7%)* above the revised annualized February estimate of $1,728.6 billion, and 11.7 percent...

Read More »The game of musical chairs in the jobs market intensifies to all-time highs

March JOLTS report: the game of musical chairs in the jobs market intensifies to all-time highs In March, as this morning’s Census Bureau JOLTS report shows, the game of musical job chairs in the jobs market has actually intensified to all-time levels. Specifically, both job openings and quits made all-time highs, and total separations during their entire 20 year history were only higher in March and April 2020. As a refresher, some months ago...

Read More »Manufacturing and construction start out the month with positive prints

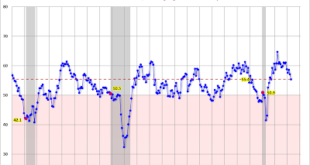

Manufacturing and construction start out the month with positive prints As per usual, the new month starts with updates on manufacturing and construction. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. This remained positive, but there has been a definite slowing in the past two months. In April the index declined from 57.1 to 55.4, and the new orders...

Read More »March New Home Sales Reported 8.6% Lower on Record Prices

RJS, MarketWatch 666 Summary: New Home Sales Reported 8.6% Lower on Record Prices in March, after Prior Months Sales Revised Much Higher The Census report on New Residential Sales for March (pdf) estimated that new single family homes were selling at a seasonally adjusted annual rate of 763,000 homes during the month, which was 8.6 percent (±12.9 percent)* below the revised February annual sales rate of 835,000, and 12.6 percent (±11.3 percent)...

Read More »Major Economic Confusion

Major Economic Confusion Anybody confused by recent economic reports is not alone. The BEA has just reported a totally unexpected decline in real GDP for the first quarter of a 1.4% annual rate. At the same time layoffs have reached a half century low and employment continues to rise. How can we have an apparently beginning recession with the hottest job market in decades? Probably this has to do with the sources of the reported decline,...

Read More »Lackluster spending, a decline in real income and savings in March; when the house price spiral turns, consumers are in real trouble

Lackluster spending, a decline in real income and savings in March; when the house price spiral turns, consumers are in real trouble In March nominal personal income rose 0.5%, and spending rose 1.1%. But since the personal consumption deflator, i.e., the relevant measure of inflation, rose 0.9%, real income declined -0.4%, and real personal spending rose only +0.2%. While both real income and spending are well above their pre-pandemic...

Read More »Q1 GDP negative; but more importantly, two of three long leading indicators have deteriorated

Q1 GDP negative; but more importantly, two of three long leading indicators have deteriorated First things first: yes, it was a negative GDP print. No, it doesn’t necessarily mean recession. I’ve been expecting weakness to show up by now ever since last summer; so here it is.But the big culprits were non-core items. Personal consumption expenditures, even adjusted for inflation, were positive. The three big negatives were a big decline in...

Read More »Post Offices Under Suspension

What happens when the USPS decides to close a Post Office? The closure does not happen over night. A Post Office may close immediately due to an emergency, a suspended lease, less business over time, etc. In any case the USPS follows up. This post by Steve Hutkins is a review of the process and where the USPS is with regard is suspended Post Offices. ________ Lost in Limbo: Post Offices Under Suspension – Save the Post Office, Steve Hutkins...

Read More » Heterodox

Heterodox