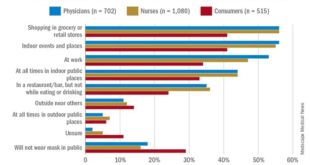

Just a collection of articles which come to my email box from various sources. Many of them I read and just let go by. Posted snippets of them to attract interest. Some I write about such as Student Loans, Healthcare, etc. “Mask-Wearing Will Continue in Some Situations: Polls,” MedScape Even as the COVID-19 threat seems to be easing, more than half of doctors and nurses expect to continue wearing face masks while shopping in grocery and...

Read More »The Great Resignation as “Take This Job and Shove It!”

Scenes from the March jobs report; and the Great Resignation as “Take This Job and Shove It!” It’s been a little while since I took a more in-depth look at the jobs market, so let’s take a look. As I wrote last Friday, we are at historic lows in both the unemployment and underemployment rates. In the graphs below, the current values of each are normed to zero for easy comparison: Historically few people are involuntarily unemployed....

Read More »Manufacturing positive, inflation-adjusted construction spending is flat

Manufacturing positive, but no longer red hot; inflation-adjusted construction spending is flat In addition to the jobs report, Friday gave us updates on manufacturing and construction. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. While the index remained positive, its leading new orders component stumbled. In March the index declined from 58.6 to...

Read More »Another strong showing for jobs and unemployment; strong wage growth likely lags inflation

March jobs report: yet another strong showing for jobs and unemployment; while strong wage growth nevertheless likely lags inflation Here are the three main trends I was most interested in this month: 1. Is the pace of job growth beginning to decelerate? 2. Is wage growth holding up? Is it accelerating? 3. Are the leading indicators in the report beginning to flag? The answers were: 1. The 6 month average of monthly gains, which...

Read More »When Safe Assets Are No Longer Safe

by Joseph Joyce When Safe Assets Are No Longer Safe The U.S. has long benefitted from its ability to issue “safe assets” to the rest of the world. These usually take the form of U.S. Treasury bonds, although there was a period before the 2008-09 global financial crisis when mortgage-backed securities with Triple A ratings were also used for this purpose. The inflow of foreign savings has offset the persistent current account deficits, and put...

Read More »4th Quarter GDP Lower and PCE

RJS, MarketWatch 666 4th Quarter GDP Grew at a 6.9% Rate, Revised from a 7.0% Rate, as PCE Revised Lower The Third Estimate of our 4th Quarter GDP from the Bureau of Economic Analysis indicated that our real output of goods and services grew at a 6.9% rate in the quarter, revised from the 7.0% growth rate reported in the second estimate last month, as a steep downward revision to personal consumption expenditures more than offset a big upward...

Read More »Consumer spending continues OK, while income continues its seemingly relentless decline

Consumer spending continues OK, while income continues its seemingly relentless decline Nominally personal income rose 0.5%, and spending rose 0.2% in February. That’s the good news. The bad news is the personal consumption deflator, i.e., the relevant measure of inflation, rose 0.6%, so real income declined -01%, and real personal spending declined -0.4%. While both real income and spending are well above their pre-pandemic levels, I...

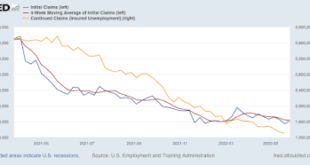

Read More »Jobless claims continue near or at record lows

Jobless claims continue near or at record lows Initial claims (blue) rose to 14,000 to 202,000, just above last week’s 50 year low. The 4 week average (red) declined 3, 500 to 208,500 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 35,000 to 1,307,000, the lowest number since December 1969: With Omicron in the rear view mirror, and BA.2 more of a ripple so far, we are having a COVID respite,...

Read More »Weekly Indicators for March 28 – April 1 at Seeking Alpha

by New Deal democrat Weekly Indicators for March 28 – April 1 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The big news of the week was the spreading yield curve inversion in the Treasury market.* Needless to say, that puts another bullet in the body of the long leading forecast – but it’s still not negative. As usual, clicking over and reading will bring you up to the virtual moment on the economic data, and my...

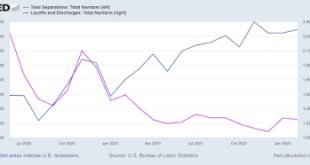

Read More »The game of musical chairs in the jobs market goes on

February JOLTS report: the game of musical chairs in the jobs market goes on This morning (Tuesday) the Census Bureau JOLTS report for February shows that the game of musical job chairs continues. As a refresher, several months ago I introduced the idea of a game similar to musical chairs, where employers added or took away chairs, and employees tried to best allocate themselves among the chairs. Because of the pandemic, there are several...

Read More » Heterodox

Heterodox