Some History 2014: A frenzy of hospital mergers into ACOs as detailed by Philip Longman and Paul Hewitt could leave many families having lesser amounts of healthcare paid for by healthcare insurance due to healthcare industry consolidation leading to higher prices. We have seen this happen with higher prices for insurance plans, increased deductibles, and less covered. I think we have all experienced this in the last couple of years,...

Read More »March consumer inflation part 2: I told you so

March consumer inflation part 2: I told you so; the Fed *must* start paying attention to house price indexes This is the second part of my take on the March consumer inflation report. As you may have already read, total inflation clocked in at +1.2% for March alone! YoY consumer prices are up 8.6%, the highest 12-month rate since 1981. As anticipated, gas prices were a huge contributor; less energy, prices were up 0.4%; less both food and...

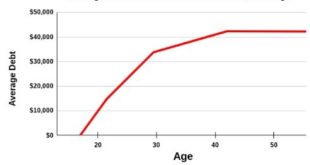

Read More »Bad Mouthing the Holders of Student Loans

Tough Guy, senator Mitch McConnell making political hay over President Joe Biden extending a student loan moratorium for a few more months. The mistake Joe is making or has made is not deciding what to do. It is getting late in the game of politics. Here is senator Mitch McConnell. “I think in this country, it’s important to remind people that we ought to pay our debts,” McConnell opined. “We all pay our debts. And with regard to extending the...

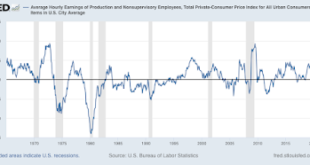

Read More »March consumer inflation part 1: real wages decline sharply

March consumer inflation part 1: real wages decline sharply The March consumer inflation report was particularly important, and particularly bad. So much so that I am going to divide my comments into two separate posts. First, the news on real wages was terrible. While nominally nonsupervisory wages rose 0.4% in March, since inflation rose 1.2%, “real” wages declined -0.8% in March alone. On a YoY basis, real wages were down -1.8%:...

Read More »House prices vs. mortgage payments

Housing affordability update: prices vs. mortgage payments; and ramifications for the economy No economic news today (Monday 4/11), and most States didn’t report new COVID cases over the weekend, so let’s take a look at something else; namely, housing affordability, which I’ve been meaning to update for several weeks. The first graph below compares 4 measures of house prices: the FHFA purchase index, the Case Shiller national index, and the...

Read More »Asymmetric Whining

Asymmetric Whining This is not news, but yet again we see the old phenomenon of people whining a lot when something gets worse but then saying nothing when it gets better. The latest example of that involves gasoline prices. They were rising and got into the range of near-real highs seen in times like 2008, 1981, and 1918. But now they have slid backward, down in the neighborhood of 20 cents per gallon where I am. Crude prices are down as...

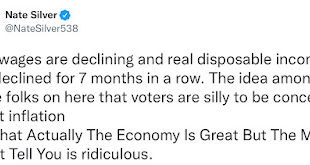

Read More »Paul Krugman vs. Nate Silver cage match

In the Paul Krugman vs. Nate Silver cage match, I’m on Team Nate Prof. Paul Krugman and Nate Silver got into a dust-up earlier this week about why so many voters seem to have soured on the Democrats. So that you don’t have to go digging through all the Twitter detritus, Alternet has a good write-up copying all the relevant tweets. (Apparently, the two have been at odds at least since 2014, when Five Thirty-Eight left The NY Times and went to ESPN;...

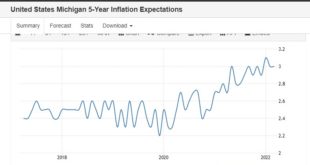

Read More »TIPS Breakeven vs Michigan Inflation Expectations

I am interested in inflation expectations (acting like a macroeconomist for a change). In particular I am thinking about something Brad DeLong just tweeted. He says his subjective probability of sustained inflation due to expected inflation causing current inflation is still just 40% Why “.only a 40% chance …? Because bond markets expect the Fed to get inflation down to 2% not in the short run of next year but in the medium run of three...

Read More »Weekly Indicators for April 4 – 8 at Seeking Alpha

by New Deal democrat Weekly Indicators for April 4 – 8 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. After several weeks of tightening and then inversion, the yield curve in the US Treasury market un-inverted in a big way this past week – via higher long term rates which drove mortgage rates above 5%, which will have a decidedly negative effect on housing. As usual, clicking over and reading should be educational for...

Read More »Four week average of jobless claims makes all-time 55 year series low

Benchmark revisions, oh my! Four week average of jobless claims makes all-time 55 year series low The DoL made revisions to the last five years of jobless claims, in particular revising the seasonal adjustments, and the differences are eye-popping. Last week initial claims (blue) were reported at 202,000. With the revisions, they are now 171,000! This week they declined -5,000 from that revised figure to 166,000, tying the revised number from...

Read More » Heterodox

Heterodox