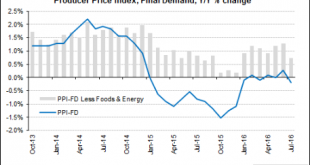

Nothing here to get the Fed concerned about inflation: Not good, less then expected and excluding autos, a ‘core reading’ even worse. Seems to me that perhaps the higher gas prices that caused the increases over the last couple of month’s have taken their toll on other spending. And at the macro level, without an increase in either private or public deficit spending top line growth won’t be there: HighlightsConsumers spent their money on vehicles in July but not on much else...

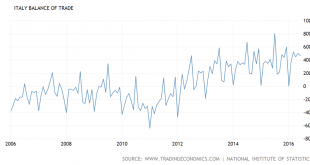

Read More »Italy trade surplus

The euro area trade surplus in general seems to be continuing, even as global trade weakens. Fundamentally this removes net euro financial assets from global markets that were sold by portfolio managers. Those managers include central bankers proactively selling their euro reserves over the last two years or so to buy US dollars, which has in turn kept the euro low enough to drive the surplus:

Read More »Wholesale sales, Household debt

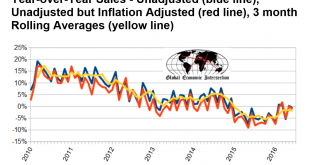

unadjusted sales rate of growth decelerated 0.9 % month-over-month. unadjusted sales year-over-year growth is down 0.6 % year-over-year unadjusted sales (but inflation adjusted) down 1.2 % year-over-year the 3 month rolling average of unadjusted sales decelerated 0.4 % month-over-month, and down 1,9 % year-over-year. Very modest household credit expansion coincided with very weak growth for the last several quarters: From the NY Fed: Household Debt Balances Increase...

Read More »China, Small business index, Productivity and Labor costs, Redbook retail sales

No sign of increased global demand here: China Exports Slide on Weak Demand By Mark Magnier Aug 9 (WSJ) — China’s General Administration of Customs said Monday that exports fell 4.4% in July year-over-year in dollar terms after a 4.8% decline in June. July imports fell by a greater-than-expected 12.5% from a year earlier, raising concerns over weak domestic demand. This compared with an 8.4% fall in June, the customs agency said. China’s trade surplus widened more than...

Read More »Employment charts, Atlanta GDP forecast

Government hiring contributed 38,000 jobs last month and a total of almost 100,000 over the last three months: This is the jobs number before seasonal adjustments: The year over year number ‘takes out’ the seasonal factors: Note how many of the new employees were previously considered to be ‘outside the labor force’ for purposes of calculating the unemployment number: The duration of unemployment has come down but it’s still higher than it’s ever been before this cycle: So,...

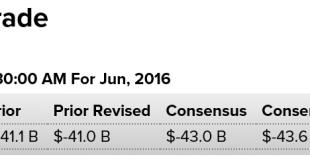

Read More »Trade, Jobs, SNB buying US stocks, German Factory Orders

Larger trade deficit than expected for June, lowering Q2 GDP calculations as previously discussed: Much better than expected and prior month total payrolls were revised up some with private payrolls revised down. The headline unemployment rate was unchanged, while U6 unemployment, the broader measure, moved up a tenth to 9.7, indicating an unexpectedly large increase in the available labor force. More details later today. Also, year over year job growth is still...

Read More »Real final domestic demand, Layoffs, Fed tax receipts, Factory orders

This was the component of GDP that was touted as a sign of underlying consumer strength, as per the last quarter over quarter move up: However, the same data looked as year over year change- call it a 12 month moving average- shows that looking past the data’s ‘volatility’ there was a move up during the last phase of the burst of oil related capital expenditures chasing $100 oil followed by a continuous deceleration that began when the oil related capital expenditures...

Read More »Auto sales, Mtg purchase applications, Secular stagnation, PMI services index ISM sesrvices

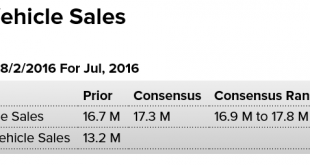

Lightweight cars and trucks better than expected, but heavy weight truck sales brought down the total: HighlightsJuly proved to be a very strong month for vehicle sales, pointing to accelerating strength for consumer spending. Vehicles sold at a 17.9 million annualized rate in the month which is far above June’s 16.7 million. Unit sales offer only a rough indication for the motor vehicle component of the retail sales report but July’s indication is unusually strong. Sales...

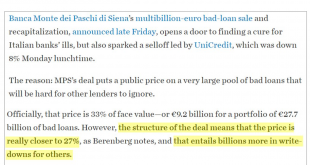

Read More »Italian banks, Campaign finance, NY ISM, July vehicle sales

Even this shows deceleration since the oil capex collapse: Early preview, not looking good: U.S. July auto sales miss estimates as pent-up demand slackens By Bernie Woodall August 2 (Reuters) — DETROIT: Four major automakers in the U.S. market on Tuesday reported July vehicle sales slightly below expectations as the pent-up demand that has helped drive sales since 2009 plays itself out. In a continuing trend, consumers shunned passenger cars in favor of SUVs and pickup...

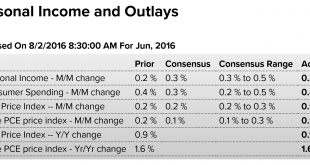

Read More »Personal income and outlays, Redbook retail sales, Saudi price setting

Income a tenth lower than expected and remains depressed, spending was a tenth better than expected and up on higher energy prices. So looks to me like a mini ‘dip into savings’ that works against retail sales, etc. but just a guess. Prices a touch softer than expected and remain well below Fed’s target. And note the deceleration of the annual growth of real disposable personal income as per the chart, which is down to stall speed: HighlightsThe consumer continues to spend...

Read More » Mosler Economics

Mosler Economics