Interesting how it peaked as oil capex collapsed;) Highlights Information revenue fell 0.1 percent in the second quarter compared to the first quarter. Information revenue in the first quarter is revised 1 tenth higher to plus 1.4 percent. Year-on-year, information revenue rose 3.8 percent in the second quarter vs an unrevised 5.7 percent gain in the first quarter. This is the beginning of the ‘revisions’ previously discussed. The govt. estimates jobs created by net new...

Read More »Mtg purchase applications, Fed’s Williams, EU, Fed Labor mkt index, PMI services index

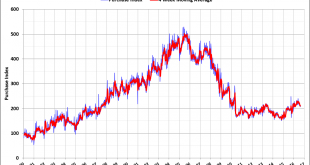

Look at how many more new applications there used to be when rates were double where they are now: Just an fyi, his logic makes no sense to me whatsoever: Fed’s Williams says U.S. economy in good shape, wants rate hike (Reuters) It “makes sense to get back to a pace of gradual rate increases, preferably sooner rather than later,” San Francisco Fed President John Williams said. Targeting low inflation, as the Fed and many other central banks currently do, simply will not work...

Read More »Saudi Pricing, Rail traffic, ISM non manufacturing index

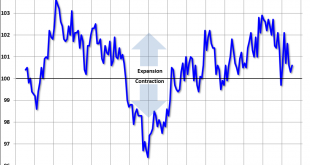

Looks like the Saudis want prices to be a bit firmer: http://www.bloomberg.com/news/articles/2016-09-04/saudi-arabia-raises-pricing-for-october-crude-to-asia-on-demand Rail Week Ending 27 August 2016: All Rolling Averages Worsen And Remain In Contraction Sept 2 (Econointerest) — Week 34 of 2016 shows same week total rail traffic (from same week one year ago) contracted according to the Association of American Railroads (AAR) traffic data. This week, all rolling averages’...

Read More »Jobs, Factory orders

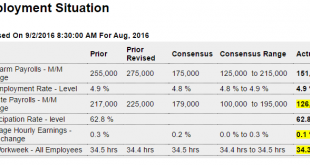

The deceleration of job growth continues since the collapse in oil capex: Highlights The labor market is solid but maybe isn’t overheating, at least yet. Nonfarm payrolls rose a lower-than-expected 151,000 in August with revisions to July and June at a net minus 1,000. The unemployment rate holds at 4.9 percent with modest increases on both the employment and unemployment side of this reading. Earnings are very soft in this report, up only 0.1 percent in the month for a...

Read More »Restaurant performance index, PMI manufacturing, ISM manufacturing, Construction spending

The downtrend looks intact, and on the edge of contraction: Highlights Markit’s U.S. manufacturing sample continues to report month-to-month growth but slow growth. The PMI for August came in at 52.0 which is only modestly above the 50 level that divides monthly growth from monthly contraction. Growth in new orders slowed which is a key negative in the report, along with slowing in employment. The sample is also cutting its inventories which points to lack of confidence in...

Read More »Mtg Purchase apps, Chicago PMI, ADP employment forecast, Pending home sales, Tax receipts

Mortgage purchase applications are now down to only 5% higher than a year ago: A lot worse than expected: Highlights Business growth has slowed in Chicago this month based on the city’s PMI which fell more than 4 points but, at 51.5, is still over breakeven 50. New orders slowed while backlogs fell sharply and into sub-50 contraction. Production also slowed while inventories were drawn down. Employment posted a gain and is the strength of the August report, strength however...

Read More »Personal income and spending, Dallas Fed

In line with expectations as real disposable income growth remains at or below ‘stall speed’, as per the charts. And the total growth of that measure of income since the 2008 peak remains very low. On the consumption side, the mini jump in auto sales provided the (small) boost for the month, though down year over year, and auto sales forecasts for August are all pointing to a resumption of weakness: Highlights Income picked up slightly in July and consumption slowed...

Read More »Car sales, Bank loans

More evidence the wheels are coming off, not that there have been any doubts… From WardsAuto: Forecast: U.S. Light Vehicles Sales Weaken in August A WardsAuto forecast calls for August U.S. light-vehicle sales to reach a 17.4 million-unit seasonally adjusted annual rate, less than like-2015’s 17.7 million and July’s 17.8 million, but ahead of the 17.2 million recorded over the first seven months of this year. From J.D. Power: August Decline in New-Vehicle Sales Fourth in...

Read More »From 1998, Q2 GDP revision, Corporate profits, Trade, Consumer sentiment

Something I wrote that got published in 1998: Revised down, note how the year over year growth has been continuously decelerating ever since the collapse of oil capex, and the strength in consumer spending looks like it could be about healthcare premiumus, which portends cutbacks elsewhere, hence the weaker q3 retail sales, etc. And with inventories still looking way too high, proactive inventory building doesn’t seem likely. Nor does the most recent housing data bode well...

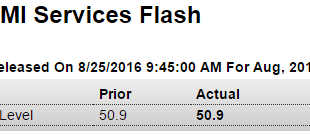

Read More »PMI services, Durable goods orders, KC Fed

Weakness now includes the service sector: United States Services PMIThe Markit Flash US Services PMI came in at 50.9 in August of 2016, down from 51.4 in the previous month and below market expectations of 52. It is the lowest reading since February with business activity, new orders and employment all slowing due to subdued demand conditions and uncertainty ahead of the presidential election. Up a bit more than expected for the month, but remains in contraction year over...

Read More » Mosler Economics

Mosler Economics