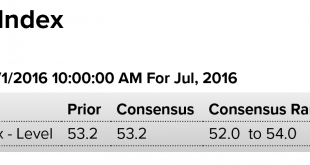

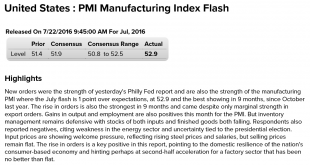

Manufacturing is showing signs of bottoming at the lower levels, as the lack of aggregate demand does it’s thing with the service sector: HighlightsEmployment fell slightly and delays in delivery times eased, two factors that held down the July ISM index to 52.6 vs June’s 53.2. But that’s not the important news. The important news is the new orders index which remains extremely solid, at 56.9 and pointing to future strength for employment as well perhaps as slowing for...

Read More »Bank lending, Restaurant index, More on GDP

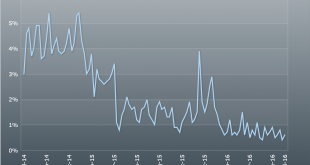

The deceleration that began with the peak in oil capex continues: Trending lower ever since oil capex collapsed. But remember the hype for the one spike up it took early this year before reversing? Wouldn’t surprise me if net trade, which worked in favor of Q2 GDP, reverses gets revised down for Q2 with the June data coming out on Tuesday, with growing oil imports, stronger non oil imports, and weaker exports as per the latest monthly data:

Read More »GDP, Chicago pmi, Consumer sentiment

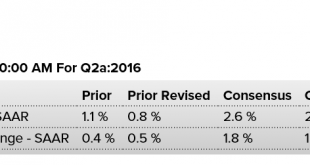

Worse than expected, Q1 revised lower, and note the year over year deceleration in the chart. The inventory correction previously discussed looks to be well underway and has much further to go to bring inventories into balance with sales. Problem is, sales growth is declining, and the downward spiral will continue until ‘borrowing to spend’ steps up to support the negative effects of what I call unspent income, aka savings desires. And the historical drivers of private...

Read More »Trade, KC manufacturing index, Atlanta Fed, Ford

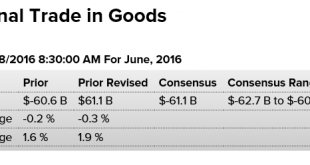

Higher than expected, and last month revised higher as well. And oil imports are increasing as output falls and consumption remains firm: More bad news doesn’t stop the KC Fed from calling for a rate hike: HighlightsThe good news didn’t last long for the Kansas City manufacturing index which, after popping to plus 2 in June for the first positive score since January last year, is back in the negative column at minus 6 in July. New orders are at minus 5 with backlog orders at...

Read More »Mtg apps, Durable goods orders, Pending home sales, Apple and Cat comments

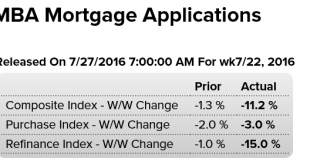

HighlightsPurchase applications for home mortgages were down 3.0 percent in the July 22 week following the previous week’s 2.0 percent decline, while refinancing applications, which tend to be even more sensitive to interest rates, fell a sharp 15.0 percent. The decrease brought the Purchase Index down to the lowest level since February, and the year-on-year gain in purchase applications was pared down to 12 percent from the prior week’s 16 percent gain. Mortgage rates...

Read More »PMC, Oil prices

PMC ride August 5th and 6th coming up fast! First, thanks to all of you who’ve donated this year! For the rest, hoping you’ll dig deep and donate this year, which also means you stay on my otherwise free email list! ;) 100% of donations got to cancer research at Dana Farber- all overhead is sponsored. The 2 day ride raised $45 million last year, $500 million since inception! For me this is a ‘must give’, and just saying I personally donate a whole lot more than shows on my...

Read More »Redbook retail sales, Home price index, PMI services, New home sales, Consumer confidence, Richmond manufacturing index

Still down and out: NYC condo price index: Good report here for June, and may revised higher as well. However, no home is built without a permit, so new home sales end up at the same place as permits, and total permits aren’t looking so good. And note the level is still well below all prior cycles, and the charts are not population adjusted: Total permits- single and multi family: Single family permits doing a bit better than multi family: Better than expected but still...

Read More »PMI, Commercial and Industrial loan growth, Japan trade

A bit better than expected, and the narrative sounds hopeful, but the chart still looking like there’s a long way to go to get back to where we were before the collapse of oil capex. And no sign of emergence of deficit spending- private or public- to drive top line growth: Looks to me like this measure of bank loan growth has been going downhill ever since the collapse in oil capex: Japan is rebuilding it’s trade surplus that made the yen the strongest currency in the...

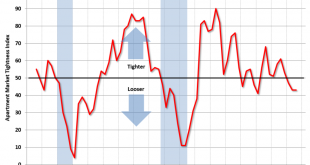

Read More »Apartment market tightness, Chicago diffusion index, Equity flows, UK PMI and public sector deficit, Union Pacific

Looks like a bit of oversupply from new construction, and it didn’t take much of that, either, as construction has been well below prior cycles: “Apartment markets remain strong, but the surge of new apartment construction is starting to shift the supply-demand balance, particularly in the market for upscale apartments,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Given that most new supply is class A, we’re not seeing the same shift in...

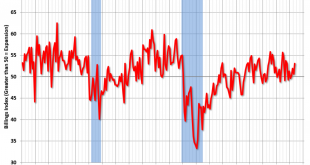

Read More »Architecture Billings Index, Teen employment

Going nowhere: Key June ABI highlights: Regional averages: South (55.5), West (54.1), Northeast (51.8), Midwest (48.2) Sector index breakdown: multi-family residential (57.9), institutional (52.7), mixed practice (51.0), commercial / industrial (50.3) Project inquiries index: 58.6 Design contracts index: 49.7 From the AIA: Architecture Billings Index remains on solid footing Buoyed by increasing levels of demand across all project types, the Architecture Billings Index...

Read More » Mosler Economics

Mosler Economics