Still very slow posting. Will pick up in September, I hope. Here a link to a game that is representative of what Keynes referred to as the beauty contest, which described the behavior of financial markets. Keynes original quote from chapter 12 of the General Theory says that:"professional investment may be likened to those newspaper competitions in which the competitors have to pick out the six prettiest faces from a hundred photographs, the prize being awarded to the competitor whose choice...

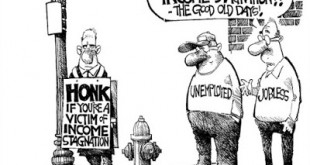

Read More »Palley on economic stagnation

Tom's new paper titled "The US Economy: Explaining Stagnation and Why It Will Persist." It's a policy problem, not a structural phenomenon. The abstract:This paper examines the major competing interpretations of the economic crisis in the US and explains the rebound of neoliberal orthodoxy. It shows how US policymakers acted to stabilize and save the economy, but failed to change the underlying neoliberal economic policy model. That failure explains the emergence of stagnation, which is...

Read More »Unemployment is unchanged and so is the Republican Party

So nothing new in the last report. 215k jobs created and unemployment rate at 5.3%. Below the employment to population ratio.It has started to go up. But there is a long way to go. By the way, in the Republican debate I didn't hear anything different as a solution for the economic problems. Tax cuts, presumably for the wealthy (job creators is not used anymore), a flat tax and even tything instead of income taxes. Deregulation always. They are for military expansion too. And yes military...

Read More »Are we on the verge of a new crisis in the periphery?

New paper co-authored with Nate Cline published by the Political Economy Research Institute (PERI). Abstract says:In this paper we develop a simple model of currency crises, which emphasizes the role of currency mismatches and the balance of payments constraint. In our model, crises are driven by external shocks, particularly foreign interest rate and terms of trade shocks, which drive payments imbalances. In a reversal of conventional causality, we show how a currency crisis can then produce...

Read More »Brazil’s Economic Slowdown Results from Policy Decisions

A new research paper from the Center for Economic and Policy Research examines the causes of Brazil’s recent economic slowdown and finds that policy choices rather than external factors have been the most important cause. The paper shows that the sharp slowdown that Brazil has experienced since 2011 is overwhelmingly the result of a significant decline in domestic demand that resulted from policy choices made by the government. It concludes that this decision to slow the economy was not...

Read More »Public debt crisis, austerity and deflation: the case of Greece

From the new issue of the Review of Keynesian Economics (ROKE). By Marica Frangakis from the Nicos Poulantzas Institute, Athens, Greece. From the abstract:Greece is the country in which the eurozone's public debt crisis began in late 2009. The policy response of the EU elites was to provide financial assistance on condition that a strict austerity-cum-deregulation policy is applied under the watchful guidance of the European Commission, the European Central Bank and the IMF (the so-called...

Read More »Galbraith on the plan B for Greece

Slow (really slow) posting this summer. Here a few links to Jamie's role on the Greek Ministry of Finance Working Group convened by Varoufakis. Here he clearly says that: "At no time was the Working Group engaged in advocating exit or any policy choice. The job was strictly to study the operational issues that would arise if Greece were forced to issue scrip or if it were forced out of the euro." So it was a plan B in case of Grexpulsion, not a tactical negotiation tool or a threat of...

Read More »Who is the real revolutionary figure in modern macro, Friedman or Lucas?

Who's your daddy? Just finished my summer macro class (last Friday actually; grades were due Monday). One of the things that always becomes important in the course is how to define the break between Keynes, or at least Keynes and the Old Neoclassical Synthesis, on the one hand, and Friedman and Lucas, in the case of the latter both the New Classical models (monetary misperception) and Real Business Cycle (RBC) models, on the other. Many authors suggest that Lucas should be considered,...

Read More »More on Greece at the Rick Smith Show

Lapavitsas Calls for Exit as the Only Strategy for Greek People

Lapavitsas says exit is the only option. He may be right, of course, since the European institutions are impermeable to change. Via Real News Network.

Read More » Naked Keynesianism

Naked Keynesianism