Curried Keynesianism in action The review with an intro can be read here (or here). Currie is often considered the first Keynesian in the Roosevelt administration (I suggested here that, while not a professional economist, that merit goes to Eccles), and was also the first to work in the White House, before the Employment Act and the creation of the Council of Economic Advisers (CEA). He was also later unjustly attacked as a Soviet spy, and Roger Sandilands has dealt with this here...

Read More »Simon Wren-Lewis on New Classical Economics and the Financial Crisis

New paper by Wren-Lewis titled "Unravelling the New Classical Counter Revolution." It provides a strong New Keynesian critique of the New Classical/Real Business Cycle schools. He argues, correctly in my view, that the problem is the abandoning of the Keynesian method of analysis. I'm less keen on microfoundations. Or at least on marginalist microfoundations. But it is important to understand how much the fundamentalist views of Lucas and Prescott have affected the profession.From the...

Read More »The relevance of Keynes’s General Theory after 80 years

By Thomas Palley, Louis-Philippe Rochon and Matías Vernengo*This year marks two important anniversaries in macroeconomics: the 80th anniversary of the publication of Keynes's The General Theory of Employment, Interest and Money (1936), and the 70th anniversary of Keynes's premature death, at the age of 63. To mark these anniversaries, the first issue of the fourth year of the Review of Keynesian Economics is dedicated to Keynes.The issue contains a symposium of papers titled ‘The...

Read More »The Chinese Economy and more at the Rick Smith Show

[embedded content]

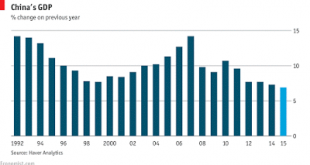

Read More »Chinese slowdown and the world economy

The Conference Board argues that Chinese official data should be taken with some skepticism. Nothing new there. They have adopted a new measure, which implies "Chinese economic growth at a more realistic 3.7 percent" for the recent past. In this scenario, interestingly enough, "it’s likely that the bulk of China’s slowdown has already taken place since 2011, even if unapparent in official statistics." So the picture is probably worse than the official one (as shown below, from The...

Read More »The Mission of Radical Political Economy

The mission of radical political economy is to accentuate the perseverance of critical social scientific enquiry. As such, the aim is to make palpable how the insights of social justice research widely make apparent how the global socioeconomic system does not automatically generate efficient situations whereby unique organizations of production, exchange, and distribution guarantee the attainment of maximum social welfare.The idea that humans are simple instrumentally rationalists, who...

Read More »Bob Pollin on Clintonomics

At The Nation. Few important points. As Bob notes Hillary does invoke the mantle of Clintonomics. In his words: "In trying to burnish her credentials as a can-do populist and to portray Bernie Sanders as a purveyor of naive socialist fantasies, Hillary Clinton has increasingly invoked Bill Clinton’s presidency as her economic policy lodestar." And Bill Clinton's program was not really progressive. Again: "The starting point for understanding Bill Clinton’s economic program is to recognize...

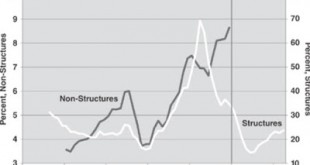

Read More »Consumer credit and mortgage finance in the 1920s

I've been reading Robert Gordon's The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War (The Princeton Economic History of the Western World), that I bought at the ASSA Meeting in San Francisco. There is a wealth of data. One topic discussed here before was the expansion of credit in the 1920s, and the role of the housing market in the boom of the roaring 20s. Gordon says with respect to the housing market: “One reason homeownership rates soared in the 1920s...

Read More »The Great Depression and the Great Recession compared

So I teach a course on the two (old syllabus here). One of the initial classes looks at Eichengreen and O'Rourke's comparison of the two events, and how, even though at the beginning the shock seemed similar, the recovery has been faster the second time. O'Rourke had noticed in his blog last year that the current recovery started way before, but has been so slow that now the 1930s look better when industrial output (rather than GDP) is used as a measure. Below the same data for the US...

Read More »The Free Market and the Hypocrisy of Small Government at the Rick Smith Show

[embedded content]

Read More » Naked Keynesianism

Naked Keynesianism