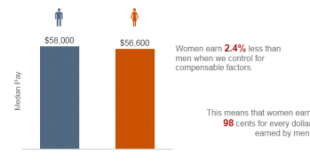

from Lars Syll Trying to reduce the risk of having established only ‘spurious relations’ when dealing with observational data, statisticians and econometricians standardly add control variables. The hope is that one thereby will be able to make more reliable causal inferences. But — as Keynes showed already back in the 1930s when criticizing statistical-econometric applications of regression analysis — if you do not manage to get hold of all potential confounding factors, the model risks...

Read More »Will degrowthing save the planet?

from Dean Baker [This is the third piece in an exchange with Jason Hickel on growth. Hickel’s response will be the last piece in the series.] Jason Hickel responded to my earlier piece on degrowth arguing that in fact economic growth is inconsistent with a sustainable environment and that we have to get people to reject growth as an economic goal if we are going to limit the damage from climate change and excessive resource use more generally. First, let me point out where we do agree. It...

Read More »DSGE — models built on shaky ground

from Lars Syll In most aspects of their lives humans must plan forwards. They take decisions today that affect their future in complex interactions with the decisions of others. When taking such decisions, the available information is only ever a subset of the universe of past and present information, as no individual or group of individuals can be aware of all the relevant information. Hence, views or expectations about the future, relevant for their decisions, use a partial information...

Read More »Stability without growth: Keynes in an age of climate breakdown

from Dean Baker [This post is by Jason Hickel. He is responding to a post I did on the possibility of having growth in a sustainable economy. I will post a rejoinder later in the week. Jason will then get the last word in this exchange.] What do Keynesian Democrats think about the movement for post-growth and de-growth economics? Dean Baker, a senior economist at the Center for Economic Policy Research in Washington, DC, has given us some insight into this question. In a recent blog post,...

Read More »A little knowledge

from Peter Radford A little knowledge goes a long way. That’s the saying, correct? Well you’d never know it by looking at economics. It’s hard to find knowledge anywhere. Now I’m not being facetious about the gaps in economic theory. Let’s all give the discipline its due and say that it has done a masterful job of getting as far as it has based on the limitations it bounds itself with. It’s just that sometimes those limitations are glaring and can stop someone in their tracks if...

Read More »Micro-Meso-Macro: Redressing Micro-Macro Syntheses

from Stuart Holland and Andrew Black and the current issue of Economic Thought When Janet Yellen questioned in her address to the Boston Fed in 2016 why there had been a lack of rethinking in economic theory since the financial crisis, she cited a host of macroeconomic analyses yet did not even refer to ‘too big to fail’. Whereas one of the reasons for seeking to redress the missing middle in mainstream economics relates to the increased concentration of banks in the US since the repeal...

Read More »Economic crises and uncertainty

from Lars Syll The financial crisis of 2007-08 hit most laymen and economists with surprise. What was it that went wrong with our macroeconomic models, since they obviously did not foresee the collapse or even make it conceivable? There are many who have ventured to answer this question. And they have come up with a variety of answers, ranging from the exaggerated mathematization of economics to irrational and corrupt politicians. But the root of our problem goes much deeper. It...

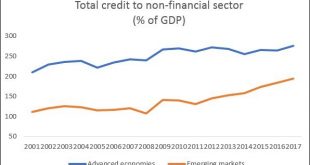

Read More »Is shadow banking a serious threat in emerging markets?

from C. P. Chandrasekhar and Jayati Ghosh Everyone seems to have woken up to the fact that global debt levels are too high and portent difficulties ahead. As Figure 1 indicates, the levels of credit to GDP, which were so high as to be unsustainable and resulted in the big crisis of 2008, have increased even more since then. There was a phase of deleveraging in the advanced economies until around 2014, and in developing countries and emerging markets until 2011, but since then, credit/debt...

Read More »Climate change: threats and challenges

from Maria Alejandra Madi Global warming and global CO2 emissions are interconnected. In 2018, heatwaves were observed in Europe, Asia, North America and northern Africa, while the extent of Arctic sea ice has been continuously dropping. According to the World Meteorological Organization (WMO), the last four years (2015-2018) have been the warmest years on record. In particular, between January and October 2018, global average temperature increased 0.98 degrees Celsius above the levels of...

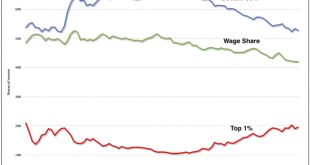

Read More »Tale of two depressions

from David Ruccio Mainstream economists continue to discuss the two great crises of capitalism during the past century like the pillars of society in the brothel—a “house of infinite mirrors and theaters”—in Jean Genet’s The Balcony.* The order they represent is indeed threatened by an uprising in the streets, and the only question is: can they reestablish the illusion of control? The latest version of the absurdist economic play opens with Brad DeLong, who dons the costume of the...

Read More » Real-World Economics Review

Real-World Economics Review