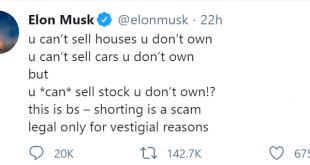

The recent craziness in Gamestop has resulted in a lot of hot takes on short selling. I have the hottest takes, of course, so let’s dive into this a bit deeper and put this debate to rest. Here’s a piping hot take from the richest man in the world: Wow. That kinda makes sense. But wait, does it really? No, Cullen, stop. Back up. Let’s explain how this works first. Just so we’re all on the same page. Short Selling Basics. This whole convo kinda reminds me of the buyback debates or the...

Read More »Three Things I Think I Think – GAMESTONK!

I’d love to talk about the mechanics of Central Banking or index funds, but the only thing that matters in financial markets right now is Gamestop. So…we’re going to talk about index funds. Seriously. But also we’ll talk about Gamestop so don’t worry. If you haven’t been reading up on the Gamestop saga then maybe circle back to yesterday’s article. 1) Robin Hood or Robinhood? The big story of the day is that Robinhood the trading platform shut down access to buying new shares of Gamestop....

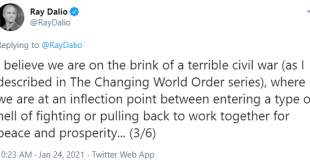

Read More »Three Things I Think I Think – Civil WHAT?

Here are some things I think I am thinking about: 1) There’s Gonna be a Civil WHAT? Here’s an interesting tweet from Ray Dalio: I really like Ray Dalio. His All Weather portfolio is more or less the kind of permanent portfolio that I think most savers should try to implement (for most of their savings). But I have a hard time figuring out how some of his broader macro views fit into all of this. For instance, he believes that there are long-term debt cycles that create patterns in social...

Read More »Rational Reminder Podcast – Understanding the Modern Monetary System

I recorded this podcast a few weeks ago with Cam Passmore and Ben Felix on the Rational Reminder show. Ben had read some of my work over the years and reached out to me before publishing this absolutely wonderful explanation of QE. He asked for my critique of the video, but I couldn’t find any. He had succinctly and thoroughly explained the topic like few can. Then he asked me to come on his podcast to do something I’ve never done before – go through my popular paper “Understanding the...

Read More »2021 World Podcast Tour Begins!

Well, it looks like it’s going to be another year of Zoom calls so what better way to start it off than a podcast recorded on a Zoom call. I joined Stig and Preston on The Investor’s Podcast again and we covered a lot of ground including: – Why money supply expansion is not equal to inflation– Understanding the new rules of bond investing in today’s inflation and interest rate environment– How to protect your portfolio against inflation– Whether there is a rational argument for stocks to...

Read More »Is All of Finance Just a Big Network Effect?

In college I was a registered Republican. After I graduated I registered as a Democrat. And a few years ago I registered as an Independent. I guess I just couldn’t ever figure out which tribe I belonged to – which network I wanted to associate with. The last 8 years have been interesting to me mainly because I feel like I’ve watched two competing network effects trying to convince one another that their network is better and the more they can demean, retain and recruit others the more...

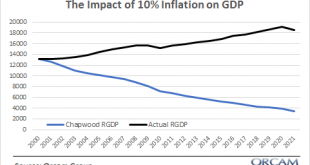

Read More »Is Inflation Really 10%?

One of the long running themes on this website is low inflation and debunking narratives about how very high inflation might be around the corner. I like to work from a first principles understanding, looking at things for what they are and trying to be as objective as possible. Overall, my predictions about low inflation and low interest rates over the last 10 years have been mostly spot-on. Sure, in the last year I’ve been predicting rising inflation due to the huge stimulus measures,...

Read More »Three Things I Think I Think – Happy New Year!

Here are some things I think I am thinking about. 1) Happy new year! 2020 – what a strange year. Awful in many ways and weirdly good in others. For asset prices it was a nightmare of a year, turned into a great year: Global Stocks: + 16.3% US Stocks: +18.3% US Bonds: +7.5% 1-3 year T-Notes/Bills: +3% 20+ Year T-Bonds: +18.1% Gold: +24.8% On a more personal level this was a year of enormous struggle for many. From the pandemic and its health problems to the constant economic concerns. I...

Read More »This Man Lost Everything Betting on Stocks

The headline of this article is something you’ll very rarely, if ever, see in the financial press. You’re much more likely to hear something along the lines of: “Joe Schmo made $1,000,000 buying Tesla stock” “Jane Doe retired early buying Bitcoin” “If you’d invested $1,000 in Microsoft in 1990….”tual I will not parse words here. THESE ARE ALL HORRIBLE ARTICLES. Most of this is survivorship bias that promotes an imprudent gambler’s mentality. Let me explain. Back in 2015 there was a great...

Read More »The 2020 Podcast World Tour Continues!

We took a break from the 2020 podcast world tour due to some engine problems in the old RV, but we got things working again and we’re back. Just kidding of course, I have been mindlessly working from home and jumping on Zoom calls every few hours. This time I spoke with Jack Forehand and Justin Carbonneau from Validea Capital. Jack and Justin are great guys and super open-minded about how to navigate the financial markets. You should check out their website and follow them on Twitter if...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism