Share the post "The Best of the Financial Blogosphere in 2015" If you didn’t pay much attention to the financial markets you’re in luck because it wasn’t a whole lot of fun. And if you didn’t read a single financial blog all year you’re also in luck because here’s a great round-up of some of the best items from the financial blogosphere: Share the post "The Best of the Financial Blogosphere in 2015" Got a comment or question about this post? Feel free to use the Ask Me Anything section...

Read More »Control What You Can Control

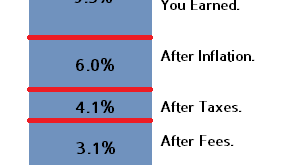

Share the post "Control What You Can Control" Vanguard has a timely reminder for investors – “cost is the new performance”.¹ We’ve entered a new era in the asset management business. The era of low fees. We now know definitively that paying high fees is hugely destructive to long-term performance. You don’t don’t get what you pay for and you don’t get better returns by paying for more expensive money managers. In fact, high costs are correlated with lower returns. As I’ve outlined in...

Read More »The Best of Pragcap in 2015

Share the post "The Best of Pragcap in 2015" Well, another year is coming to an end. It wasn’t a great one for the financial markets, but one thing that’s getting better and better is the sheer amount of free information being provided to investors helping them make smarter decisions every day. I hope that this blog contributes a little bit to that process. Here are some of the things I wrote in 2015 that I hope contributed to the pursuit of knowledge and better decisions in the world of...

Read More »Three Things I Think I Think – No, You’re Wrong, Edition

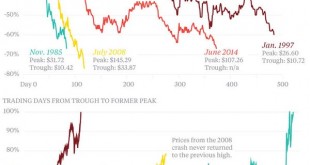

Share the post "Three Things I Think I Think – No, You’re Wrong, Edition" Here are some things I think I am thinking about: 1) Called out by Andreessen. Last week on Twitter I mentioned that oil prices were on the verge of their worst decline in decades. Marc Andreessen of Netscape and Venture Capital fame called me out for posting this chart and calling it “the worst decline”: “Best.” @cullenroche https://t.co/aObXfp1br8 — Marc Andreessen (@pmarca) December 18, 2015 @cullenroche...

Read More »The Confirmation Bias of the Anti-Forecasters

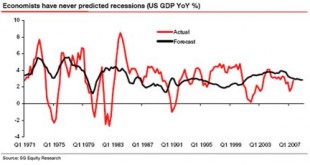

Share the post "The Confirmation Bias of the Anti-Forecasters" It’s become fashionable in recent years to shun all types of forecasting about the future. This narrative usually involves the cherry picking of bad forecasts to prove the point. For instance, we often hear about how economists have never predicted recessions or how Wall Street strategists never predict bear markets. Something like this might be presented as evidence of how bad these people are at forecasting the future:...

Read More »Are Junk Bonds Pointing to Economic Doom?

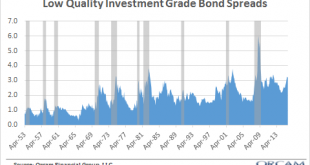

Share the post "Are Junk Bonds Pointing to Economic Doom?" There is a good deal of worry in recent weeks over the sharp increase in junk bond yields and what they might portend for the future of the economy. I wanted to explore this a bit more closely to see if we can’t decipher what might be going on here. First, it’s important to put the “junk” bond market in perspective: Junk bonds are a relatively young asset class as they were first sold en masse in the mid-80s. The junk bond category...

Read More »Three Things I Think I Think – Martin Shkreli Edition

Share the post "Three Things I Think I Think – Martin Shkreli Edition" Here are some things I think I am thinking about: 1) Why does the world hate Martin Shkreli? Christmas came a few days early for the 90% of the world that completely despises Martin Shkreli, the hedge fund manager and pharma CEO who allegedly ripped off investors. An interesting discussion has surrounded the hatred of Shkreli. Ezra Klein says he’s a symptom of the system and not the problem. In essence, Klein...

Read More »Yellen Fears the Boom, Part Deux

Share the post "Yellen Fears the Boom, Part Deux" Last September I talked about how Janet Yellen was more afraid of a boom than a bust. Basically, she is scared that the US economy is stronger than many think and that the global economy’s weakness won’t persist and so we’ll start to see all of this translate into a stronger overall picture on the other side. I can’t say that I disagree. After all, if oil prices and China ever stabilize then inflation comparisons will start to look high...

Read More »Rate Hikes and Roulette Wheels

Share the post "Rate Hikes and Roulette Wheels" In my book I tell a story about a friend in college who claimed to have a foolproof gambling strategy. We would simply watch a roulette wheel and identify a trend in specific spins and then bet against it until we won. The thinking here is that a roulette wheel has about a 50% chance of landing on red or black (it’s actually a bit lower than that depending on where you play and the number of green slots the casino uses to tilt the odds in...

Read More »Three Things I Think I Think You Should be Reading

Share the post "Three Things I Think I Think You Should be Reading" Here are three things I think I think you should be reading: 1) Here’s a very smart piece by Jesse Livermore over at Philosophical Economics. Jesse questions the validity of backtesting, systematic approaches and the importance of looking into these approaches with a grain of salt. I’m a big fan of well reasoned skepticism in finance and economics and Jesse always does a nice job of making you think deeply and thoroughly...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism