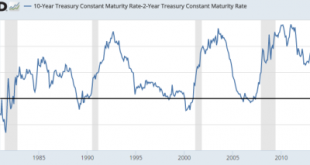

Share the post "How Much Can the Fed Raise Rates?" Larry Summers has a very good piece today in the FT on the irrationality of raising rates and the limits of monetary policy in the current environment. I largely agree with his views as I hashed out in September. But the Summers piece got me thinking about the precise limits of Fed policy here. Summers says the limit is about 100 bps. I think he’s probably pretty darn close. Historically, the economy does not perform well in an...

Read More »Three Things I Think I Think – Bubble Spotting Edition

Share the post "Three Things I Think I Think – Bubble Spotting Edition" Here are some things I think I am thinking about: 1) Dean Baker says bubble spotting is easy. Dean Baker was among the few people who spotted the housing bubble fairly early. In a recent blog post he goes through how he identified it and asserts that this was “easy”. He says it was inexcusable for policymakers to be blindsided by it. Hmmm. I don’t know about that. I remember the housing bubble quite well because I...

Read More »Could the Fed Have Prevented the Financial Crisis?

Share the post "Could the Fed Have Prevented the Financial Crisis?" Janet Yellen’s Congressional testimony today brought up an interesting line of questioning from Ted Cruz who said that the Fed was “passively tightening” policy in 2008 which contributed to the financial crisis. This is a popular line of reasoning among many economists. David Beckworth, whose work I admire greatly, posted some nice comments explaining this view. In essence, by not signaling an offsetting change in the...

Read More »The Temporal Problem in Market Forecasting

Share the post "The Temporal Problem in Market Forecasting" You can’t talk about money and investing without talking about time. After all, the two are inherently interconnected. There’s the time value of money, the erosion of value due to inflation, the linkage between money and interest rates, etc. The problem is, time is a great unknown for all of us. It is a concept that we apply in a strict sort of theoretical sense to create structure to our lives. But there is nothing certain...

Read More »Capitalism Needs More Capitalists like Mark Zuckerberg

Share the post "Capitalism Needs More Capitalists like Mark Zuckerberg" Yesterday Mark Zuckerberg announced his intention to give 99% of his Facebook stock to charity. I found the responses to this announcement largely unfair. The Guardian referred to it as a form of “imperialism”. Thomas Piketty called it a “big joke”. Others referred to it as “tax avoidance”. The other common criticism was that 1% of $45B left Zuckerberg with $450MM which is, well, a lot of money (too much being the...

Read More »The Euro’s Broken Promises

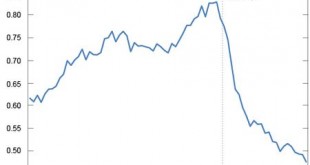

Share the post "The Euro’s Broken Promises" I really liked this comment by Bloomberg Europe Economist Maxime Sbaihi on the purpose of the Euro: => The point of the euro was to give Greece the interest rates of Germany, and Germany the exchange rate of Greece. pic.twitter.com/bGtW1QNGC7 — Maxime Sbaihi (@MxSba) December 1, 2015 That’s precisely right. Of course, Germany has basically gotten the better end of the bargain here. After all, were the peripheral countries not still...

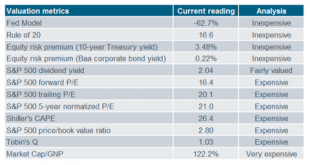

Read More »Conflicting Value Indicators Lead to Confusion over Clarity

Share the post "Conflicting Value Indicators Lead to Confusion over Clarity" I’m not a particularly big fan of relying on traditional “value” metrics. It’s not just my mistrust of factor investing. It’s that I just don’t think anyone really knows what the “value” of the market is at any particular time. As I’ve stated in the past, the concept of value is dynamic so the perception of value is much like the perception of beauty. And what’s beautiful to some people in some eras might be ugly...

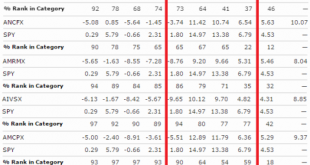

Read More »There is no Defense of Closet Indexing

Share the post "There is no Defense of Closet Indexing" Closet indexing occurs when a high fee mutual fund or ETF promises to be able to “beat the market”, charges a fee premium relative to its benchmark and then largely mimics the performance of the benchmark. This is a tremendous problem for investors because they usually end up paying hefty fees in exchange for empty promises. When I review client portfolios I find that an alarmingly high number of them hold closet index funds (before...

Read More »The Great Normalization

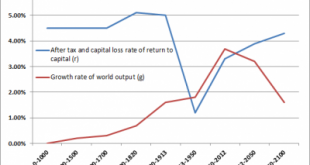

Share the post "The Great Normalization" The slowing growth of the global economy has many people confused about what’s going on. There are all sorts of explanations out there including the “secular stagnation” theory, the “New Normal”, the “rise of the robots”, etc. But what if the “new normal” and “secular stagnation” are merely the normal normal? Thomas Piketty put things in perspective for us in his popular book “Capital” when he discussed the long-term trends in growth. Piketty...

Read More »Thanks!

Share the post "Thanks!" It’s that time of year when millions of Americans will sit down at dinner and give thanks for mashed potatoes, turkey, loose pants and American football. I will be somewhere in Paris continuing my attempt to go from Ironman to Dougboy in record time (in all seriousness, how is everyone in France not 800 pounds?). Of course, Thanksgiving isn’t about calorie consumption records. It’s about being thankful for all the things life affords us. I am grateful for many...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism