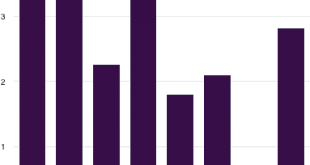

from Peter Radford We are, no doubt, about to be barraged by a torrent of alternative facts concerning the economy and economic growth under our new leader. So let’s get a few facts on the table in order to set a base level for future reference. Let’s start with growth during the past six presidencies: So, no, Obama was not the disaster Trump and the Republicans are trying to paint him as. The economy during Obama’s term outperformed that of his predecessor. This includes the enormous...

Read More »Beyond Trump and free trade

from David Ruccio Now that President Trump has begun carrying out his campaign pledges to undo America’s trade ties, formally withdrawing the United States from the Trans-Pacific Partnership and announcing he will start to renegotiate the North American Free Trade Agreement, it’s time to analyze what this means. As it turns out, I’d already started to do this before the election, with a series of posts (e.g., here, here, here, and here) on Trump and the mounting criticism of the trade...

Read More »The Trump cabinet: strangest show on Earth

from Dean Baker As we start the Trump presidency, events just keep getting more bizarre. At his first and last press conference as president-elect, Donald Trump boasted about his divestment plan in which he was “sort of, kind of” turning over the management of his business enterprises to his two adult sons. He displayed a table full of documents that were supposed to indicate the extent of his divestment, but the documents were not made available for the press to examine. Furthermore, in...

Read More »The Fed and the Crisis on the Eurozone

Yes, he said it. One of the gems found by Erwan Mahé in the minutes of the FOMC meetings. Ben Bernanke: “Here we potentially have a comparison to Keynes’ The Economic Consequences of the Peace and the Versailles treaty, where he pointed out that forcing Germany into extreme austerity, although it might satisfy certain moral, ethical, or political urges, had macroeconomic consequences that might force Germany eventually to rebel. By the same token, if there’s not growth for the South,...

Read More »A $500 bn pot of gold: How Boston Consulting and Google pushed Modi to end the era of cash

from Norbert Häring Boston Consulting Group (BCG), the omnipresent US-consulting company, and Google, the global data miner, issued a joint report in July 2016 on the “$500 bn Pot of Gold”, which is the Indian digital payment market. Even though the authors deny it, the report gives much reason to suspect that the authors knew that something radical was imminent from the Indian government. The report is remarkably honest about the aims of the whole exercise. There is no statement in the...

Read More »Economism—or vulgar economics

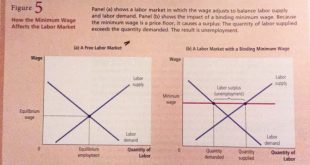

from David Ruccio In discussing the textbook treatment of the minimum wage, James Kwak provides a perfect example of how contemporary mainstream economics “can be more misleading than it is helpful.” Kwak refers to the problem as “economism.”* For me, borrowing from a different tradition, it is a case of “vulgar economics.” The argument against increasing the minimum wage often relies on what I call “economism”—the misleading application of basic lessons from Economics 101 to...

Read More »The Beginning

from Peter Radford Already the Trump regime is taking shape. Or, rather, I ought say the agenda is taking shape since the cabinet that is supposed to be overseeing things is well behind schedule in arriving on station. First things first. Trump raised to cost of applying for a mortgage for low income people. He undid a recent reduction in the fees charged by the FHA. That reduction had been put in place because the FHA has a large surplus and wanted to pass along that prosperity to...

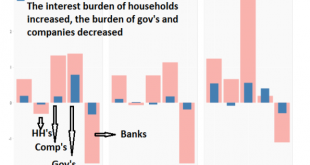

Read More »A case for low Eurozone interest rates

As far as I’m concerned, the ECB does not yet have to increase interest rates – as households still have to be able to refinance many billions high rate loans. As mister Draghi has shown, using sectoral balances, households have, unlike companies and governments not yet profited from low rates and QE! Individual EU countries have to reign in the housing market, though. Below, I’ll share some thoughts about this (as I’m a member of the ECB shadow council who gives advice on this, and I am...

Read More »College and the American Dream (3 charts)

from David Ruccio The American Dream has all but collapsed under the weight of growing inequality. It’s becoming increasingly difficult for the American working-class to sustain a decent standard of living, and their children are increasingly unlikely to be better off than they are. But those who hang on to the American Dream—or at least the selling of that dream to others—believe that sending young people to the nation’s colleges and universities is the solution. The problem, of...

Read More »Are negative interest rates dangerous? A debate between Thomas Palley and Adam Posen

Thomas Palley A negative interest rate policy (NIRP) appears revolutionary, but its justification rests on failed, pre-Keynesian “classical” economics. This claims that lower interest rates can always solve aggregate demand shortages and lead to full employment. Keynes discredited classical economics by showing that saving and investment might not respond, as assumed, to lower interest rates. Once all profitable investment opportunities have been undertaken, negative interest rates may...

Read More » Real-World Economics Review

Real-World Economics Review