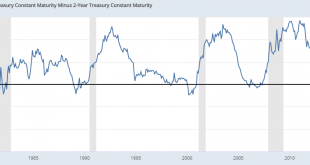

Alright, nerds. It’s time to put on our thinking caps and fill up our pocket protectors. We’re gonna talk about inverted yield curves. First things first – What is an inverted yield curve? An inverted yield curve is a description of the comparison between 10 year Treasury note yields and 2 year treasury note yields. Those are the only two instruments that matter here. If anyone else says an inverted curve is some version of some other set of instruments then take away their nerd badge....

Read More »Three Things I Think I Think – Recession Alert Edition

Here are some things I think I am thinking about. 1) About this negative yield thing….Interest rates just keep pumping lower. There’s now over $15 TRILLION worth of bonds in the world with a negative yield. Now, negative yields aren’t as crazy as some people think. There’s perfectly practical reasons for yields to be negative (for instance, if you believe inflation will be very low or negative). But check out this price action in 30 year Austrian Government Bonds: If that’s hard to see,...

Read More »How I Think of the Stock Market During its Ups and Downs

I’ve previously written about how I like to think of stocks as bonds. Of course, I know this is a bit of overreach, but it’s a useful exercise when putting things in the proper perspective. For instance, I find bonds intuitively easy to understand. After all if you buy a AAA rated T-Note with a 5 year maturity then you know your time horizon, nominal risk, and return. In other words, you know every single element of this instrument when accounting for how it fits into your portfolio. The...

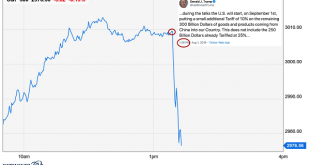

Read More »Three Things I Think I Think – Rate Cut Edition

It’s almost the weekend, folks. Hang in there a few more hours. In the meantime, here are some things I think I am thinking about: 1) The Fed did whaaaat? The Fed cut rates for the first time since 2007. Things are a bit different this time. In 2007 the housing market had been screaming higher and was softening quite a bit. GDP was consistently over 6%. Rates were 5.25% and inflation had been consistently close to 4% for years. This time around inflation can barely get over 2% and GDP is...

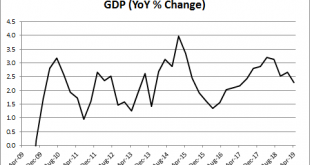

Read More »Three Things I Think I Think – Negative Rates and Stuff

Here are some things I think I am thinking about: 1) Q2 GDP – more of the same. Second quarter GDP came in at 2.1%. Pretty weak. But more of the same. As I’ve long been pointing out – this is the golden age of low and stable growth. It really is a sort of Goldilocks economy. Not too hot, not too cold. Just right. But this general trend has been going on for 10 years now. 2) Negative rates everywhere. There has been a lot of chatter in recent weeks about how bond yields are going negative...

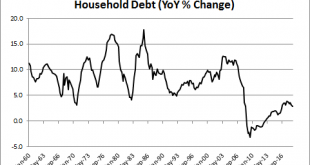

Read More »Congrats on Your Debt Ceiling Increase

Hooray! We did it folks. We raised the debt ceiling again and averted a self imposed default on US government debt. And to celebrate this joyous occasion I wanted to write my 3,589th article explaining some of the never-ending misconceptions about government debt and borrowing.¹ And to do that I found this David Stockman interview from last week. Stockman was Reagan’s budget director in the 80’s and seems like a good guy from everything I’ve read. But he’s also become the poster-child for...

Read More »My View On: ESG Investing

I write this post with some hesitancy because I suspect that it is going to annoy lots of people. This annoys me because the goal of this post is to emphasize the importance of being objective and emotionally agnostic when we’re investing. I’ll put on my flame retardant suit and see how well I can communicate this view without enraging people. Wish me luck. ESG investing (environmental, social and corporate governance) is a hot new space in the investment product landscape. The basic goal...

Read More »Seeing Both Sides of the Argument

Here was another fun question this week from Tadas at Abnormal Returns: Question: What have you learned in the past year (or so) that genuinely surprised you? Or said another way, what thing have you changed your mind about recently? A: “I’ve started doing this thing where I always assume that other views are right before I assume they’re wrong. For instance, I often hear political narratives about this or that and I tend to defer to my priors first. But now I start by considering all the...

Read More »Will Active ETFs Save Active Management?

Here’s Tadas again with a good question for a bunch of influential financial thinkers, and also me: Question: Traditional active management is dying a slow, painful death. Is the introduction of non-transparent, active ETFs a potential turning point or simply a finger in the dike of an unstoppable trend? Answer: “This conversion has been slowly taking place for years. ETFs are a flat out better product wrapper. 10 years ago I said that mutual funds are dinosaur products and that’s been...

Read More »Is Value Investing Dead?

There’s been a lot of chatter in recent years about the underperformance of value vs growth. This has led some people to declare that value is dead. But is it? Tadas Viskanta recently asked this question of some influential financial thinkers (and also me). Here’s a link to their answers. And here’s what I said: ”I have never liked the idea of “value investing” as a data traceable “factor”. That is, we are all value investors in the sense that we are all looking to buy assets that we can...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism