Here are some things I think I am thinking about on this beautiful Saturday morning…. 1) Are buybacks propping up the stock market? One of the more annoying narratives going around these days is this idea that buybacks are propping up the stock market. I was reminded of this yesterday while reading a Ned Davis Research piece which said the stock market would be 19% lower without buybacks. Let’s think about this rationally…. This sort of thinking assumes a hyper inefficient market where...

Read More »Capitalism Vs. Socialism

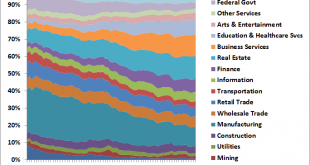

I really enjoyed this segment on CNBC about capitalism and socialism. In this short clip Warren Buffett, Charlie Munger and Bill Gates discuss the nuance of their view and many of the confused narratives that are going around these days. Take a look for yourself, but here’s how I basically see this debate and the many problems around the use of these terms: Socialism means social ownership of the means of the production. Capitalism means private ownership of the means of production. No...

Read More »Three Things I Think I Think – Berkshire, Jobby Jobs and Chase Tweets

It’s almost Cinco de Drinko weekend so hang in there for a few more hours. Or, if you’re reading this on Sunday, salud! In the meantime, here are three things I think I am thinking about: 1. Buffett buys….zzzzzzzzzz. So, Berkshire bought some Amazon stock recently. I am not gonna lie, this is a big snoozefest. The financial media always goes crazy when Buffett buys something new, but why is this news? Seriously? Berkshire stock hasn’t outperformed the S&P 500 in over 10 years. It’s...

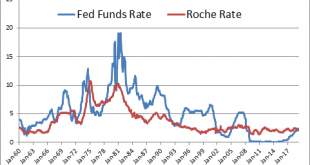

Read More »Whom Would I Nominate for the Federal Reserve?

So, Stephen Moore is no longer being considered for the Fed. As I explained in detail this is a good thing. Moore was nowhere near qualified and had a long track record of misunderstanding basic things about the Fed. So good for Trump for recognizing this and dropping the nomination. Now what? Someone asked me an interesting question on Twitter: “Who would you nominate?” I (half jokingly) answered FRED...

Read More »How Will The Fee Structure of Financial Advisory Change in the Future?

Financial advisory fees are a huge controversy at present. After all, there is significant evidence that paying higher fees for asset management services is detrimental to your portfolio. And while the average fee for portfolio managers has fallen significantly the average financial advisory fee remains pretty much where it has been for the last decade at 1%. What explains this and will it persist? When I started in the world of financial services we were mostly commission based. You...

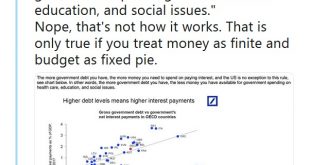

Read More »Having a Printing Press Doesn’t Mean Money is Infinite

Deutsche Bank put out an imprecise piece of research saying that higher debt levels mean higher government interest payments. This isn’t really true because the government can technically set its interest rates at whatever it wants. For instance, there was nothing stopping the Fed from keeping rates at 0% forever.¹ What DB was really implying was that there is a direct connection between debt and inflation (which interest rates are primarily a function of). But this is not really a good...

Read More »Was the GFC a Once-in-a-Lifetime Event?

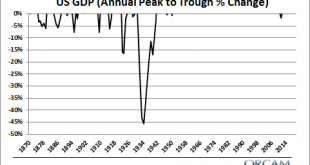

Someone emailed me with a very good question yesterday: “Did we really go through a once-in-a-lifetime Great Recession in 2008, or is the global economy overleveraged to an even greater extent, just in different ways?” My basic view of the Great Financial Crisis is that is was not unique in that it was a debt crisis, it was unique in that it was a debt crisis attached to such a significant household asset. Back in the old days we used to have regular panics or Depressions. The reason for...

Read More »Hard Truths for the Inflation Truthers

The main goal of this website over the years has been to search for an operationally sound and empirically supported perspective of how the monetary system works. I’ve debunked tons of myths in the process of this search, but the inflation truthers have been hard to convince for some reason. Strangely, there are still people out there who believe that the BLS lies about inflation stats and that all the data is manipulated. But I have some hard truths for the inflation truthers. Hard truth...

Read More »Redemption

Everyone deserves second chances in life. And everyone is a work in progress. Those are the big lessons for me after watching Tiger Woods win The Masters today. It took me a long time to learn to like golf. It’s a frustrating game that requires a terrible amount of patience. But as I get older it dawns on me – golf is a lot like life in that you spend huge amounts of time waiting to become average at something only to get glimmers of hope bunched in with persistent disappointments. And...

Read More »My View On: Minsky’s Financial Instability Hypothesis

Hyman Minsky’s Financial Instability Hypothesis (FIH) has been an influential component of how I think of the financial markets and the economy. The FIH, in a nutshell, says that capitalist economies will, at times, deviate from an equilibrium into substantial inflations and deflations. In other words, booms can beget booms which can beget busts which beget busts. This view, that booms lead to busts, has garnered renewed interest in the wake of the GFC where a housing boom clearly led to a...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism